Sponsored By: Brilliant

This article is brought to you by Brilliant, the app that helps you ramp up on the skills of the future—from math and logic to data science, programming, and beyond.

I called it. While I usually love saying that, this time doesn’t feel as good.

In May of 2022, I argued that we were about to enter into a creator economy winter. The startups serving the digital entrepreneurs creating online content would struggle. Specifically, I forecasted that because only the top 1% of creators make any real money, a startup would have to either 1) capture a percentage of their biggest customer’s revenue or 2) find a way to sell to the long tail of part-time creators. Because of this struggle, funding would dry up and we would see most startups fail.

The response to that original post was pretty heated—I got some angry DMs from founders and investors. “Creators are the future!” “You don’t get the trends!” “Look at Mr. Beast!” (For whatever reason, VCs love to trot out Mr. Beast for any topic even tangentially related to online content). These defenders were wrong.

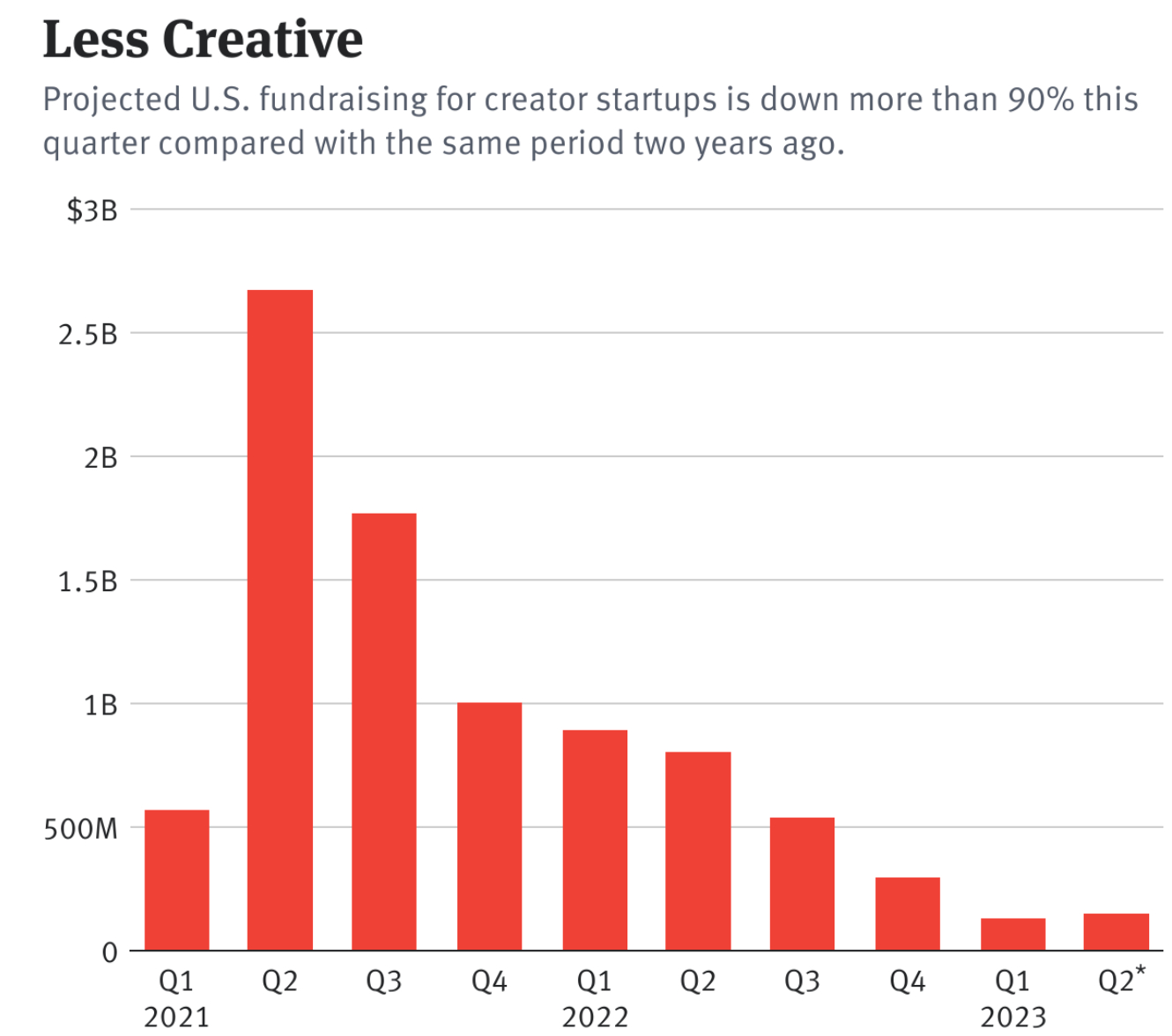

First, creator economy funding crashed. Dollars invested are down 86% to $123M. In comparison, funding for the broader market is down ~50% year over year.

Next came the layoffs. The giants of the space have had issues: Patreon laid off 17% of staff, Linktree first sacked 17% of staff, then a few months later another 27%, Cameo has laid off 160 (probably 33%+ of staff), Substack laid off 14%, on and on. While many startups had layoffs, it is unusual that all the stalwarts of an industry, the so-called ‘safe bets' are the ones who were making such big cuts.

Now, I have heard whispers of multiple creator economy startups quietly shutting down. This isn’t a newspaper and I’m not a journalist so I’m not going to publish a list. This is a moment of heartache for founders, so I’ll leave it to other publications to spill secrets. Most are smaller players, but there may be a few surprises in there.

How does the smartest person in the room do it?

By expanding your expertise (just a little) every day. Brilliant makes it easy.

Brilliant has thousands of interactive lessons on everything from math and logic to data science, programming, and beyond. In as little as 15 minutes a day, you can master next-level concepts that unlock new ways of thinking—and new career possibilities.

Join over 10 million people around the world and try Brilliant free for 30 days. Plus, get 20% off an annual premium membership for EVERY readers.

In my opinion, the creator economy thesis fell apart because investors had a fundamental misunderstanding of what risks they were underwriting. They didn’t understand the media industry, they didn’t understand creators’ needs, and they totally missed that this was a vertical SaaS bet.

To understand why creator economy bets were bad, you have to understand why creators themselves are a bad business.

What is a creator?

A small business in general is a shitty business. 65% fail in the first 10 years in the U.S.

A media company is also a shitty investment. Media stocks had their worst decline in 30 years in 2022.

A creator is a small business that is also a media company (aka shit squared).

It is important for me to note that as a creator, I am one of those terrible businesses. I think there is economic value to be found by smart operators, but the fact is that the macroeconomic conditions for the sector aren’t exactly favorable.

It isn’t all doom and gloom—when evaluated as a business, a creator has four distinct advantages relative to ye olde small and medium business.

- Low cost of goods sold and operating costs: A creator makes all their product themselves, with the only costs being their time and a laptop. Most P&Ls will have gross margins in the 90% if they don’t include a creator’s salary. It also isn’t operationally expensive to run. For example, as a writer, my only real operating cost is all the Diet Coke I drink. Everything else is pure margin.

- Zero marginal transaction costs: The cost of adding one more email subscriber to this newsletter is essentially zero. It doesn’t matter whether a piece of content gets one view or one million, my costs stay roughly the same. Therefore I want to sell my content to as many people as possible.

- Free, algorithmic distribution: If I were to make a TV show, I would have to give up some value of the program to a distributor like Hulu or the Hallmark Channel. Internet creators, on the other hand, mostly distribute their product through the web platforms (YouTube, Facebook, TikTok) and these platforms want to make it as easy as possible for you to upload. They can surface your content with people who might be interested. (Of course, it’s a bit of a devil’s deal—more on that later—but there’s no denying it lowers the barrier to entry for new creators.)

- Consumer preference: Some studies show that consumers like individuals more than brands. Most of these studies were all commissioned by people that would benefit from creators doing well, so take this point with a grain of salt.

However, all of these advantages are available to anyone who decides to make content online—there is very little competitive moat. If you have a laptop or a smartphone congrats, you are now a creator. Anyone can harness the power and pain of algorithmic distribution. And there are a hell of a lot of individuals willing to do so!

The power law is the only law of the internet: 99% of the value accrues to the top accounts and the rest is distributed over the population of the planet. From my article last year, “According to a Linktree survey, only 12% of full-time creators are making more than $50,000 per year, and 46% of the same cohort makes less than $1,000 a year. Even more brutally, 66% see this as a side hustle.” The total volume of high-revenue creators is painfully low. The other 99% of options are so small that it makes it really hard to build scale.

The end result is you have millions of individuals competing over scraps.

The real winners of the creator economy are the attention and advertising aggregators. YouTube did $29.24B in revenue in 2022 which is more revenue than Pinterest, Snapchat, Twitter, and every creator economy startup on the planet combined. The companies who capture the majority of the value are the ones selling things all creators need: distribution and monetization (Google, Facebook, Twitter) or creation technology (Apple, Sony).

Now, enter creator economy startups. These companies are tasked with serving a market full of customers that look like this. Most will never make it, some consider it a side hustle and make very little money, and a few blow-up. Plus the things that matter most (creation, monetization, and distribution) are best served by the biggest and baddest tech companies in the world. If you’re a venture-backed business serving a market like this it is very challenging. Let’s talk about why.

Who has succeeded?

As a technology vendor, you are looking to solve a customer’s most important problems more effectively than they possibly can. Creators' costs are already so low that it is really, really hard for a Substack or a Patreon value proposition to be “save them money.” There aren’t that many costs to cut! Really, a company has to bring them more subscribers or more money. The creator platforms that have thrived have done so.

The most successful creator economy startup is OnlyFans. They won because they gave adult entertainers a platform to monetize their work. This was a case where the major existing platforms wouldn’t work with them—the Facebooks of the world—but there was enormous consumer demand for porn products. OnlyFans offered distribution and monetization to pornstars all in place. Its last reported earnings had the company at $433M in pre-tax profit.

Other successful startups have followed that pattern—Substack allowed writers to easily charge for newsletters (and now offers some demand aggregation). Kajabi, a company that allows creators to easily sell courses, has far surpassed $100M in ARR and has done over $5B in gross merchandise value in course sales.

The startups that have scaled are the ones that support creators or products that big tech hasn't bothered to care about (yet). It is in the margins, the niches of monetization that these companies have succeeded. OnlyFans (porn), Substack (subscription newsletters), Cameo (shoutout video product), Kajabi (courses), all have succeeded because they serve a distribution/monetization need of creators that the big platforms are ignoring. And remember, many of these companies just had to do layoffs! The growth they hired for isn’t appearing.

My sense is that companies were planning for a “middle class” of creators to appear. That didn’t really happen. In my research with founders and investors for this piece, I heard over and over again that either creators were “too big to care” or “too small to matter.” The early winners of the creator economy startups were the ones who solved immediate, big needs that were totally ignored by major platforms.

What hasn’t really worked are the companies trying to do everything else.

The land of broken vertical SaaS

Again, I need to remind you what a creator is. It’s a small, online business! That’s it. There are the feel good stories of someone making money off their creativity that make the sector so fun to write/read about, but on a purely economic basis, these are the digital equivalent of coffee shops: small enterprises that often fail and almost never scale to a meaningful size.

When a startup is “building tools for the creator economy” what they are actually building is a vertical SaaS startup. A vertical SaaS company has to serve the needs of an industry 10x better than a horizontal tool meant for all SMBs ever could.

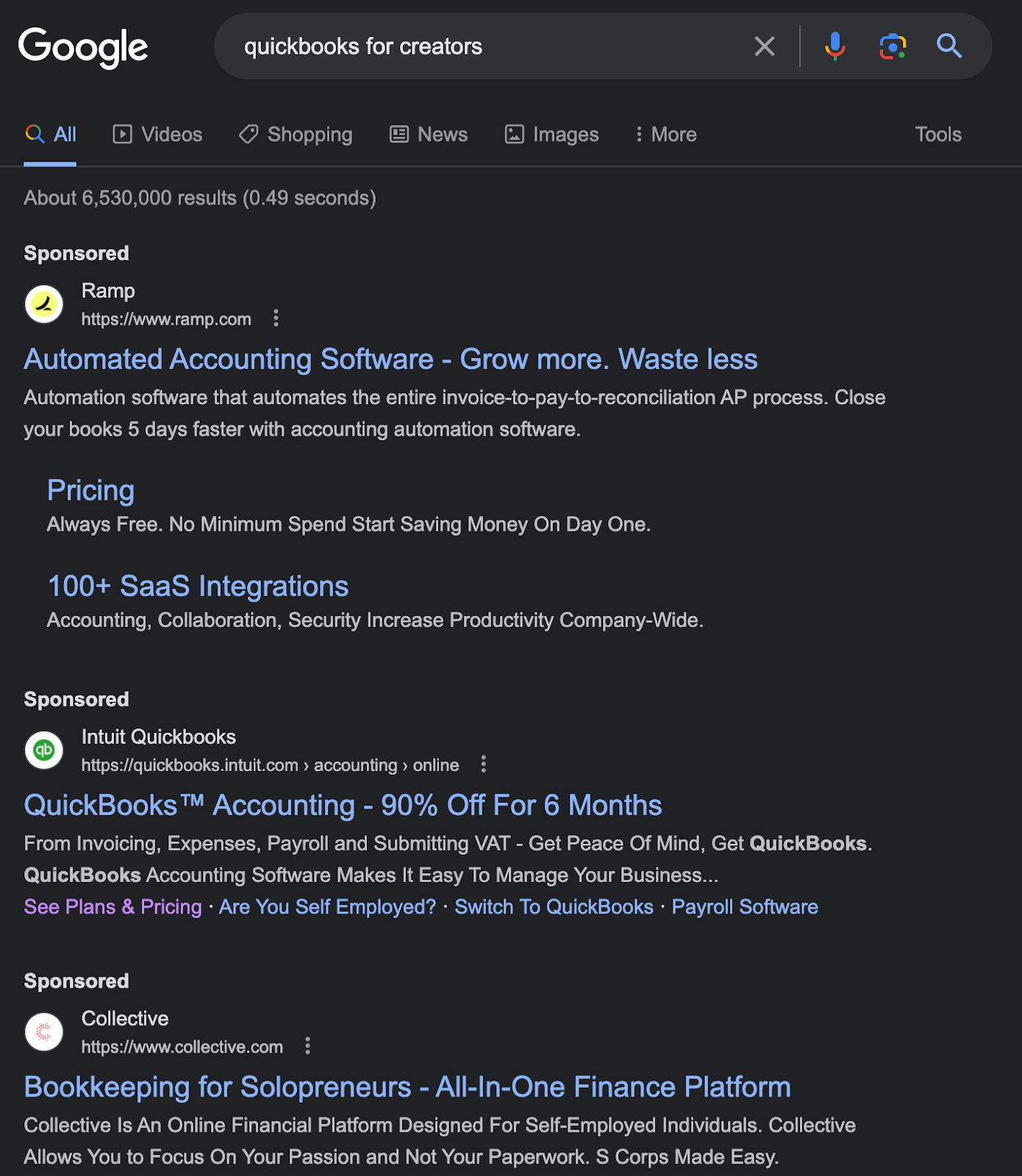

For example, if you were building accounting software for creators, you would need to build something 10x better than Intuit’s Quickbooks. To make it even more challenging, Quickbooks is like 30 bucks a month, has 15 years of feature development baked in, and is actively running AdWords against your category.

This is not easy to do. Like, at all. Creators actually do need specialized bookkeeping and tax services (trust me, Turbotax does not cut it) but the tightrope of positive unit economics a startup has to walk is so, so small. You add in the power law distribution of creator outcomes and man, this is not easy.

And this is with an actual product that creators need! So many of the startups that got funded over the last few years have been direct competitors to existing horizontal SMB SaaS solutions without any real validation that there was a distinct, creator-specific need. Investors saw the size of the market, felt FOMO, and deployed a bunch of capital.

Now, in 2023, when VCs are actually doing due diligence again, investors realized that these companies are not magical. Instead, they are vertical SaaS and vertical SaaS is something they know how to evaluate. Software investing is a brutal, hard world, with exacting standards of performance. The creator economy has so many macroeconomic factors working against it that I bet we will see fewer than five startups serving back-office needs actually make it in the long run.

Yes, the creator economy bubble finally popped. Yes, it has its own challenges that make it a particularly tough market to compete in. But I think it’s worth noting that it’s not unique in this regard. Every venture-backed sector has a 99% failure rate...and that's when things go well!

I warned everyone a year ago because it was obvious that the cycle was in its froth phase, as all sectors go through. But, like most industries, there will be a few big winners that manage to persist, changing the way our world works. The internet does actually enable a new type of media company. It turns out the creator economy is real—it was just already well served by existing providers.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

.08.31_AM.png)

Comments

Don't have an account? Sign up!

It's interesting when VCs always want your pitch deck to look like every other and define your problem down to one simple idea [seemingly so they don't have to understand how much engineering went into the unicorn].

W3 is an economic and technological revolution and while the masses do not doubt they will use it some day, they don't know how nor why yet. So in order to engineer an onramp for the noobs, you have to solve MANY problems. While my solution statements says 'an Build in Public suite as an onramp'. They surely would not even wonder why it is a BIP suite, in fact they will not get it because when investors think of W3, they see it as a centralized, 'all or nothing' centralized model. The old economy is trying to crowbar W3 into it (another problem) and there's a new kid in town (see layoff list above).

So the short tie in to the article is because the suite too solves the problem for content creators lost in the centralized economic model. But wait... there's more. In order to bring a revolutionary economic system to the masses without a crowbar, it has to solve all the crony economic system created problems along the way. Most, including funds, think of W3 as [centralized] crypto only, that will help them earn USD; they are part of the problem of why the masses haven't found a W3 tooling system which provides a pleasant UX.

Maybe the problem statement should be; 'VCs do not understand the W3 revolution as a P2P, D2Community exchange in 'value', (side note; USD is losing value)

Solution; with a BIP suite, content creators can exchange their value P2P. But wait...!! There's more...

I've been thinking of vertical SaaS of creator economy platforms. And I noticed that it's hard for startups to win against major players. So, we changed our strategy of focusing on writers as main target audience to more broader usable platforms for learners.

Memo to myself: https://share.glasp.co/kei/?p=qJNoq69gcwt1i7uKqTgW