TL;DR

- Welcome to my many new subscribers! Last week’s piece on Why You Shouldn’t Work at A Startup went semi-viral so a couple hundred fresh faces here today.

- Every other week, I publish a financial explainer where I go through the theory and application of financial concepts. We’ve been in the midst of a series on the income statement, with previous pieces covering Revenue, COGS, Gross Margin, and OPEX.

- Today we are covering four intimidating words ITDA (Interest, Taxes, Depreciation, and Amortization) that signal how well a company is playing the meta-level games of growth and capitalism.

- These Four Horsemen are all incentives created by governments in order to steer the behavior of businesses. Smart operators can utilize game theory and new software-powered services to save serious money.

The income statement starts with simple stuff, and gets increasingly shrouded in mystery as you work your way down.

At the top, we see Revenue (money customers give you), and then COGS (the direct cost to make the product you sell). After that you get into slightly murky territory with OPEX (the overhead costs to run the business), and beyond OPEX lies the true hidden chamber of the income statement—Interest, Taxes, Depreciation, and Amortization—which conceals a vast system of complex power games played by governments and corporations. In the context of an income statement, ITDA measures the skill with which a corporation plays the game.

By participating in the American economic system, we passively opt-in to a series of social contracts that support society’s structure. Thomas Hobbes called these government-enforced contracts “the leviathan”—a monster of mythic power, armed with state-sponsored violence, that ensured the general populace were incentivized to do what they were supposed to. Note: I hear the political theorists whinging. Yes, this is an oversimplification/stretch, but I like this analogy so let me run with it. Go read some Kant you nerds.

If you are a Leviathan (government) of the 21st century, you might have more than individuals to worry about. The U.S. is home to huge corporations armed with millions or billions of dollars, some so vast and wealthy they’ve been compared to nation-states. It’s Leviathan’s job to make sure businesses, like individuals, follow certain rules; like environmental regulations or worker's rights. But Leviathan can’t always go to war with these corporations (unless they’re willing to nationalize an industry or start throwing executives in jail, things at least this government is loath to do). Sometimes, violating certain rules might result in strong legal action taken against companies, but overwhelmingly this is not the case. Typically you’ll see larger companies quietly pay a fine and go right back to a slightly tweaked version of the bad behavior. Plus Leviathan’s don’t want them to not just do “bad” things, they want them to do good things too! Build warehouses, research new technology, hire more people, that sort of thing. So if the stick doesn’t work, how is Leviathan to use the carrot? Note: These power dynamics, that of when you have more money/power, the more you get away with holds true for both individuals and corporations. Small businesses suffer while big companies prosper just as the poor suffer while the rich receive extra privileges.

It’s simple, actually: Money.

You dial up or down the cost of certain things, using whatever tools you have at your disposal. If you make an activity cheap, companies will do more of it. If you make an activity expensive, companies will do less of it. Note: It is never this easy in practice, but we are simplifying it to help you understand the complexity of the system.

You might think of Taxes as the only tool governments have to do this. But on the income statement, Taxes are just one of the four major ways governments influence corporate behavior. These tools come by a few names, but on the income statement, they appear as Interest, Taxes, Depreciation, and Amortization. If you are an investor or operator, this post will help you understand these systems and how to use them to your advantage.

The Four Horseman

Two weeks ago, we discussed how EBITDA and Operating Expenses will indicate back-office efficiency. The ITDA of EBITDA are a little more complicated. They are each distinct ideas that could probably be a post on their own if I felt like really dragging this out (only two posts left in the series!). However, when they are mixed together they give an insight into how well management is investing/operating their business. Before I tell you how, it is important to lay down some quick definitions of what each of these letters stands for.

INTEREST

When companies borrow money—whether through a loan, bond, or anything else—they have to pay that money back gradually over time, with interest. The consumer comparison is the interest you would pay on a mortgage or a car loan. This is the same thing, just on the scale of a business. If this metric is ever the focus of an analyst’s attention, it is typically to answer the question, “If things go bad, can they still pay this loan?” Sometimes companies will take on so much debt that the interest payments sink them (Sears is one example). The amount of interest a company has to pay in a given period of time to service their debt is what shows up in the Income Statement. Note: Debt facilities are fascinating and I’ll write a post about their use in leveraged buyouts at a later date. For now, if how loans are used in business is interesting to you, I recommend reading Barbarians at the Gate.

TAXES

Love ‘em or hate ‘em, you should know what these are. There are lots of types of taxes that businesses have to pay and we’ll talk more about them later in the essay. The formula that gives you what this number should be in the income statement is Taxable Income x Tax Rate.

DEPRECIATION

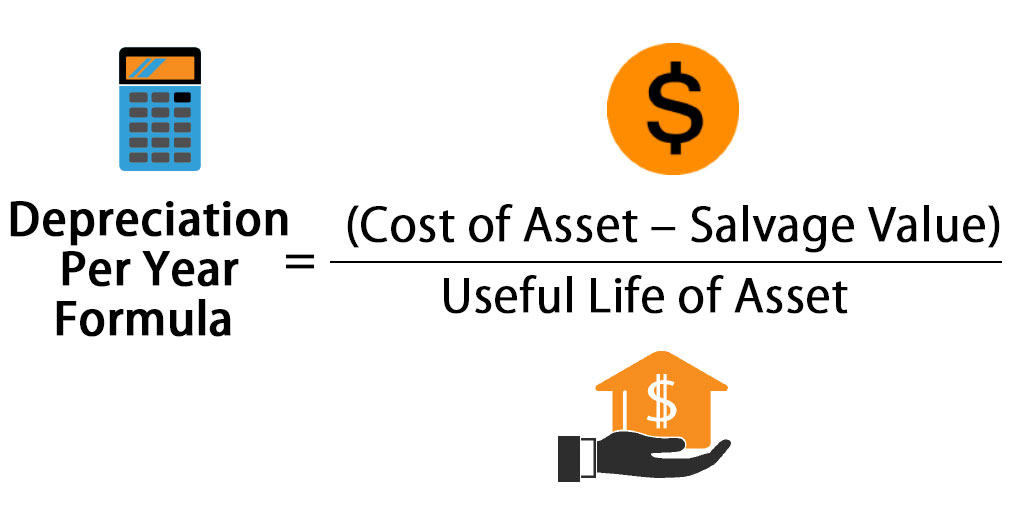

When you buy physical equipment for your business, whether that is big or small, you pay all of the cash up front. But just because you paid the cash now does not mean that you have to expense it now. Instead, the cost of the equipment can get added to your income statements gradually over time, even though you wrote a check for it as one lump sum. You may have heard that this is how accounting works, but have you ever thought about why? Leviathans want businesses to invest in production capacity, so it created depreciation as an incentive—it reduced, in some sense, the cost. The way this works, in theory, is you get to expense the asset as it creates value for you and gets worn down over time. In the real world it's never a straight line, but capturing the full complexity of reality is not necessary in a financial statement, so the IRS allows you to just model it as—you guessed it—a straight line. An additional wrinkle is that sometimes you can resell an item of equipment to give you a little bit of cash at the end. Combine all these variables and the formula is simple:

Photo credit to a random image I found on educba.com

Let’s say I’m starting a new income stream for Napkin Math—Napkin Math Naan, the world’s best finance newsletter/naan conglomerate. To get it off the ground, I can buy a tandoor oven for $10k (this oven is HUGE, I really think it is going to be a big business). My accountant tells me that it lasts for 10 years and at the end of those 10 years I’ll be able to sell it for $1k worth of parts. This means my yearly depreciation would be $900.

AMORTIZATION

If Depreciation allows you to expense a physical asset (like a giant naan oven) gradually over time, Amortization is the exact same thing, except for intangible assets like Patents, Software Licenses, and Copyrights. You might be wondering why Leviathan made an arbitrary rule separating intangible from physical assets, and the answer is that intangible assets often have a much fuzzier connection to value, and they don’t degrade in the same way tangible assets do. So it’s useful to handle these two types of assets separately.

But the question remains: how are intangible assets amortized over time? This is really a matter of taste and backroom negotiations. The calculation of non-tangible goods is the dark wizardry practiced by the bespectacled nerds of accounting firms. Not something that we will cover today!

Most important for today is how these concepts are used by Leviathan to influence corporations, and how corporations manipulate them to achieve financial optimality. The bottom line is that both depreciation and amortization can be used to lessen your tax burden by reducing the operating income of a business. Again, if you are looking for tax strategies get an accountant! This is a newsletter, not a CFA on demand.

Imaginary rules, real world riches

The fascinating thing is that all of these expenses are entirely dictated by human control. COGS is dictated by the cost of supplies and manufacturing. OPEX is determined by how much running the business costs. ITDA is different. There is no mine where loans are pulled out of. No tree upon which depreciation schedules are grown. Instead, they are artificial tools the Leviathan uses to incentivize desirable behavior by companies. Interest rates are set by the Central Banks to control inflation (don’t spend too much too quickly). Depreciation and Amortization policies are designed by an independent board endorsed by the SEC to get companies to invest (build more stuff now!).

Taxes have more incentives, loopholes, shelters, structures, and general wonkiness than the rest of finance combined. They are a byzantine labyrinth, navigable only with long years of practice. Uncle Sam’s tax policy is a many-armed beast trained by the legislature and the executive branch to accomplish whichever aims they deem best (which, presumably, the people have voted for). This may be shocking to my American readers, but there are lots of disagreements in government and people differ on how these taxes should be levied. This conflict results in the one environment that private enterprises are most accustomed to—competition.

Because government bureaucrats and politicians want to incentivize what they deem “goodly behavior” they will use taxes as the mechanism to encourage businesses. If you are a student of game theory you already know what is going to happen here. “Build in my town, hire 10 people, and you won’t have to pay property tax.” Next town over, “Well build in my town and you won’t have to pay property tax or sales tax.” On and on. Companies will happily play local and state government off each other to find the best deal possible for themselves. Think of Amazon trying to get New York to give them millions of dollars of incentives. Smart companies do this all the time. They are thinking about expanding, go to several local commerce councils, get them to compete against each other, and then laugh all the way to the bank as these cities give them whatever they want.

On one hand, this is obviously bad for society. Companies being able to so easily play government against itself is not great (it was backlash from locals that sunk the Amazon deal). On the other hand, I think companies should employ exactly this strategy. Business is a bloody battle, combat fought with incentives. It is not a place for the weak or soft-hearted. To win, the natural tendencies of businesses will be to shove aside moral quandaries. This goes beyond taxes and applies to every aspect of what they do. So while on an individual level I find these strategies morally reprehensible, as a consultant I advise my clients to always employ tax arbitrage strategies. If opening an office in MiddleofNowhere County means I save my business millions, I should absolutely do that. Money saved from the government is money that can be put to work in efforts that enable me to win.

Many of the incentives were obviously designed to benefit large companies versus small businesses. As an example, the process to get tax credits for research and development expenses is incredibly opaque. Your generic small business accountant doesn’t have the time or expertise required to get this money for their clients. This has given rise to services that help small businesses find the money they can get back from the government, like Mainstreet (20% take rate of what money they get back for you) and Neo (10% take rate). Think of them as a software layer on top of the tax system, using computers to help take advantage of these arbitrage opportunities.

Again, on an individual level, I find these types of software tax service companies morally complex. Their existence is an additional testament to how broken or skewed the system is against the less powerful, like low-resource small businesses. If things were working right, none of these tax-service companies would exist. But this isn’t their fault! They are performing a valuable and useful service for companies. As a business strategist, I would say that any company not using this type of service is being stupid. This is free money—take it!

What type of horses does the apocalypse ride?

Back to our original point: ITDA. This series was written to be a practical guide to finance for operators and investors. Because today’s terms are so flexible, so malleable, based on the guidelines of where a business is operating and in which sector they are in, it is tough to say, “Here is the definition, this will never change.” Instead, today I wanted to remove the fog of financial war, to show the metagame that is being played with the variables.

One of the ways I personally decide if a business is running a tight financial ship is by how much a company uses these strategies. Amazon getting millions back from the federal government for R&D credits, using equity-based comp to lower their overall tax bill, and pitting cities against each other in tax combat—good! I mean bad for the system of a just society, but good for them and their investors.

Average businesses are just participants in the system, extraordinary ones use the system (or break the system) to their advantage. ITDA can be a way that you can see just how skilled a player is in the game of capitalism.

Note: Next explainer will be our final post on the income statement. If you could let me know, either via Twitter DM or by responding to this email how useful it has been that would be great. What would you change? What do you want to stay the same?

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!

This is a cynical take re: depreciation. It’s not as made up as you make it out to be. Depreciation is a representation of a cash outflow in the form of investment. Companies can write off expenses, is your issue with being able to write off investments? Cash accounting is not “manipulateable” like you say GAAP is, but allows for full depreciation in year 1, and is therefore always preferable wrt tax treatment. Only small companies can use cash accounting. From this lens, GAAP depreciation rules could be viewed as unfair to large companies. At the end of the day, a cash outflow is a cash outflow. Agree with your other takes though, good article.