In the mid 2010’s, Chegg seemed like it would be yet another eCommerce flame out. High flyers like GroupOn and GoPro were starting to crash and many investors assumed textbook rentals would succumb to a similar fate. A fine business, but a lot smaller than initially expected.

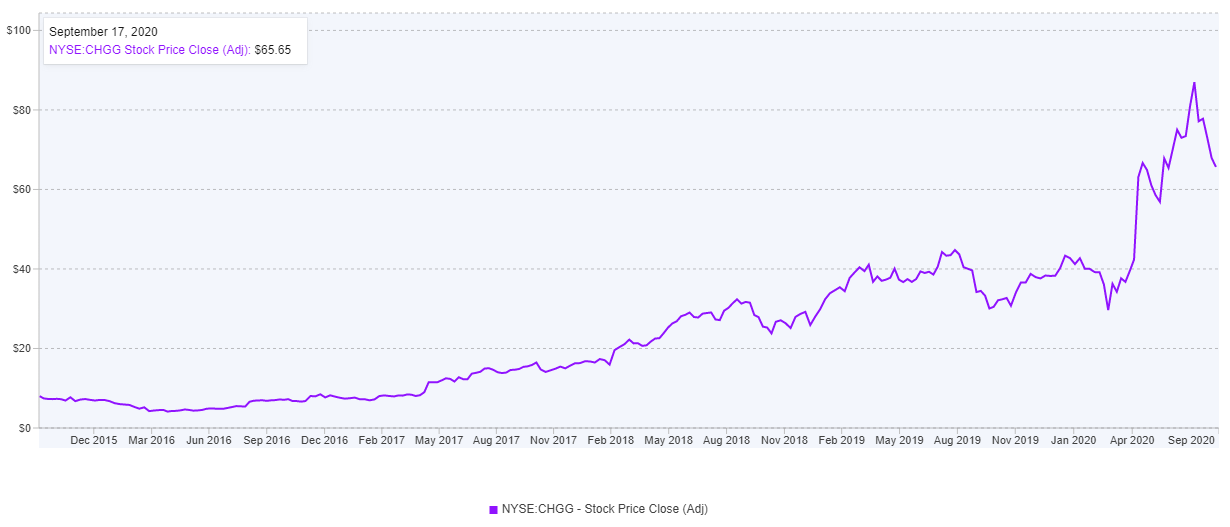

In 2015, Chegg’s revenue fell 1%. In 2016, it dropped 16% further. The business was in the midst of a transition from physical textbook rentals to textbook question solution subscriptions and the future was murky. In early 2016 the stock traded for just over $4.

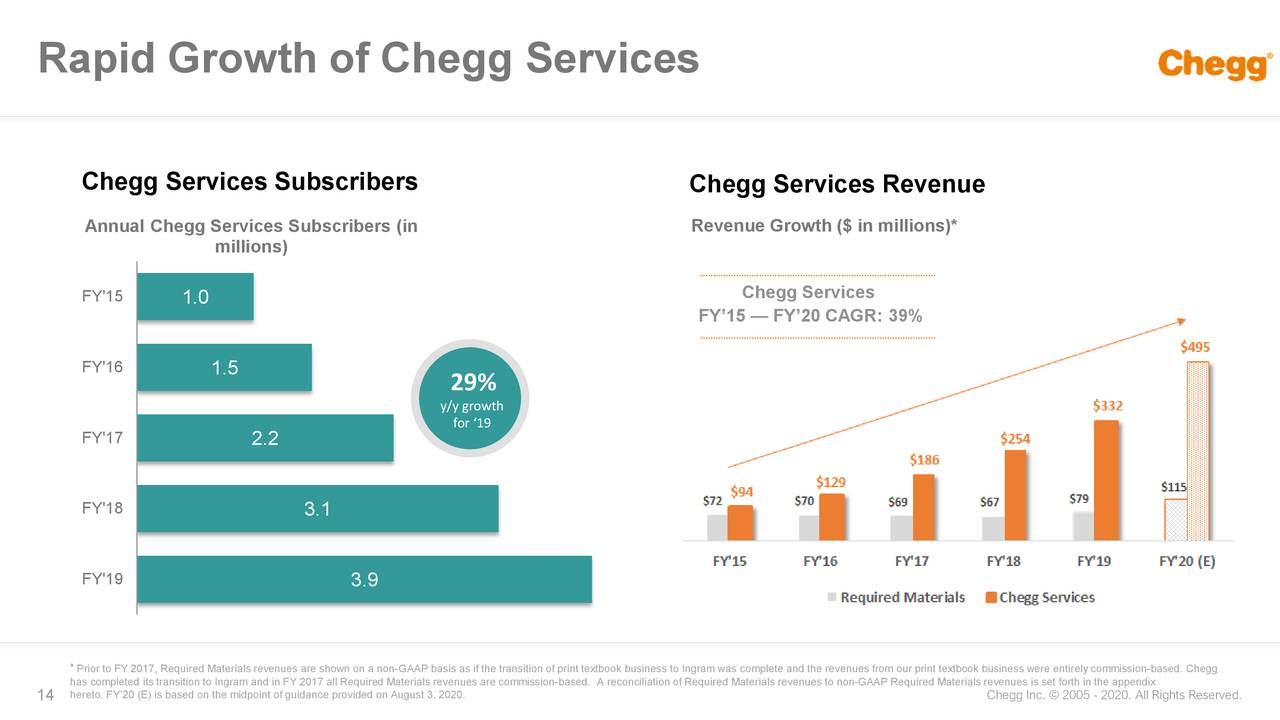

But then things started to change. Margins started improving, and the digital subscription business took off.

Source: Chegg Investor Relations.

On August 7 2020, the stock reached a peak of $86.98, a return of over 20x from it’s 2016 lows.

Chegg 5Y stock price chart, via Finbox.

Chegg was often referred to as the “Netflix of textbooks” due to their textbook rental business model, and years later CEO Dan Rosensweig would borrow another strategy from Netflix: allocating resources away from a dying business line into a growing subscription business. Textbook rentals are more or less a commodity. Chegg pivoted out of the business and leveraged their brand resonance with college students to build a direct-to-student subscription product.

In this post, we take a look at the origin of Chegg, how they grew their textbook rental business, why they shifted out of it and into subscription, and what we can learn from them. Let’s dive in.

Collegiate Origins

Usually when I write about companies, I don’t bring up my university alma mater. A land-grant university, Iowa State University is principally known for strong programs in agriculture and engineering (aerospace especially). But today’s post is a rare exception: Chegg was founded by Iowa State students almost two decades ago in the thriving metropolis of Ames, Iowa.

Originally called CheggPost, co-founder Josh Carlson and a couple friends built a “Craigslist for Iowa State” in the fall of 2000. They sold everything from couches and golf clubs to computer monitors and textbooks. The name Chegg comes from mashing together “chicken” and “egg” — how they thought about the job market after college. Every job required experience, but in order to get experience, you needed a job.

A couple years after launching the site, the founders saw that textbooks were the best performing category. Then the thought occurred to them: instead of being a marketplace, what if they bought the inventory themselves? At the time, they were just collecting a fee for the posting. If they owned the inventory themselves, they could earn a higher margin.

Around the same time, Aayush Phumbhra began his MBA at Iowa State and joined with the others to build CheggPost into a bigger business. They incorporated in 2005 and took the concept nation-wide in 2007 under the name “Chegg”.

After a few years of rapid growth, Chegg needed a more experienced management team to take the company public. They turned to Dan Rosensweig, who had quite the background himself.

In the 1990’s, Rosensweig was the executive behind PC Magazine growth into the largest computer magazine in both audience reach and revenue. Along the way, he sold advertising directly to some of the most successful technology CEOs of all time, including Michael Dell and Bill Gates. He also spent four years as the COO of Yahoo and was the main negotiator that offered to buy Facebook from Mark Zuckerberg for $1 billion. While the deal never went through, Rosensweig’s background in media set him up for success when he took the reins at Chegg in 2010.

Issues with Textbook Rental

In 2014, Chegg found itself with a tough business. They were buying textbooks and renting them out at increasingly deteriorating prices. Competition (from Barnes & Noble and Amazon in particular) threatened a business that didn't really have a moat. While it was clear this was the future — depending on the format, rentals are 10% - 80% the cost of buying textbooks — textbook rentals were a commodity business.

There is no product differentiation (professors listed a textbook for a course, and that’s what everyone bought) and the supply base of textbook publishers was already an oligopoly with five firms making up over 80% of the market. The price of rentals would fall to the cost of customer acquisition and profits would vanish.

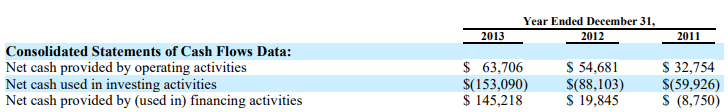

In addition to being hard to differentiate, textbook rentals were also capital intensive. From their 2014 annual report, we can see that capital expenditures dwarfed cash flow from operating activities. There was a massive amount of capital being deployed into textbooks: in 2013 alone, Chegg spend $122.2 million on textbooks and only produced $63.7 million in operating cash flow.

(Source: Chegg 2014 Form 10-K. Purchase of textbooks represents $122.2M, $104.5M and $74.1M in 2013, 2012, and 2011 respectively. Purchases were offset by textbook liquidation of $38.0M, $34.1M and $30.9M).

At the time, Chegg distributed around 5-6 million textbooks to students each year. If we assume a three year useful life (the number Chegg cites) then they might purchase 1.8 million textbooks each year. Textbooks retail around $100, so if they got a wholesale discount of, say, 30%, they might get each textbook for $70. 1.8 million textbooks times $70 per unit equals ~$128 million, which lines up pretty close to their 2013 annual textbook expenditure of $122.2 million.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

.08.31_AM.png)

Comments

Don't have an account? Sign up!