Sponsored By: Composer

Wall Street legend Jim Simons has generated 66 percent returns annually for over 30 years. His secret? Algorithmic trading.

With Composer, you can create algorithmic trading strategies that automatically trade for you (no coding required).

- Build the strategy using AI, a no-code editor, or use one of 1,000-plus community strategies

- Test the performance

- Invest in a click

On day three of our week of bringing you the best of our AI writing, Evan Armstrong ponders the practical business implications of an AI-first world: Will AI tools become so powerful that a single person can create and run a billion-dollar company? If so, what kind of companies can be built? And if everyone gets access to AI agents that can replicate human output, what is the uniquely human edge that will differentiate success from failure? As always, let us know what you think in the comments.—Kate Lee

In a recent interview, OpenAI cofounder Sam Altman said:

“We’re going to see 10-person companies with billion-dollar valuations pretty soon…in my little group chat with my tech CEO friends there’s this betting pool for the first year there is a one-person billion-dollar company, which would’ve been unimaginable without AI. And now [it] will happen.”

Altman’s idea is that AI tools will soon reach the point where they can replicate the entire output of human employees. Instead of needing to hire a designer, you can use GPT-6 to design for you. There will be far less need for software engineers (meh), sales staff (no one will miss them), and newsletter writers (a tragedy of Greek proportions, leaving our society barren and empty).

An ambitious founder could outsource the work they would use employees for to an army of artificial intelligence agents. Theoretically, this would allow entrepreneurs to focus on only tackling their most important competitive advantage.

This is a claim worth examining, not just because I would like to be the first person to build that billion-dollar company. The one-person billion-dollar company matters because it is a handy way to understand how AI will disrupt knowledge work. In a good world, Altman’s prediction would come true because AI would allow people to build something whatever they can dream up. In a bad world, it would become true because AI will make most people’s jobs irrelevant, concentrating power in the hands of the elites.

Writing is perhaps the most obvious use case of AI. All of these AI companies have my life’s work squarely in their crosshairs. It makes me wonder if the consumers of the future will even want writers in their life. This is a deeply important question for me personally, because, you know, student loans. Is there a way I can use these same tools to build a billion-dollar company of my own? Can I use the instrument of my career’s destruction as my financial savior?

But let’s start with a more basic question: Is anybody close to achieving this today?

Closest proxies

First off, we need to lay some ground rules. Altman is talking about a billion-dollar valuation for a company—which is not a rigorous enough metric. As I wrote two weeks ago, valuations for startups are made up anyway. I’m pretty sure that if Sam Altman tweeted, “I have an idea for an AI company,” he could raise a round that valued his company at $1 billion.

What I want is a real business, one that has healthy profit margins and judicious revenue growth. To keep things simple, let’s say that our one-person billion-dollar company has to have at least $100 million in annual recurring revenue (ARR). Then, if the company is hot enough to attract investment, it could probably get a 10x revenue multiple, valuing it at $1 billion.

There is no company that even comes close to qualifying.

In technology, the most recent example is Midjourney, a generative AI imaging startup. It’s never raised outside capital, has fewer than 100 employees, and is reportedly at over a $200 million annual revenue rate. Not bad! But it is still disqualified on an employee volume basis. In 2012 there was Instagram, which Facebook acquired for$1 billion, but it had 13 employees and no revenue, so that’s out. Alternatively, I have a few friends who run $1–10 million ARR SaaS companies with no full-time employees—but that’s because they contract with part-time, low-cost developers (which feels like it violates the spirit of the exercise). Plus, those companies are a tenth of the size we need to get to the billion-dollar mark. So no dice in the private tech sector.

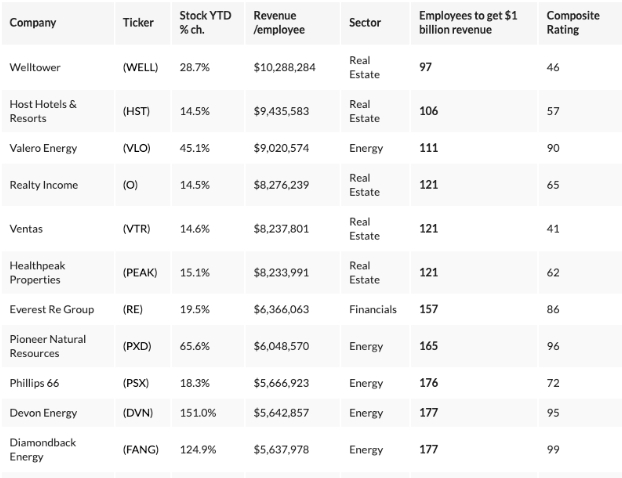

In the public markets, investment and energy firms come closest to meeting the bar. This data set from 2020 provides a sense of what they look like.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

.08.31_AM.png)

Comments

Don't have an account? Sign up!

> there is a significant opportunity for ambitious people to build businesses in the $1–10 million ARR range

For solo entrepreneurs who reach this range by potentially selling to prosumers/SMBs/mid-market, what will it take to crack the enterprise market & 10x their revenue? Is it just the sales cycle of enterprises?