Today is a special treat. I’ve long admired the work of Byrne Hobart over at The Diff. His newsletter is one of the best around when it comes to tech and finance analysis. Turns out he likes my work too (maybe with slightly less fanboy admiration then I have for him). So we teamed up to write today’s four thousand word deep dive into Twilio.

Twilio is valuable to study not just in an “oh that’s cool” sorta way, but because their example offers concrete, actionable insights to improve your business/investing. Each aspect of their business is impressive—from their stock performance having a ~1,400% increase over the last 5 years, to their aggressive M&A strategy (9+ deals totaling over $5B), and a unique product/pricing strategy. Twilio invented an entirely new type of company (developer-driven, API powered) and is now working to create its second act. Let’s get it.

Note: Please let me know if there are other writers you would like to see me team up with. I have two more newsletter collabs (with other tech/finance writers of Byrne’s stature) in the works but would love to hear from my community who they would be interested in.

Twilio 101

Much of a developer’s life consists of being told to do the impossible by people who have no idea what they are talking about. Whether it is the Product Manager who can’t code or the CEO who thinks reading a16z’s content marketing makes him a technical leader; their idea may sound good but is usually unobtainable. These managerial requests can occasionally be resolved with a liberal amount of copy & pasting from places like Github or StackOverflow. Sometimes however, the tasks being demanded are beyond the immediate capabilities of clever code. As an example, regions of the market like finance, telecommunications, healthcare—all the powerful institutions of yesteryear—are not set up to interface with someone typing into a text editor at 2am trying to hit sprint goals. They just don’t care about the small fry coder at a startup. If you were a developer trying to make something that relied on access to these institutions ~15 years ago you would be screwed.

One of the biggest problems in 2009 was that developers were increasingly being asked to text or call customers, directly from their apps. This was incredibly hard to do. It involved brokering deals with telecoms and other communications infrastructure providers. You likely know the frustration of trying to Verizon to give you a clear contract for your iPhone 12 so you can sympathize with the agony that accompanies deals to get commercial access.

Twilio had settled on the novel solution of building APIs to solve this problem. Application Programming Interfaces (APIs) allow developers to insert a few simple lines of code into their program that then allows them to use someone else’s application. In plain human speak, developers could write a million lines of code telling a program to send a text OR they could just use a three-line API call to leverage the million lines of code Twilio has already written. But it isn’t just “oh let’s use Twilio’s code to make computers do stuff.” What makes this so powerful is the code also contains the agreements Twilio had in place with Telcos. By using Twilio’s API you instantly gained access to their partnership privileges on top of all their fancy shmancy code.

This sounds cool! But it is difficult for people to grok how powerful being able to communicate with customers is. Developers are not customers to be intellectually engaged by 4x4 charts. When Jeff Lawson strode across the stage at the SF New Tech meetup to demo his startup Twilio in 2009, he was trying to solve this product marketing problem.

In his own words (via Stratechery):

“I turned to my co-founder...John and I said “John, how many people can be on a conference [call]?”. At the time it was like fifty, and I said “Is there any way you can make it three hundred?” and he was like “I don’t know, I don’t think we’ve tested it”. “Can you just do it?” and he was like “Okay” and so I invented that demo on my way over to the meetup. We’re just going to build it live, because you can do it in three lines of code, and I probably had slideware somewhere that I could’ve used, but I’m like “Who wants to see slides?”

When you have a mobile app or something, oftentimes, what you might do is demo it or show people what it does. I remember thinking, “Well, how do I demo Twilio?” It was like, “Well, I think the best way to demo it is just to, as they say, do it live,” and so we did...There’s a One More Thing which is I can use the API to pull a list of everyone who called in. You do it and then you say, “Oh, I forgot one thing,” and you write another line of code and it dials everyone in the audience and all the phones start ringing and everyone in the audience picks up their phone and that’s the encore. We’ve done that demo so many times because it’s fun, it’s entertaining, and it actually works. It really gets the mind of developers in particular going, “Oh, wow. He did that in three minutes. What can I do with that thing?” And it turned out to be just the best way to pitch Twilio.”

This pitch, and the lightning in a bottle energy it captured, encapsulates what Twilio is. It is a developer-focused business that allows anyone to quickly and easily set up communication channels with their customers via API. Their APIs give developers an easy way to build customer communications channels like texts, calls, chat, emails, and videos. They are an infrastructure play—similar to the work of Stripe with payments which Bryne has written brilliantly about. Twilio is focused on selling tools that allow developers to easily incorporate customer communications into their products. It is a business that is focused on selling components that allow customers to deliver an end service. In a retail housing boom, they are selling a power drill. This strategy has served them incredibly well with 5,450+ employees in 26 countries, a 62% year-over-year increase in Q1 revenue to $590M, and over 235K active customer accounts.

Because they are focused on helping customers build stuff versus trying to rent seek or arbitrarily flex pricing power, they can do some fascinating things around pricing and GTM strategy.

The Twilio Model: Usage-Based Pricing

For decades, micropayments were a promising idea that never got much traction: why buy an entire subscription to a news site when you just wanted one article? Why buy an entire bundle when you just need a subset of it? As it turns out, in most cases the mental cost of micropayments was high enough to offset the lower financial price; if it costs a dollar worth of consideration and inconvenience to make a five-cent purchase, it’s hard to close the gap. For a long time, the only successful micropayments-based businesses were a handful of monopolies: USPS generates revenue from first-class mail in $0.55-increments, and Google can charge pennies per click (or much much more), but other services had to use round-number bundles.

Riffing on AWS’s success in breaking down pricing into its minimal atomic components, Twilio generates its $2bn in trailing revenue as the sum of billions of tiny interactions—$0.0075 for a single text message, $0.0042 for a WhatsApp message, $0.013 per minute for outgoing phone calls.

The magic of this model is that there’s still a cognitive cost to micropayments, but it’s a cognitive cost that’s paid upfront and in bulk: when a developer decides to use Twilio, they’re typically building a prototype whose financial cost is close to zero, but whose cost in time and effort will be much higher. Since the actions Twilio charges for are a relatively cheap complement to a fixed investment that’s expensive to the developer, there’s very little price-sensitivity for Twilio actions.

This gives Twilio some very interesting operating metrics. Many enterprise software companies talk about their net dollar retention: of all the customers who were using Twilio services over the course of year T, how does their revenue in year T+1 compare to year T? This is a challenging number to increase, since it requires existing customers to spend more money in a way that offsets the ones who will naturally churn. Twilio’s net dollar retention was an impressive 133%; if the company didn’t land any new customers, they’d be growing 33%.

This built-in growth is at one level very comfortable for Twilio, since it means the default expectation is that they’re a high-growth company, and execution is just the difference between that and being a hypergrowth company. But it also presents a challenge: if customers are growing that fast, and Twilio’s incremental margins on that growth remain high, then it makes financial sense to throw a lot of money into acquiring small customers on the assumption that they’ll be bigger later on.

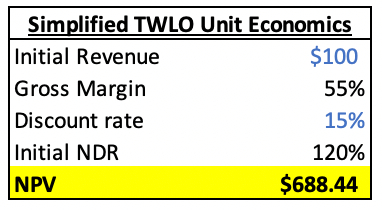

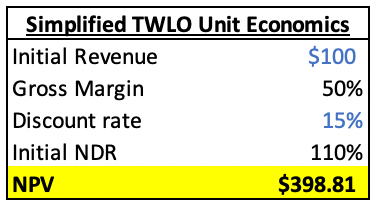

For example, if Twilio assumes that a typical new customer generates 55% gross margins and has 120% dollar retention for ten years before spending flattens, then to get a 15% return on marketing spend they’re justified in spending almost 7 times their customer’s first-year revenue to acquire them. Tweak those assumptions just a bit—110% gross retention instead of 120%, 50% gross margins instead of 55%—and the budget for acquiring new customers drops from 7x year-one revenue to 5x.

Plenty of companies have to deal with making upfront investments that involve long-term uncertainty. An airline buying a plane today is making a bet on the market for aviation in 2030, and a chip company breaking ground on a new fab is partly trying to predict the course of chip deployment over the coming years. But Twilio’s challenge is deeper, because part of that long-term revenue ramp comes down to the decisions they make, especially around which product launches count as competing with customers and which don’t.

Plenty of companies have run into the ground by spending optimistically based on long-term cohort performance that didn’t pan out. Groupon and Blue Apron both overestimated long-term revenue retention. One of the more amusing examples of this is the printer company Lexmark. Their model was to sell printers at a loss and make the money on ink cartridges. At one point, their printers were cheap enough that Dell was bundling them with computers for free; Lexmark saw the printer sales, and assumed ink would follow—but it turned out that the cheap printers were usually worse than the ones customers already owned, so Lexmark was eating the cost of the printers without recouping it in sales. Fortunately for Twilio, one element of their growth strategy is naturally low-cost.

How to Hire Ten Million Part-Time Junior Account Reps for Free

A competitive economy tends to resist easy arbitrages. Continuing to sell to a big company once it’s been landed as a customer is fairly easy, and the enterprise software companies that focus on big accounts tend to put up the highest dollar retention numbers. But that’s offset by how difficult it is to start selling to these companies. Steven Sinofsky describes the process like this:

>Every enterprise sales person I have worked with begins to build out the physical and logical org chart from the first engagements. You want to learn the management reporting structure as well as the power You want to understand the budget and decision making processes. Great enterprise sales people also know that you invest in the full org chart and don’t just focus on the areas of most authority and power—you never know where an advocate or obstacle might appear from as a deal progresses.

Enterprise sales means reverse-engineering how a company works, possibly understanding its internal politics better than most people at the company itself, and using that to help shepherd a deal into existence.

Twilio has stepped up its direct sales to enterprises in recent years, catalyzed, paradoxically, by losing their single biggest client. In May of 2017, Twilio’s stock lost almost 30% of its value overnight when Uber, which represented 12% of revenue, decided to move away from Twilio. The company realized that the only way to avoid being excessively dependent on one big customer is to have lots of big customers, ideally with most of them at a stage of breakneck growth where they can’t afford to move a service that works in-house.

But individual developers are the place to start for those huge companies. Twilio’s tutorials make it easy for someone to quietly hack together a prototype that uses Twilio, and then scale it. The winning move for Twilio is for developers at prospective enterprise customers to build something that amounts to a customized product demo pitching Twilio to their employer, and then to initiate the sales process internally. By providing prominent documentation, lots of project templates, and numerous products—from the obvious voice and messaging to more niche services like phone number verification and even automated faxing—Twilio pushes the cost of starting as close to zero as possible. (For startups, they push it even further, by offering credits to companies that are early-stage enough to be budget-constrained by that have growth plans that will make them meaningful customers in the future.)

At their latest investor day, Twilio said they have ten million unique developer accounts on their platform. This is far higher than their customer count, since some customers will have multiple developers and many users will sign up but never spend. But it’s a good proxy for the number of people who would consider spending on Twilio, and who can advocate internally for their company to use it.

Twilio is well aware of this dynamic. Their CEO recently published a book called Ask Your Developer, whose title comes from a billboard Twilio bought. They weren’t sure what message would convey both what the product does and why users like it—the downside of a flexible product is that the most impressive use cases can be irrelevant to a specific user’s problems. So they outsourced both the details and the hype to their forward-deployed sales team embedded in every company.

Twilio’s M&A Strategy

Despite its army of free developer evangelists, Twilio has been happy to pull the trigger on inorganic growth strategies. The majority of their acquisitions have been small, <$100M type deals. Six of these have been publicly disclosed. A sample flavor would be them adding two-factor authentication with the acquisition of Authy in 2015.

What is more interesting have been the large moves that dramatically accelerate the size and scope of Twilio’s ambition. There have been 3 transactions of sufficient size to warrant investigation. We’re power ranking these from most predictable to most compelling:

1) SendGrid for $2B in 2018.

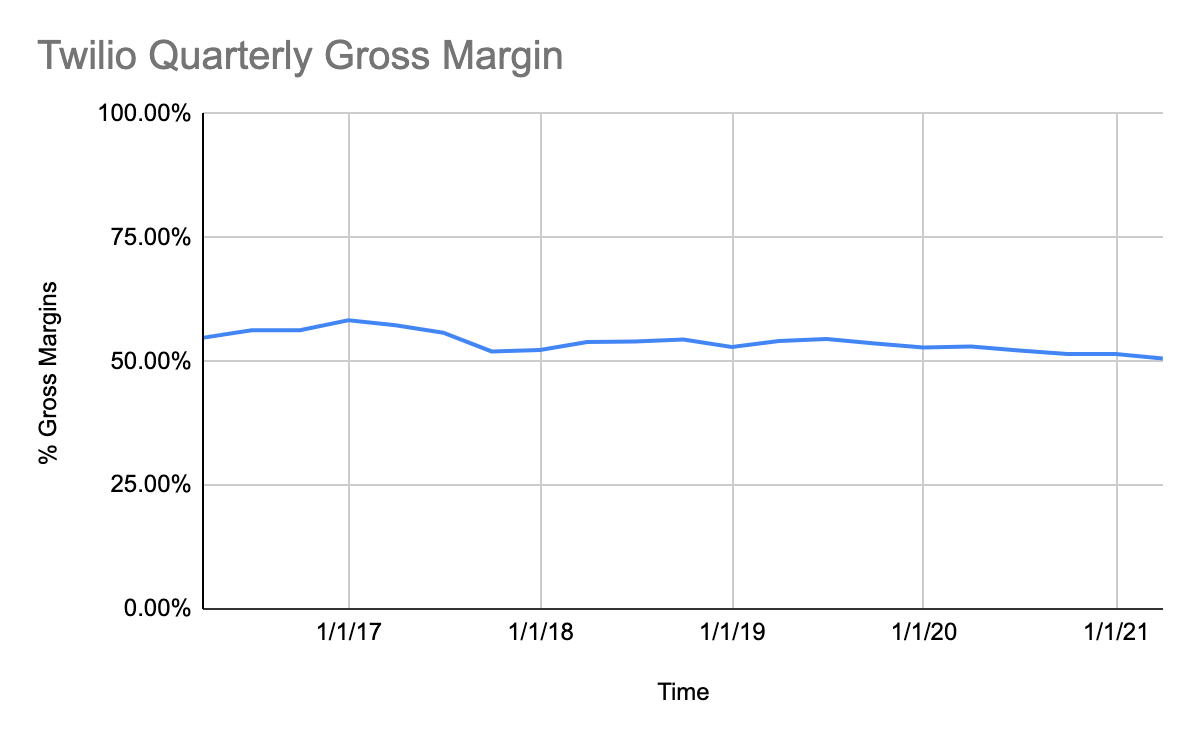

One of Twilio’s biggest issues has always been gross margin constraints. Because they are so reliant on telco networks for delivering texts/calls, and each of these messages have a fixed associated cost, Twilio can’t expand dramatically beyond where it has been. Their gross margin has sat around the 50-60% mark for years.

As Michael Porter would say, their product suffers from a case of strong supplier power. Sendgrid is one part of Twilio’s answer to the gross margin problem. The company is structured very similarly to Twilio—an API-focused tool that enables developers to easily incorporate new communication channels into their applications. Only difference was that SendGrid does emails, not texts. Email is a free channel and isn’t presided over by a bunch of rent-extracting gatekeepers—although Google is increasingly in a position to act as such a gatekeeper, and the company’s policy changes have periodically forced email-based startups to scramble. At the point of acquisition, Sendgrid was sitting at ~75% gross margin on a forecasted ~$144M in annual revenue. Plus there is the whole benefit of doing emails!

One last and important note about this transaction—it was an all-stock deal. Sendgrid got a great exit at 14x sales price and Twilio got an addition that clearly believes and is incentivized towards the long term future of the company.

2) Zipwhip for $804M in May 2021

Zipwhip is a “Trusted Partner to Carriers & a Leading Provider of Toll-Free Messaging in the United States” according to their transaction announcement press release. To translate, Zipwhip has direct relationships with each of the U.S. carriers and makes software that enables business landlines to text. This transaction feels a little...weird to us. When we first started chatting about Twilio’s M&A we hypothesized about the temptation that Twilio must feel to buy end applications of their software. There is an entire cottage industry devoted to helping businesses do texts and other forms of communication. Podium (Y Combinator backed, $218M raised) sends texts and chats and emails for 100k+ SMBs like car dealerships or hairdressers. Weave (Tiger Global backed, ~$150M raised) does the same for SMB healthcare providers. Attentive (Coatue backed, ~$390M raised) does text marketing for retailers. On and on. The secret desire would have to be there for Twilio’s deal team to roll some of these folks up.

Instead, Twilio did a kinda lukewarm version of this. Zipwhip has the typical hallmarks of a Twilio target. (An API powered communication tool that gives businesses a new medium of communication). They come with the benefit of direct contact/contracts with American carriers. Zipwhip differs in that most of its ~30,000 clientele are SMBs. These SMBs don’t think of Zipwhip as a building tool, but rather as an end software service. The API isn’t even included in the primary pricing package!

So either Twilio considers Zipwhip’s core technology so impressive that they are willing to shut down that SaaS revenue or they are starting to wonder if they should push downstream towards texting SaaS. Zipwhip gives them an insiders’s view into win rates, ACVs, etc. If they think they can win, expect them to double down on this area in the future.

3) Segment for $3.2B in Oct 2020

The Segment acquisition was one that sent shockwaves through the SaaS community. The move was universally unexpected and universally lauded. It pushed Twilio from being a company that provided a tool to a company that owned the customer relationship. Segment is about the customer relationship on the ingest. They link together all of your different sources of data (websites, apps, etc) and then fire off data about it to your various systems. When you put these two tools together it looks like Twilio can provide you a way to manage your customer from the moment you meet them to the last minute of you talking with them. Think of those texts that a website will send you if you abandon your shopping cart.

Every type of tool that touches customer data is angling to become a “data platform.” The end state is that companies want to be the one where customer data is stored and actioned upon. By being the company that holds the data they are embedded so deep into their customer’s tech stack that it is nearly impossible to be replaced (see Salesforce’s continued dominance). The difficulty with this ambition is actually finding a way into the firm. Ripping out an existing data system to swap with the system you are trying to sell is very hard. Twilio’s bet is that by combining with Segment, they can make communication the center component of data activity for companies. Based on the CEO’s comments in his interview with Ben Thompson, the GTM strategy appears to use Twilio’s communication APIs as the entry point and then extend deeper into the org with Segment. Twilio gets a higher margin, larger TAM. Segment gets an incredible GTM motion to jump on top of.

As with the Sendgrid deal, this transaction was all stock. Both companies viewed their future as stronger together.

The Universal Switchboard

What’s Twilio’s end goal? In a way, they don’t have to think of one: the company states repeatedly that it’s building tools that other companies use to build their products. From the 10-K, for example: “We do not aim to provide complete business solutions, rather to offer flexible building blocks that enable our customers to build what they need.” The ideal is to be surprised and delighted by what customers come up with once Twilio reveals the seamless user experience hiding behind clunky, uncooperative legacy technology.

And yet, the history of startups is littered with companies that built an open platform rather than a specific product and discovered that nobody really needed to use their platform. An open platform gives users plenty of places to start, but doesn’t tell them where to go, so it throws up the same problem as a blank page with a blinking cursor. (You might write the Great American Novel by opening a blank Google Doc, but it’s not something Google should assume will happen.)

And as Twilio does more M&A, it becomes more important for them to aim for some definite goal. A highly valued stock is a great currency for acquisitions and compensation, and Twilio, which trades at 24x next year’s sales, certainly qualifies as pricey. But that price is a function of both the growth Twilio reports and the story they can tell. An acquisition that adds to revenue but dilutes the story ultimately hurts their stock price, and that limits their ability to buy new companies and to retain employees.

The Segment acquisition in particular changes the story, making Twilio a repository for customer data as well as a way to reach out to those customers in whatever medium they prefer. Email and phone numbers are two global unique identifiers, and combining the two means getting more data.

With Segment, Twilio is creating a new abstraction that’s actually familiar given where they started: they’re a universal switchboard that helps customers connect with companies and companies connect with customers. And this is not just a nice incremental add-on; it’s a macro bet on the increasingly popular model of converting one-time sales into repeat purchases and subscriptions. If fitness gear and grills can turn into businesses that quote ARR (not to mention email newsletters!), then the companies that help them identify and sell to their customers get that much more valuable. Twilio is still not providing the logic behind what to do with that data, but they’re making it easier to default to Twilio as the way to work with it; Twilio is building a peripheral nervous system and letting its customers provide the prefrontal cortex that decides how to use it.

The Crux of the Argument

The classic competition-focused way to look at businesses is that the best ones are more concentrated than their customers and than their suppliers. A business with a fragmented customer base doesn’t have to worry about losing any one customer, and can make itself a standard. A business with fragmented suppliers can play one off against another, keeping its costs low and allowing it to stay flexible.

Twilio has half of that. Their customer base is incredibly diversified, with a long tail of companies that constitute a portfolio of call options on future growth. But on the supplier side, they’re working with big companies that have wide competitive moats. If they raise prices, Twilio can’t just build its own global telecommunications infrastructure. (At least, not yet.)

They’re very aware of this. What the company does in the short term is that it passes through price increases to customers. So the economics of sending a text via Twilio include a convenience layer that Twilio provides at a fairly stable price, and a physical infrastructure layer that telcos provide at whatever price they choose. The incentive for the telcos is not necessarily to push prices as high as they possibly can—at prohibitive price points, Twilio users can switch to WhatsApp or other messaging services, and may decide not to switch back. But it does mean that the company is in an uncomfortable position where it’s hard to control its own fate.

It’s possible to sketch out scenarios where the market in messaging gets more decentralized, and Twilio’s pricing power gets stronger. But it’s equally plausible to see a shift in the other direction: messaging has incredibly strong network effects, and the biggest platforms get very big indeed. So, over time Twilio might switch from worrying about telcos to worrying about other partners, and a narrowing set of them. The company has a massive advantage with respect to its customers—it can provide all sorts of useful tools that help them do their own jobs better. But the way it provides them is subject to unpredictable forces, and consolidation. Twilio’s not-quite-software-like gross margins are easy to strip out, and that does give a better look at its fundamental economics at any one point in time, but the gross margin gap between them and other high-growth software companies speaks to a fundamental truth. The marginal cost of selling bits is zero, but the marginal cost of moving bits along a wire or through spectrum owned by somebody else is whatever that owner decides it should be.

Twilio’s original innovations of usage-based pricing, developer advocates, and API delivered products gave it enough momentum to become the company it is today. Whether its M&A strategy will give it the push to be the universal switchboard remains to be seen.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!