Red-shirted protestors marched up and down the streets of New York screaming their battle cry, “The End of Software.” Their garments symbolically bloodied by the ridiculous cost of CRM systems like Siebel, they chanted, they marched, they bathed the sidewalks in the melodrama that is the special talent of all white guys who sell B2B software. This farce of a movement was taking place in front of the Siebel customer conference in early 2000. It was stupid—but that was the point. This “protest” was actually a Salesforce marketing stunt.

When Salesforce was birthed in 1999, almost all software meant for business was delivered “on-prem.” Meaning that when a business bought software, the next step was a sweaty engineer would show up from Seattle, sit in their server room for 2 weeks, and promptly send a $2 million dollar service bill. This sucked. But this was software.

Salesforce pioneered something new — the cloud. Instead of an engineer eating at Ruth Chris’s on the customer’s dime, the software could just be delivered via an internet browser. Way, way better. To further differentiate itself, Salesforce allowed (or forced) customers to purchase software on a subscription versus the license typically required by their CRM competitors. By doing it on a subscription versus perpetual license it made their price significantly less.

Salesforce argued that a radically different product delivery method, coupled with a novel monetization structure, signified that software was over. But this is….obviously wrong because they are literally selling software. What they actually meant was the previous software paradigm was over. And in that regard, they were right. There are 1000x more software companies now than there were in 2000 (and the size of those businesses are way larger too) but going from licensed/on-prem to subscription/cloud was a significant shift, rapidly changing the power structure of numerous markets.

I believe we are now at a moment of equal import — software is undergoing a quiet revolution that will dramatically alter the power, profits, and market share of incumbents. This is the biggest, most important trend in B2B software since the cloud in 2000. There have been elements of this idea scattered everywhere, but I have yet to find anyone who has, to my satisfaction, actually thought through all the implications. Simply put:

Just as the internet and web browser unlocked the previous shift, the new ease of embedding payments, lending, and other financial products will allow industry-specific software platforms (Vertical SaaS) to destroy multi-market/horizontal solutions like Salesforce. Ever smaller niches will be able to sustain venture-scale software companies because of the addition of financial products. Over time, these niche players will eat their way upmarket capturing SMB then Mid-Cap until the Salesforce’s of today only serve legacy behemoths.

I recognize this is a big claim but stick with me.

To lay the intellectual foundations to support my assertions, I’ll start by discussing some history and theory. This is important because it is very, very rare that something truly new happens in business and what we will see occur in B2B software has happened elsewhere. From there, I’ll tell you all the reasons that you may be wrong, and how I am adjusting the deployment of my capital based on my theory.

We reside in the ASS machine

I think of enterprise software in two general periods: BS and ASS (Before Salesforce and After Salesforce’s Success).

During the BS period, software was installed on-prem by professional services teams and was sold via license. Since 2000, we have been in the ASS period.

Some people (prominently a16z) might argue that product-led growth and bottom-up GTM are the third era of software starting around 2010. I disagree. In my opinion, a new era needs to be accompanied by a dramatic change in monetization and technology, not just marketing strategy. PLG and Bottoms-Up are simply more efficient iterations of Salesforce’s model. This is a hot take and I recognize some of you will disagree with me on this one :)

Regardless, during the ASS period we have learned a ton! Lots of big, public companies have established various operating heuristics that we know to be true in B2B software. A few quick examples:

- You can build a bottom’s up horizontal platform with individual contributor buy-in (Twilio).

- Product-Led Growth can allow you to build large, horizontal platforms (Slack) but unless you intelligently add strong sales and marketing capabilities at the right time, you’ll lose (SurveyMonkey)

- Companies, both large and small, are comfortable with usage-based pricing Snowflake

Whatever the audience, sales strategy, or product, there was one rule that became universal—don’t exclusively sell to small and medium businesses. These customer cohorts will churn more frequently, have a Net Revenue Retention that barely breaks 100% (if your company is good), and will offer significantly smaller Average Contract Value of <$15k versus an enterprise contract of $50k+. Paradoxically, almost all startups start by selling to this segment but the goal is always to move upmarket as quickly as possible.

Note: I scanned 150+ public software companies SEC documents and couldn’t find a single company that didn’t portray an ambition to move upmarket from SMB. If you can find one that does, I’ll give you a free month of Napkin Math subscription. *Edit Oct 11, 2021* Had it pointed out that GoDaddy publicly says in their 10-k that they will only go after SMB. Missed one! I am now only 99% correct here lol. But credit to Kyle for getting it right.

When this law is paired with the need for software companies to pursue large markets, there are very, very few vertical SaaS companies to reach public market size (Shopify and Procore are the two best semi-recent examples). To get there they typically had to focus on a market so massive, so fragmented, and so underserved that the horizontal platforms couldn’t truly fit their needs. The necessities of subscription pricing made it incredibly difficult to achieve the delicate balance between profit/growth.

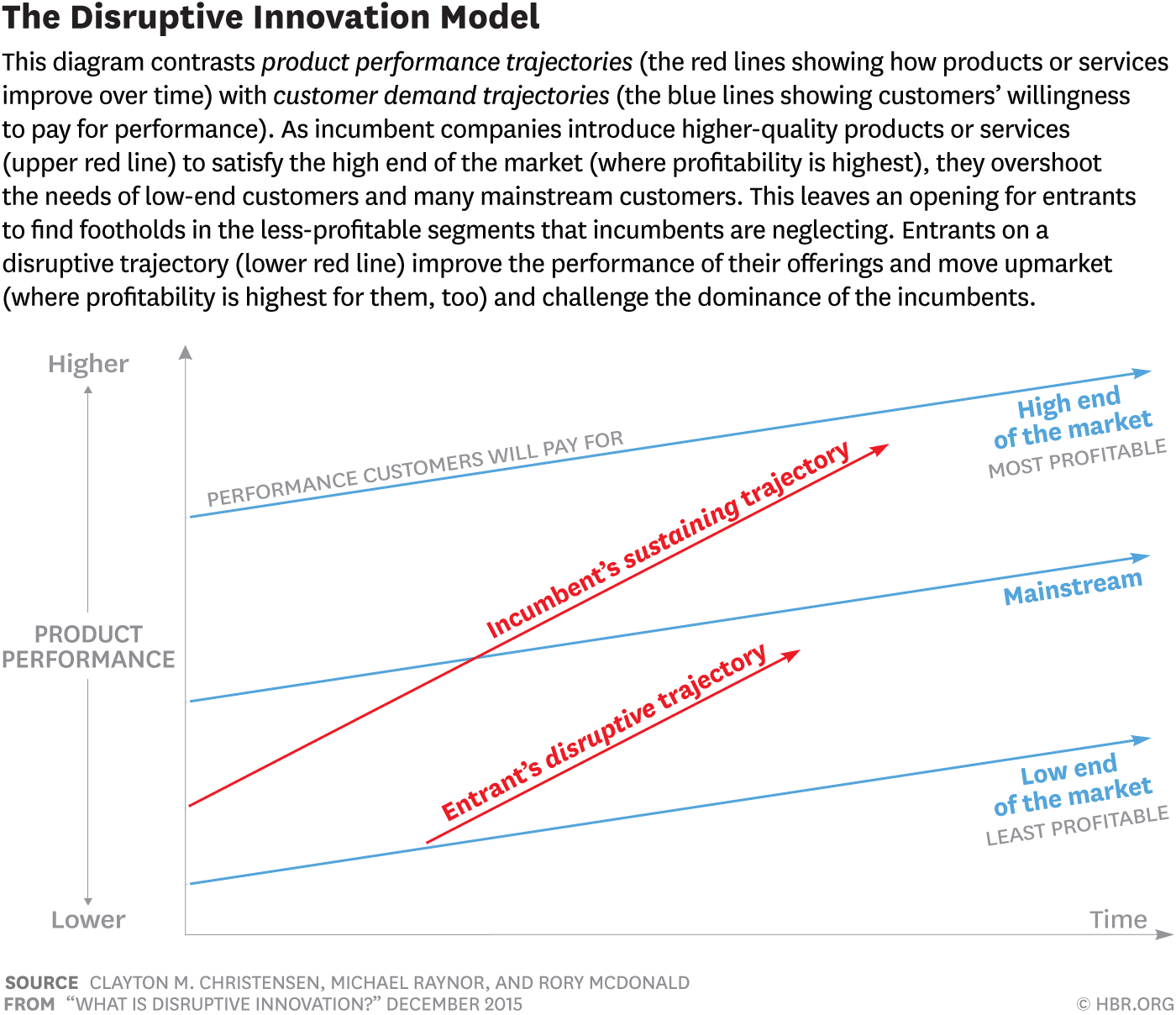

When the history of software is overlaid with disruption theory it becomes a lot more clear on why fintech is so important.

Why should I pay for your product again?

The word disruption is liberally applied to Silicon Valley’s lexicon. No matter the company, no matter the product, being *disruptive* is considered the required secret ingredient of success. It has become used so liberally that it has essentially lost all meaning.

Embedded financial products enable vertical software to be disruptive in the classic and full sense of the word.

The original Disruption Theory stated that through natural decision-making patterns, incumbents would choose to give up their least profitable customers to startups that boast radically different cost/revenue structures. Through totally natural, profit-protecting habits, incumbents would give up market share to new entrants until there was nothing left.

Whether a company was vertical or horizontal, during the ASS period, both models were largely reliant on subscription revenue.

Embedded financial products open up entirely new revenue streams to productivity software companies that were previously only accessible by financial institutions. Fintech APIs (like payments from Stripe) allow companies to monetize not with expensive subscriptions but through financial instruments that were previously the purview of banks.

What if a company isn’t fighting for a limited software budget against all of the other software providers but instead is fighting for a budget against a capital provider? Sure, the software products may be slightly worse than someone who is a specialized horizontal platform solving an individual problem, but because a vertical software company doesn't rely solely on SaaS revenue, they can offer their products at a price their competitors simply can’t match.

A great way to win a customer contract is to be a hell of a lot cheaper than your competitors.

For most software providers, their first entry point in this space is almost certainly going to be payments. It doesn’t really cost the customer anything, has the most robust solutions currently available (aka Stripe), and is the most well understood by equity investors. Become the Payment facilitator, monetize through interchange fees, and become everything else later. Note: This is the strategy being deployed by Toast which I have written about previously. And in the consumer world, this is how neobank Chime monetizes.

A great example of this is one of my current favorite startups, Khatabook. They are a vertical software company out of India that services mom & pop corner stores that are almost universally run out of a paper ledger. They give away their software completely for free and monetize via payments. Their customers could never afford the prices that Toast would charge.

Outside of Khatabook and a few select others, most vertical providers do a blended revenue mix of both subscriptions and payments to build their businesses.

In the world of tomorrow, any industry that is sufficiently fragmented and ignored can have a billion-dollar software business built around it. There will be a Toast for every major industry and there will be billion-dollar businesses in every minor one.

Embedded financial products fully meet the requirements of the Innovator's Dilemma because big horizontal platforms will happily surrender the small fish of SMB to the supposedly unthreatening vertical software companies.

This sounds convincing! (Hopefully). But it is important for me to be honest, there are some very reasonable scenarios that could prove me wrong.

Let me give fuel to the haters

- Excel never dies: There will always be a role for generalist, flexible software. But for established industries where patterns of behavior are more established/well understood (aka companies that are not active residents of startupville) there will be custom software built just for them. The flexible all purpose tools like Notion, Airtable, and Bubble, will fill in the gap of expensive tools for emergent industries. However, there is a chance that this new batch of no and low code software outpaces vertical software to win the day at the SMB level.

- Payments as an entry point sucks: As I’ve discussed this thesis with software-focused venture capitalists, one common pushback I’ll get is, “Well that only works if you are owning their payments.” And this is understandable! Payments as an entry point only really works if you are doing transactions that their customers are using credit cards for. This means that you almost need to exclusively serve companies with a consumer-facing component. While there are a ton of additional financial products a vertical software company could deploy, it is still unproven that you can monetize effectively via other options. (Though I think you can).

- SaaS margin beats Fintech’s price: One of the beauties of the ASS period is how strong the gross margin is for SaaS businesses. Fintech monetization is far less then the 60-80% gross margin that these other businesses enjoy. When you have a cushy margin and positive cash flow you can sustain a more aggressive GTM strategy. There is a world where the Khatabooks of the world can’t gain a toehold because the subscription businesses use their margin/cash to crush them.

- My timing is off: Technology trends are usually easy to see but difficult to time. There is a chance that this current wave of fintech peters out and there isn’t a robust enough ecosystem that vertical SaaS companies to build off of. Last quarter, 1/5th of all venture dollars went into the fintech space. Personally, I’m doubtful this is a huge risk but it is a distinct possibility. If you put a gun to my head, I would forecast that we should start seeing major shifts towards vertical SaaS in about 6 years.

- Smart people read my newsletter and act appropriately: I have lots of CEOs of major software companies who read this publication. Almost universally, they lead companies designed using the ASS model. In my conversations with them, I’ve found them surprisingly open to the idea of shifting more towards embedded finance and reducing their prices. If it becomes obvious that this is the way forward, there is a chance other horizontal platforms try to capture the opportunity.

So let’s say you buy my theory and think the bear cases that I’ve outlined are unlikely—what do you do from here?

Conclusion

I am not currently deploying any capital besides my own (though if you would be interested in me putting together an Angellist syndicate you should let me know) but there are so many startups that are just starting to explore this space. Vertical software for architects, car mechanics, and basically everything else already exists, it is only a matter of time until they wake up and start layering in additional fintech capabilities. Disclosure: My day job is at a vertical software company that services the legal industry. If you think there is merit to this thesis there are dozens of companies available pursuing this opportunity for either investment or employment.

Existing software operators should examine their products and ask how they can push towards fintech to lower their subscription pricing.

Really, this whole thing is a grand race to the bottom. When vertical software company Toast filed their S1, they noted that they used professional services and hardware expenses as customer acquisition costs and ran those at a cost. To my eyes, it is almost certain that software will one day soon be added to that list. When that happens it will be death by a thousand cuts to the horizontal giants as a new world of customized, free software arises.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!