Sponsored By: Alts

Let me guess: Your portfolio has been getting hammered lately?

Yeah, me too. The S&P is down. The NASDAQ is down. And crypto is down.

But did you know that comic books are way up? Or that tickets are mooning? Or that farmland is completely unaffected?

That's why we've been reading Alts. These guys analyze the heck out of alternative investment markets, and you reap the rewards.

Stefan and Wyatt provide original research and insights to help you become a better investor.

Oh, and and get this: They don't just track these markets, they are actually crushing them. While everything else in the world was down last week, their own recommendations were up 1.4%.

Join 30,000 others and find out what you've been missing.

When Twitter IPO’d in 2013, the general feeling was elation. It had incredible product-market fit, the growth story was compelling, and it was set to be the hot new thing. The next Facebook, maybe. If you were a banker selling the stock, your pitch probably sounded something like the following:

“An ad-supported content platform is the single greatest business model ever invented! There is strong incentive alignment between the service you deliver to consumers and the service you deliver to your paying customers (advertisers). You want consumers to scroll and scroll and scroll, interacting with content, indicating interests, and just spending as much time on the site as possible. This interaction feedback loop results in a content canon, firing memes that keep people clicking. Simultaneously, advertisers love it because all those clicks help make the ads really effective. Twitter is where this is going to happen.”

That is a compelling pitch! There is nothing retailers want more than a service that tricks their customers’ stupid monkey brains into buying whatever an ad slaps in front of their faces. Unfortunately, this growth story turned out to be completely false.

It would not be an exaggeration to say that Twitter has blown it. Its stock is down ~21% from its IPO price 8 years ago. Their overall growth is abysmal in comparison to Facebook. They have less than 5% market share in digital advertising and are an afterthought for marketing teams. In 2017 they had negative user growth! While things have picked up recently with the service adding 25M monetizable daily active users last year, it has fallen far short of its potential. My favorite description of the business comes from Mark Zuckerberg, who said, “they drove a clown car that fell into a gold mine.”

However, over the last year, it feels like Twitter has finally woken up. There are dozens of new product initiatives, a fresh strategy, a new CEO, and a 2023 revenue target of $7.5B and 315M monetizable daily active users. These goals are challenging and demand perfect execution from the team. The company has a renewed focus on creator monetization tools and improving their direct response ad business. There is actually some optimism among the investor base that maybe, just maybe, this time will be different. Maybe Twitter will finally be able to turn its soft, social power into hard dollars and cents.

I am not convinced.

Today, we will be explaining how the digital ad market works, where Twitter fits on that landscape, and why its likelihood of building a high-growth advertising business is small.

Click, Click, Buy

Ads exist to justify your marketing team's existence. Depending on who you talk to, they are an absolute necessity, an evil necessity, or just plain useless.

You can think of ads as being placed along a spectrum where on the left-hand side is brand ads, and on the right-hand side is performance ads.

Brand ads are exemplified by TV commercials and magazine pages. Their efficacy is tough to measure and there is a whole cottage industry justifying doing these for the sake of buzz. Performance ads are where ads are (allegedly) more targeted and where the payout is determined by some action taken by those who see the ad. There are lots of in-betweeners with fuzzy boundaries in the middle of these two labels. But it is helpful to think of them split this way.

Note: There is lots of legislation being proposed against ads that use “targeting” or “surveillance.” In the typical fashion of American lawmakers these laws are poorly thought out labels because technically speaking, everything is targeted! If I choose to buy an ad in a local paper, targeted. An outdoors magazine ad for my fishing lure company, targeted. There are bad actors within ad targeting, but banning the practice would essentially ban all advertising. Dumb dumb dumb.

In a large company, there will usually be two competing sides of the marketing team advocating for the two types of ads. In one corner, you’ll have some mustached white dude who wears thrifted Vans, insisting his title be that of a “creative,” arguing that his Superbowl ad of Billy Joel singing the Mcdonald’s theme song drives sales. In the other corner, you’ll have some sweaty stats nerd, ranting about how his spreadsheet conclusively proves that their multi-million budget (and enormous salary) are totally justified on a return-on-ad-spend basis. Depending on the current Chief Marketing Officer’s background, there is usually a favorite child between the two.

The relationship between these two types of advertising is, in my opinion, symbiotic. Both must exist for the long-term effectiveness of a sales motion. Brand marketing can help cultivate awareness, while performance marketing acts as the catalyst utilizing that previously accumulated goodwill. However, because performance ads are further down in the process of making sales, and therefore are easier to measure, they will usually win out if you have to choose one.

Twitter currently sits at an 85% brand ad and 15% “direct response” ad which is their word for performance ad. This is a relatively new development! For the past 8 years, almost all of their ads were brand deals. The growth in direct response is a new thing. We will get to why in a second, but keep in mind that their business was historically reliant on brand marketing.

Regardless of the type of ad, they both rely to a certain degree on targeting and attribution.

Targeting means the ability to get your ad in front of the person who is willing to buy it. If you were to google this topic, the discussion focuses on the demographic profiling component of targeting. Facebook and their ilk will try to figure out your race, age, income levels, etc., so they can more accurately give you ads you’ll want to click. To gain this data, ad networks essentially have three choices:

- Populate their models with in-house data: This was the original brilliance of Zuckerberg. By having users enter in all their data, even their relationship status, users self populated the demographic models.

- Rely entirely on outside data: This is more hypothetical than real, but theoretically, an ad network could entirely rely on user demo data from other sources. It doesn’t really happen, but it could be possible.

- Mix in-house and out-of-house data: To help enrich their data, companies will often utilize internal data and purchase other data on their customers.

When you read all the various data modalities above, it is easy to feel like your privacy is violated. It is spooky that there are companies out there who are targeting you based on your interests. If that is the way you feel, rejoice! The dirty secret is that this stuff isn’t actually overly useful on its own. What matters is being able to pair targeting data with attribution.

The Butch Cassidy to demographic data’s Sundance Kid is user behavior. It would be your demographic profile plus a history of everything you’ve ever purchased. For many years, this was the world we lived in! Facebook would know everything about you and then you would click an ad. Once you left a Facebook property, you would go to where the advertiser linked you. Here, the advertiser would shoot you with a digital tracing dart, colloquially known as a Facebook pixel, to see where you came from and what you did. (If you were going from app to app, they would use Facebook’s SDK). The data from the pixel or the SDK would feed back into Facebook’s models, making the ads ever more accurate. This took Facebook into a trillion-dollar valuation in July of last year. The end result is that you could be followed around the internet, with websites knowing your demographic profile and what you liked to click/buy.

I know this all feels borderline invasive, and it probably is, but for small businesses, this was manna from heaven. It enabled individuals to compete with corporations. There are tens of thousands of businesses that are reliant on Facebook ads for contacting their customers.

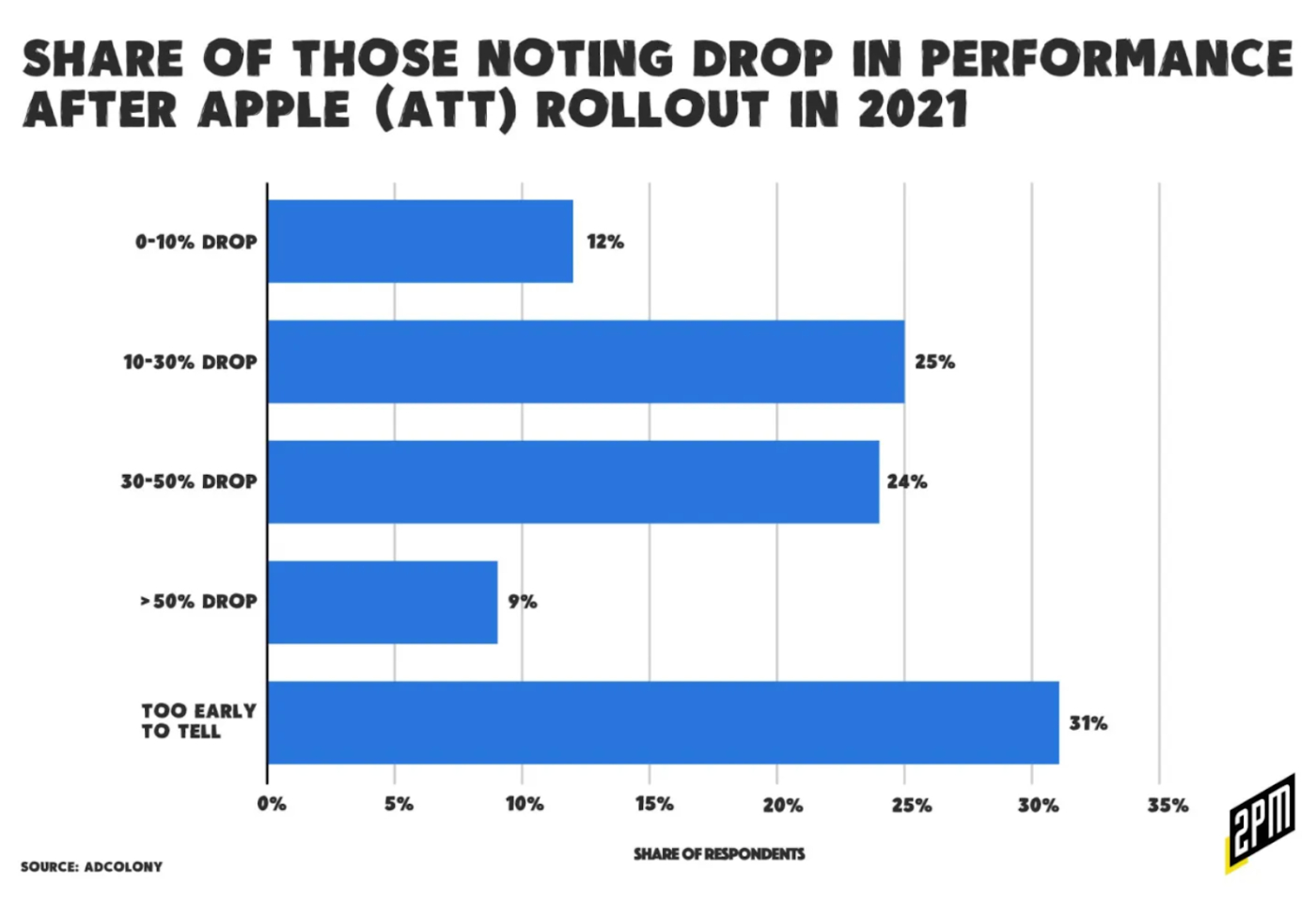

However, everything has changed. Pixels are slowly being depreciated with the gasping demise of cookies. And most consequentially, Apple has rolled out app transparency tracking (ATT) where users can opt out of being tracked from app to app. The impact on advertisers has been enormous.

Let’s say you are one of unlucky advertisers with a 50% performance drop. That means you’ll have to spend double the amount on marketing to have the same output in ads! This is bad for any business, but for SMB retailers it is a doomsday-level scenario. Big companies will do so much volume that less accuracy isn’t as important because so many people use their product. But for companies like the newer digital-only retailers, ads have to be targeted because they don’t have the budget/talent for bigger campaigns.

Returning to Twitter—if you want to understand the future of their advertising business, you need to understand how they are responding to all these changes in the tracking ecosystem. In a nutshell: not well.

Twitter’s Incompetence Wins Again

When ATT came out, I expected all ad platforms to be devastated. However, there was one company that I got wrong. From Twitter’s Q4 shareholder letter,

“The revenue impact associated with App Tracking Transparency (ATT) in Q4 remained modest, and we have incorporated an ongoing modest impact into our Q1 guidance. The impact of ATT is likely to vary across ad platforms given the unique mix of ad formats, signal, and remediations on each, as well as other factors. Although retooling our revenue products in light of Apple’s privacy-related iOS changes took additional time, energy, and resources in 2020 and 2021, we believe that our product improvements have helped reduce the impact on Twitter.”

Allow me to translate the corporate lingo: Twitter never fully developed models that relied on outside attribution, so they were able to largely avoid the impact of ATT. The clown car somehow escaped catastrophe once again.

It is likely that Twitter’s recent success in direct ads is less a matter of increasing technical competence and more a matter of decreasing performance by other ad providers. In both my analysis of publicly available data and calls with ad experts, it is impossible to isolate how much of Twitter’s performance is a matter of their performance improving versus their competitors getting worse, but my sense is that the competitor’s dismal performance plays a significant component.

Because Twitter mostly relied on first-party data housed within their platform to target their ads, they kinda skipped the whole ad adpocalypse. They now have the chance to build a new tech stack that will allow them to be competitive.

High on the Mountaintop

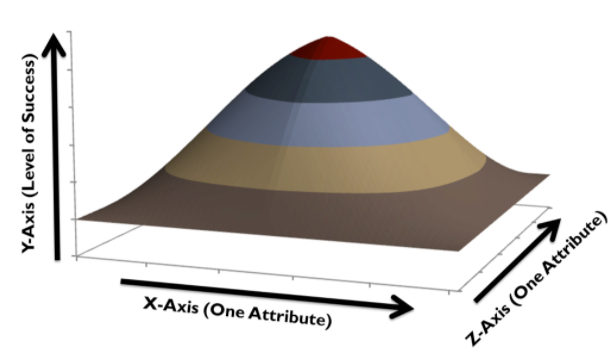

One of my favorite strategy frameworks is a little-discussed theory from 1997 called Rugged Landscapes. While it is famously dense (like yours truly), there is a single point I want to use for today. Picture a mountain, where the summit is the most profits available to a firm.

Companies navigate the mountain by changing their coordinates on the X and Z competitive axis. Why this matters is that when you think of a market, the temptation is to think of it as a stacked bar where companies divide portions of the available revenue. For example, Twitter has ~$5B in revenues, which gives it around 3% of the $150B+ digital advertising market. If you followed the natural tendency of most investors, that last sentence would give you the feeling that they have a ton of room to run. However, a market is not a single mountain to climb, it is a rugged landscape.

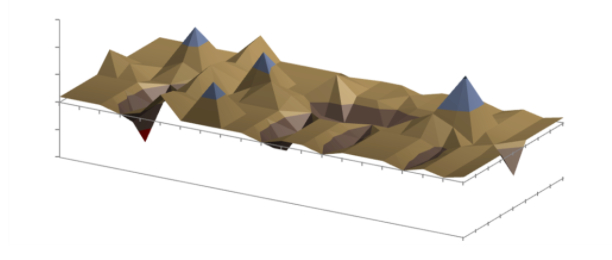

There are multiple peaks, multiple places where profitability (or pick your performance metric of choice for the Y axis) can reach its zenith. The rugged landscape framework is also an argument against the sunk cost fallacy. The temptation of knowing about the sunk cost fallacy is to dismiss the starting position of an organization as it undergoes a change. However, rugged landscapes help strategists grok that not only where you start matters, but it also matters how far away is where you want to go. And because companies are constantly shifting, there can only be one king of the hill for an individual mountain. To make this even more difficult, a landscape isn’t static. It is constantly shifting. Mountains of profit grow or shrink.

The digital advertising landscape has gone through, dare I say it, a tectonic vibe shift. The rugged landscape has moved. Now, all advertisers and retailers need to find a new way to do attribution (or figure out a way to no longer need it). The starting positions of all the ad platforms have given them unique mountains to climb. There are 3 things that matter for Twitter:

1. In-platform purchases are now in vogue

The easiest and most obvious solution for our merry band of ad slingers is for the shopping to take place within the social media app. This is the most surefire way to connect ad spend to revenue. To this end, Facebook announced in 2020 the ability to build storefronts directly into your brand’s Facebook page. This has the case to be a win-win for both retailer and advertiser platform. The store gets an additional virtual shelf to sell in a place that consumers already are, and the advertiser gets all the attribution data that is so crucial to the targeting models. There are similar efforts underway for Instagram

Twitter was late to this game (surprise!) but has multiple ongoing efforts to remedy the problem. They have a live streaming product that was demoed with Walmart, an in-app web browser store front called Twitter Shops that went live about two weeks ago, and an ecommerce module that can be embedded at the top of the profile. However, they tried this in 2015, and it is tough for me to see why the user behavior has shifted enough for this to be successful now.

While this may solve some attribution model issues, this push to become a storefront naturally rewards those who are closest to transactions. This includes, of course, Google’s ever-present search bar, but also Amazon. Amazon’s ad business is one of the most impressive growth stories of the last decade, blooming to $31B in 2021—revenue all within the last 7 years or so. In comparison, this is 3x the revenue of Twitter, Snapchat, and Pinterest combined.

In an interview I conducted with a protein bar startup two years ago, the founder talked about how crucial Amazon ads were. This is how I remember the comment (it stuck in my brain because I was looking to build a competitive product for Amazon ads, so this was not encouraging).

“With other ads I run, I’m always worried about whether I'm going to actually convert to a purchase. Amazon is different—I just put $10K into their ad manager and I hit my revenue targets. There is a direct connection between my ad spend and my volume on the platform.”

Twitter is unlikely to unseat Amazon or Google or Instacart or Walmart as the premier shopping destination on the web. Sure some people will convert, but ATT ends up benefiting large retail platforms more than social media.

2. Probabilistic attribution is the next bet

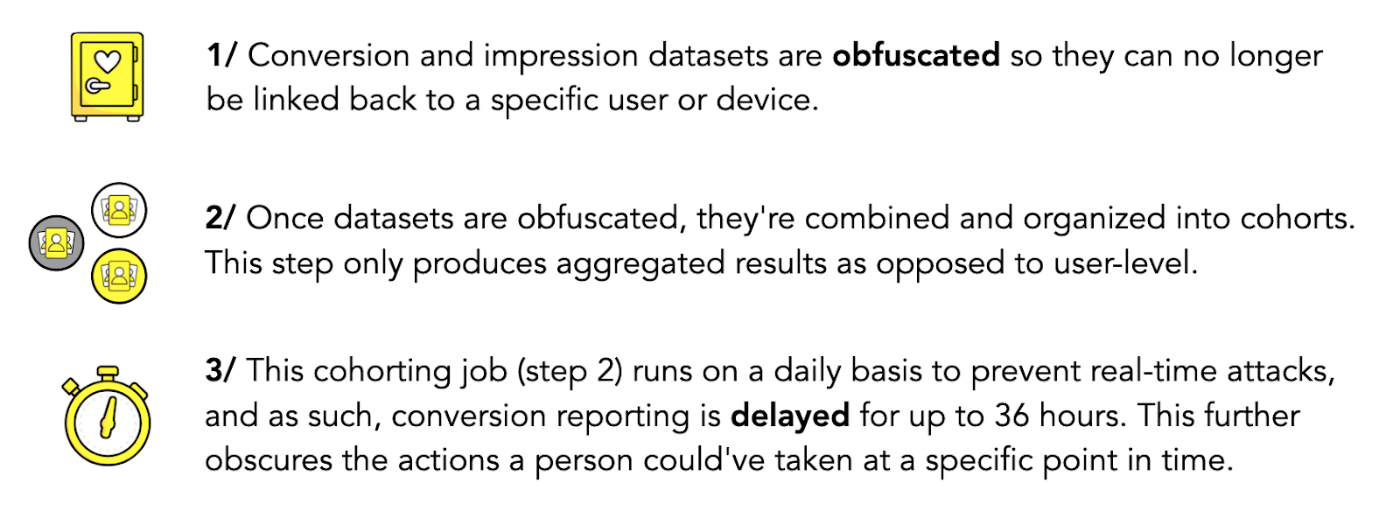

If in-platform shops/ads are not the answer, Twitter is back again to the issue of improving its direct response ads model efficacy. To do so, their best bet is force-feeding all of the data into machine learning algorithms. It requires advertisers to hand over their entire conversion data set from within the ad run period. Essentially, they have to give their entire database over to the social media platform. Platforms will then compare it with the impression data set they have—e.g. did someone click this ad? Snapchat describes their product as follows:

Their description focuses on “cohorts,” but the gist is the same. Compare lots of anonymous transactions and hope that the AI doesn’t screw you.

And getting screwed is the biggest concern with this approach. The fundamental ingredient in this process is trust. Retailers must trust that platforms aren’t going to abuse their data or deceive them. It may be that people have no choice, but no one, and I mean no one, should trust their data or their future to the tech platforms. When business priorities change, previous promises are thrown out the window. Twitter has a particularly poor history of treating their partners with respect, having screwed developers over by cutting off API access multiple times. And in a world where it comes down to ad execution, would you rather bet on Facebook’s or Twitter’s team? Note: There are increasing signs that Facebook has already figured this out and is solving ATT with probabilistic attribution. There have been no such indicators that Twitter has been able to do the same.

3. Engagement modalities:

If you’ll indulge in a more philosophical product conclusion, my biggest concern with the long-term success of Twitter as a direct-response ad platform is how users interact with the platform's content. Twitter is a place of active discussion and consumption, an intellectual battleground where text and memes fly back and forth. Its primary use case is to hear directly from experts, see breaking news, or debate ideas. In comparison to the drooling, slack-jawed, oh baby you are touching me just right in my Medulla Amblagada dopamine feedback loop of Instagram, I worry that users just aren’t likely to switch from “ah that guy is a moron I need to tell him!” to wanting to buy whatever ad is in front of them one scroll later.

Twitter is a victim of its own product-market-fit: by being great at intellectual engagement, it fails at passive consumption. Advertisers have long recognized this—this quote is from a Tegus interview with a former director of performance marketing at a top 10 retailer. (Lightly edited for clarity)

“What makes Snapchat, TikTok, and Twitter different is the use case of how the platform actually works. A major driver of our decision-making with Twitter, was more like brand safety and brand health kind of concerns. The prior presidency made advertising, just generally being on the platform a pretty unsafe space. It just felt like the upside to doing stuff like that was not worth the potential downside.

So that had been a big challenge for us working with Twitter in the past. But more recently, thinking about the way that people use the platform as like buzzworthiness, newsworthiness event coverage. When we’re doing some of these live streaming events, Twitter is a much more integrated part of the conversation there.

Even when the [Twitter] sales teams bring us a product that feels like something that is competitive with our other social platforms, the costs are either one we can’t stomach the costs, or the scale is relatively small.”

If Twitter’s strategy is just to play Facebook’s game they will fail. ATT may have given them a chance to get a little market share, but my guess is that it is just a temporary bump. Brand advertising will continue to perform well but not enough to materially alter the company’s trajectory. The rugged landscape’s new geography benefits Amazon even more.

Ultimately, Twitter only has one choice to become a superlative business: to find new, non-advertising revenue streams around SaaS and the creator economy. Of those prospects…I also have serious doubts. For paying subscribers, I’ll be releasing an analysis of their new efforts around SaaS, enterprise data access, and creator economy tools in the upcoming weeks. Enter your email below to be notified of its release.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

.08.31_AM.png)

Comments

Don't have an account? Sign up!

This is the section that really stood out for me: "Twitter is a victim of its own product-market-fit: by being great at intellectual engagement, it fails at passive consumption."

It's jarring to see a promoted tweet in this environment (especially folks who promote tweets under their personal twitter account). Very different that a promoted YouTube video.