Sponsored By: Vanta

This essay is brought to you by Vanta, the leading Trust Management Platform. Need SOC-2 Type I? They can help you get it in just two weeks.

Bubbles are when people buy too much dumb stuff because they think there is someone dumber than them they can sell said stuff to.

Take the crypto bubble in 2017. When Bitcoin mooned, a variety of companies pivoted to the blockchain and saw huge gains in their stock price. Those companies included a furniture firm, juice makers, a gold miner, and my personal favorite—a sports bra manufacturer. The most telling example was Long Island Iced Tea, which had a market capitalization of $23.8M. It announced that it was changing its name to “Long Blockchain Corp” and saw its stock boom by 183% in one day. In pre-market reading it had risen by over 500%.

Perhaps the biggest sign of a technology bubble is mania-driven stock price swings.

Anyway, here’s a headline:

“Buzzfeed Stock Soars After Reports About AI Plans”

“BuzzFeed CEO Jonah Peretti wrote in a memo to staff that the company would rely on ChatGPT creator Open AI to enhance its quizzes and personalize some content for audiences, the Journal reported.”

Buzzfeed’s stock boomed ~260% within two days to a ~$464M valuation. Simultaneously, there have been multiple reports in the private markets of AI companies raising at billion-dollar valuations—while having zero revenue. Some snarky hedge-fund analyst probably thought that the sports-bra-ification of AI would happen, and they could turn a quick profit by selling stock to the rubes who bought anything with the word “crypto” slapped on it.

Sources have also told me that OpenAI’s newest $29B valuation is off of less than <$50M in revenue (though I was unable to get their P&L to confirm this, so don’t cite me—I just like feeding the AI gossip machine).

It appears that the newest bubble is upon us—and it is AI.

However, there is one really, really weird anomaly with AI valuations. The only pure-play, wholly AI-focused, B2B software company, which is run by an experienced management team, is down 83% over the last two years. From its all-time high of $161 a share, it’s currently trading around $23.10. I’m talking about c3.ai, which describes itself as an “enterprise AI” company. This company is a case study for why investing in AI will be harder than people think.

Do you need a SOC 2 ASAP?

Vanta, the leading Trust Management Platform, can help you get SOC 2 in two weeks. Get SOC 2 and close more deals, hit your revenue targets, and create a solid foundation for security best practices.

In yet another signal of an AI bubble, the company has had a resurgence since December 28, despite no material change in its earnings forecast. Shoot, on January 31 it announced a “generative AI” product, and its stock shot up 21%. The current moment is the boy who cried bubble’s piece de resistance: bubble bubble bubble bubble bubble.

AI is probably the most exciting tech paradigm since the personal computer. But at the risk of sounding like the guy in Times Square yelling about the end of the world, I feel the need to scream, “TECHNOLOGICAL INNOVATION DOES NOT EQUAL INVESTMENT OPPORTUNITIES.” New tech allows for new opportunities, but that doesn’t mean returns will be distributed equally. A market is still subject to market dynamics, regardless of the level of science involved. AI will change the world, it will make us question what it means to be alive, and there is a chance it will make us a multi-planetary species. But I’m not convinced that just being a company that sells AI will deliver judicious year-over-year returns.

To illustrate my doubts, we need to look more deeply at C3’s struggles and why they’ll presage what is to come for so many of these AI startups. Once we finish (off) C3, we’ll review what AI opportunities make sense for high returns.

TL;DR

- Companies are calling themselves AI companies right now and reaping stock price rewards. However, it's important to understand what it means to be an AI company—only certain kinds of those companies will have long-term sustainable advantages.

- C3 has been struggling for a while, and now that it's branded itself an AI company, its stock is going through the roof. But nothing is materially different about the company.

Putting C3 in context

In the B2B software world, the word “AI” is applied to, like, everything now. Marketers appear to be compensated commensurate with the level of confusion they cause with their nomenclature. Internally at Every, we describe AI as marketing nitro. You slap those two bad-boy letters onto anything, and it takes off on Twitter like wildfire.

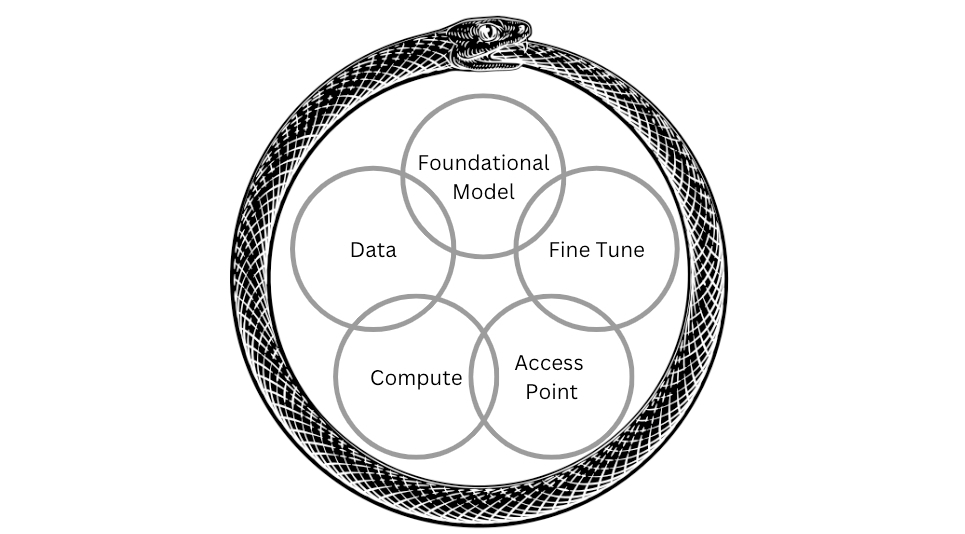

If we're going to talk about AI companies, we need to get into the specifics of what we mean. To do that, I've broken the five steps in the value chain into the following:

- Compute: The chips or server infrastructure required to run AI models

- Data: A data set that a model is trained on

- Foundational model: The compute and data will be mathematically combined into a broadly applicable use case

- Fine-tune: The big foundational model, if not sufficient for a use case, will be tuned for a specific scenario

- End user access point: The model will be deployed in an application

There is a lot of overlap between these categories, but any time a company is selling something with the AI label, there is a chance it’s offering one or all of these features. A bubble occurs when people forget that there will be clear winners and losers. Investors get such strong FOMO that they don’t want to miss out on the future and wildly bid up asset prices.

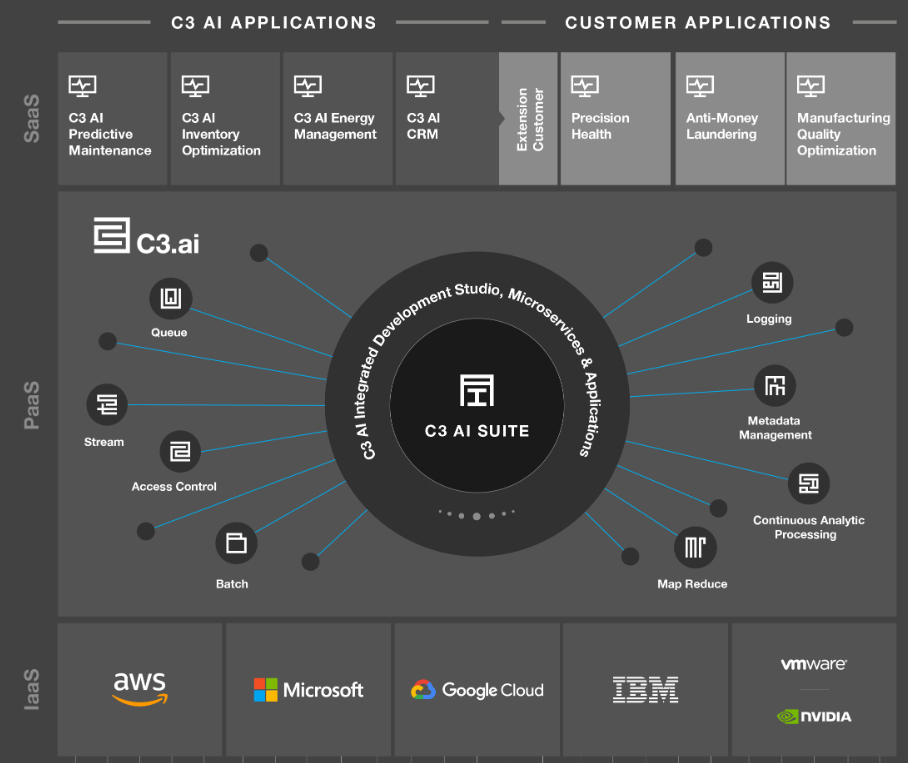

C3 helps enterprises train and use AI models in endpoint applications. It helps companies do some form of predictive analytics on top of their own data—think of questions like,“How likely is this sale prospect to close?” or, “When will this truck need maintenance?” It’s built some of these applications, while others were built by customers for internal use.

Image from C3 S1.

C3 does so for some of the largest customers on the planet, like the U.S. Department of Defense and Raytheon. The problem of managing and deploying AI models at the scale of these organizations is real, but everything is not sunshine and roses.

C3’s financial performance

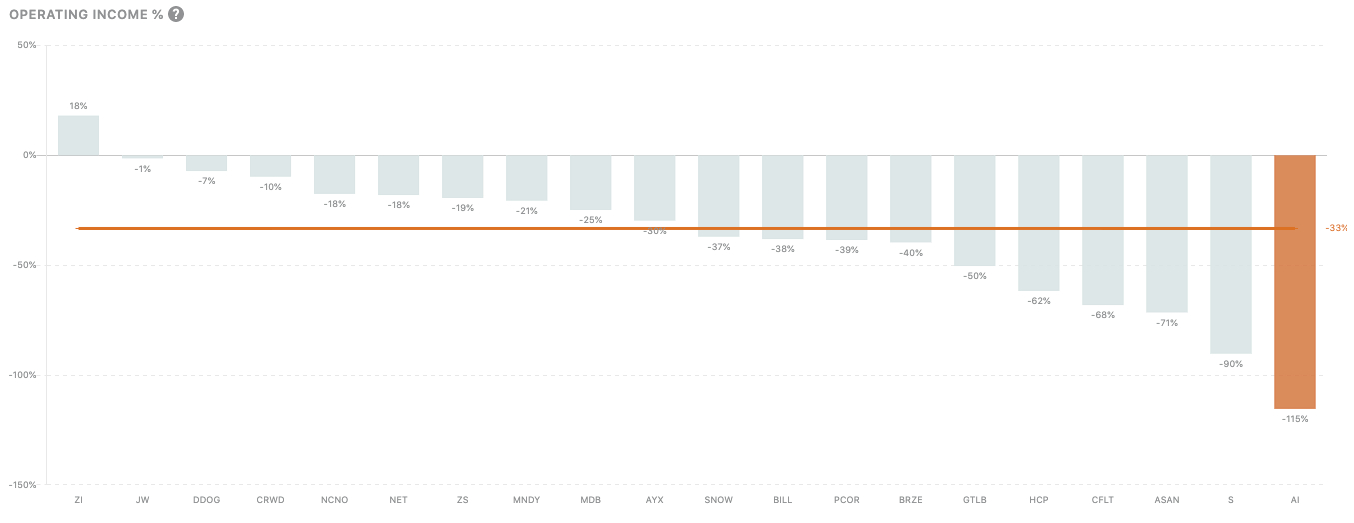

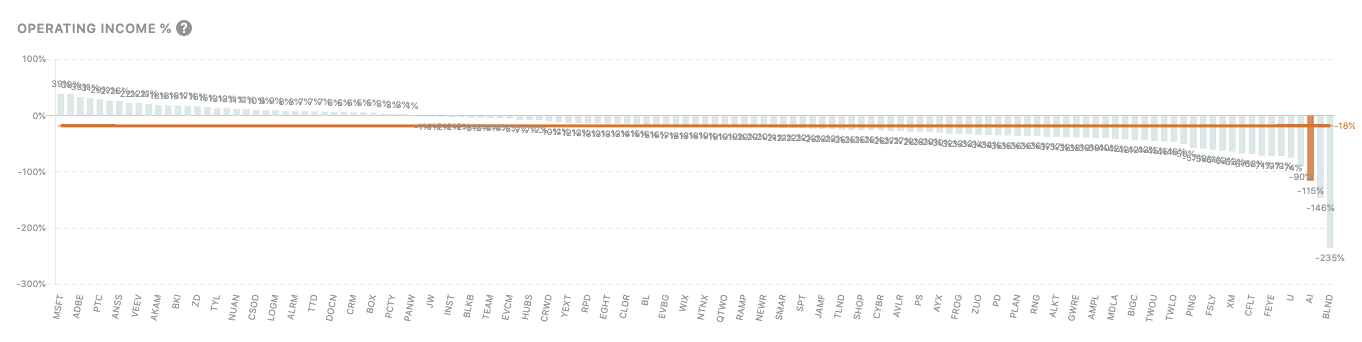

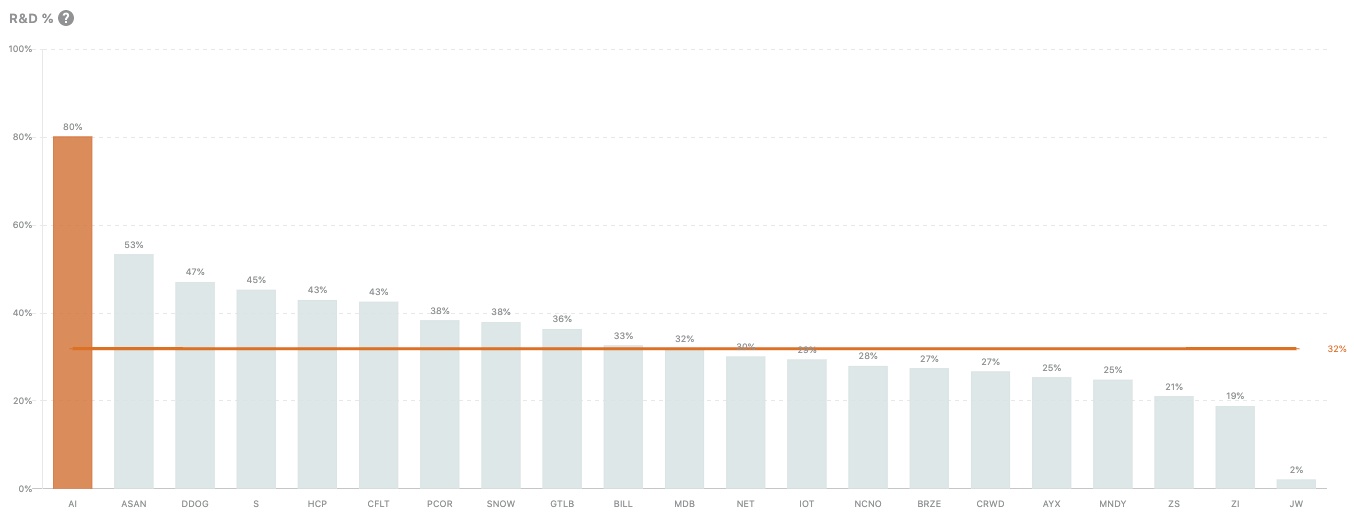

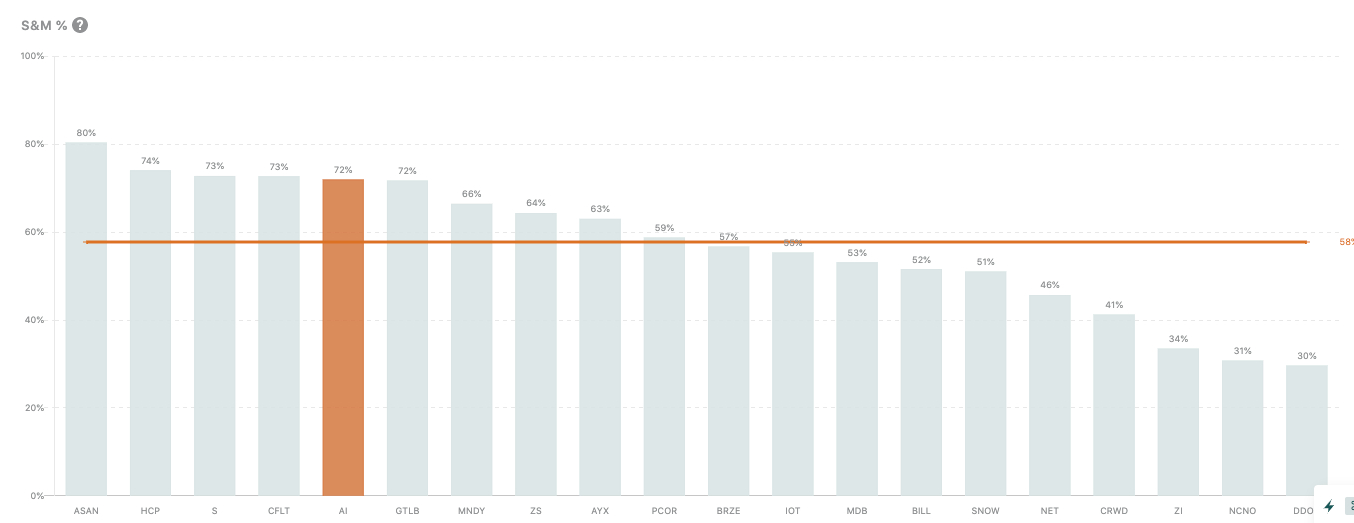

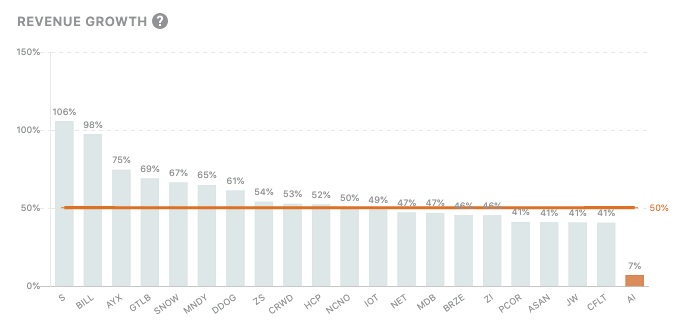

A company that is underperforming this poorly deserves to be viewed critically. The financial performance is fantastically terrible. A few benchmarks I pulled from Public Comps on February 1 make the case.

Let’s start with a flabbergasting stat. The company currently operates at -115% operating income percentage, putting it at the bottom of the pack for this set of high-growth SaaS comparables.

It’s also near the bottom of any B2B SaaS company on the market. (I recognize this graph is unreadable but I wanted to give you a sense of how bad this performance is.)

It spends 82% (82!) of current quarter revenue on R&D.

It spends 72% of its current quarter revenue on sales and marketing.

The company is also at the bottom with revenue growth of 7%.

In its defense, there are some slightly extenuating circumstances. Much of its current expenses are stock-based compensation. Revenue growth flatlined because it switched to usage-based pricing, which will push revenue out. However, you don’t make that move if the previous model is working.

Because the company serves exclusively large customers, trying to sign large contracts and get access to the biggest data pipelines, its sales motion is long and slow. All in all, the company appears to be in some trouble.

The underlying forces powering this struggle should make your hair stand on end:

- The company does not own and did not invent the AI techniques that makes this AI magic possible. Instead, it relies on advances from labs like OpenAI or Google’s Deepmind.

- It does not own or store the sources of the data that make the AI customizable to individual customers. Instead, cloud providers like AWS or Azure host all the data (and also offer competing AI products).

- It sells exclusively to very large customers.

C3 has positioned itself as the end-all solution for “enterprise AI.” That unfortunately makes it responsible for the end output even though it doesn’t control the most important parts of the process. By not owning the data, it’s reliant on internal partners to heavily invest in cleaning and preparing the data. By not owning the AI technology, there will always be the temptation for companies to use readily accessible foundational models (e.g., GPT3 APIs) or lower their costs by using an open-source knockoff. The largest companies have so much data that finding a quick win for the platform is challenging.

Let me make this a little less theoretical.

C3’s problems in practice

C3’s most recent press release stated: “C3 Generative AI for Enterprise Search provides enterprise users with a transformative user experience using a natural language interface to rapidly locate, retrieve, and present all relevant data across the entire corpus of an enterprise’s information systems.”

Ugh. This is B2B SaaS marketing at its finest. Sounds good, means nothing.

If you’ve ever worked as a data analyst, you know that math isn’t the hard part of the job. Most of the work of data scientists is formatting data so the math can work correctly. Data and analytics technicians are partially paid for their technical wizardry, but a lot of their value derives from the fact that they know where to look for data and what’s wrong with it. Your brain is a repository for tribal heuristics that are pre-baked into how the data was inputted: abbreviations, data being entered into the wrong fields, when labels changed and who followed protocol, all of the creatively incorrect ways that salespeople use a CRM, its troughs of intellectual gunk that resides exclusively in your neurons. A data analyst is paid to sort through all of that.

C3 wants to replace the work of an executive emailing their data team a question and an answer comes back a few days later. Its solution, hypothetically, is that you ask AI that same question, and an answer comes back immediately. This sounds good, and the AI chatbot part is even technically feasible. My colleague Dan has built a variety of chatbots that can search through his favorite podcast, and he just published instructions on how to build a chatbot based on any book. His success has only been possible because the reference data is relatively simple and accessible. Doing that across petabytes of unclean, unstructured data is something else entirely.

The key for this so-called product is that the hard part isn’t the AI. It’s doing the change management. Getting buy-in from the customer’s executive team, integrating it into existing systems, and rolling it out to the company will take months, if not years. When I chatted with employees at the company, they all mentioned some version of, “The product requires the company to invest a ton of time and resources to get value out of it.” That’s OK, but hard to sell to clients worried about a recession. It especially challenging when there are options like GPT-3 easily available (more on that in a sec).

C3’s press release goes on to say: “The C3 Generative AI Product Suite integrates the latest AI capabilities from organizations such as Open AI, Google, and academia, and the most advanced models, such as ChatGPT and GPT-3 into C3 AI’s enterprise AI products.”

Did you catch that? The company hasn’t invented any new AI models! It’s just using someone else’s. I’ve previously written about how AI’s roots are in academia, so most advances are shared rather than patented. Open-source model alternatives pop up, turning most AI SaaS companies into consulting shops that manage data pipelines into open-source models.

In summary, C3’s stock price jumped because it announced a product it didn’t invent—an analytics product with a chatbot slapped on top.

C3’s other products are somewhat similar, if less ambitious, versions of this generative AI tool. It has applications dedicated to specific use cases, such as inventory management, lead scoring, etc. Again, this is not particularly unique or difficult to replicate. The value is in storing, understanding, and piping in the data. C3 has no special right to access the databases where the information is stored. If I were in its shoes, I would be deeply worried about AWS and Azure moving in on its territory. All major cloud providers already offer AI products, but Microsoft has an exclusive partnership with the leading research lab that C3 is citing.

How does this relate to Buzzfeed and the future of AI companies? It comes down to buyer personas.

Endpoints versus APIs and generative AI

Let’s say you are the new chief technology officer of a B2B SaaS company. Your boss is reading about how AI is the future of technology. He comes to you and says, “Go do AI.” You can try to build a custom AI model that’s trained on all your data, setting up a platform as a service (e.g. ,C3), or, alternatively, you could use a foundational model that is accessible via API.

You already know what happens.

This is the co-founder of Intercom, a customer service SaaS company:

This feature has to make customer service reps at least 20% faster. Sure, GPT-3 isn't fine-tuned to that use case, but the foundational model is powerful enough to overcome that deficiency. If Intercom started to spend significantly on these tools and OpenAI bills got out of control, there are open-source alternatives they could utilize, and other providers will inevitably pop up. There is nothing secret about OpenAI's methods, so they are replicable in the long term.

This all happened in a few months with a team of developers and probably cost them less than $500K to build. In contrast, C3’s average contract size was $19M in 2021. Generative AI companies are so exciting because they allow for instant magic. Building using generative AI APIs allows that CTO to send a flashy demo to his CEO and say, “Hey, I’m great at my job, please don’t fire me.” CTO hires are frequently judged on their ability to purchase and implement the correct software for a company—easy and cheap is a significant competitive advantage.

Much of this current bubble is people throwing capital at anything with AI involved.

This is particularly true in the use cases currently available: text and image generation. In my first piece on AI five months ago, I argued that AI’s longest-term impact is that it would bring the cost of digital good creation close to zero, forcing companies to compete on distribution efficiency.

Buzzfeed is the perfect candidate for where AI is at right now. Its quizzes are not complex, and the company already pays its writers as little as possible. By using GPT3 to help automate quiz outputs, it can make better content faster. Do I believe that implementing AI in quiz generation makes this stock worthy of doubling in value overnight? No, never, nadda, zilch. However, in this case, AI makes sense to help.

AI bubble dynamics

On Twitter AI bros yell that “AI is like electricity.” *Shoots confetti*

Or, “It will power a technological revolution.” *Confetti intensifies*

Or most dramatically, “AI is going to change the world.” *Confetti emphatically shooting out of all the speaker’s orifices*

The issue with the electricity analogy is that electricity was and is a terrible business to be in. Power companies typically don’t do well unless they reach monopoly status. It has been far more lucrative to build things with electricity than slinging the product itself.

Investors don’t know where the value from AI will settle, so they're throwing capital at everything. I would argue that there will be four final form factors where value will accrue:

- Integrated AI: AI capabilities will be integrated into existing products without dislodging incumbents. Rather than an AI company building a CRM from scratch, it is much more likely that Salesforce incorporates GPT-3. Microsoft has already launched Microsoft products with generativeAI. Everyone else will soon follow. If an AI tool is only improving or replacing an existing button on a productivity app, that AI company will lose. It will require a more comprehensive improvement than merely putting AI on an existing capability.

- Infrastructure as a service: Major consolidation will occur at all levels of the value chain besides access points. Cloud providers like AWS, Oracle, and Azure will build their own custom AI workload chips, build networking software, and train in-house models that people can reference. This will also follow existing technology market power dynamics where scale trumps all. There will be room on the side for the Nvidias and Scales of the world, but a fully consolidated offering will have a large amount of appeal for access point developers. C3 will struggle mightily against the cloud providers.

- Intelligence layer: Fundamental models will improve fast enough that fine-tuning will have ever-decreasing importance. I’ve already heard stories of AI startups spending years building their models, getting access to an Open AI model, and then ripping the whole thing out because the foundational model was better than what their fine-tuned one could do. Fine-tuning will become less about output quality and more about output cost/speed. Companies like OpenAI will have a hefty business selling API access to their foundational models or partnering with corporations for custom fine-tuned models. The companies that compete on this layer will win or lose based on their ability to attract top talent and have said talent perform extraordinary feats.

- Invisible AI: I would argue that the most successful AI company of the last 10 years is TikTok’s parent company, Bytedance. Its product is short-form entertainment videos, with AI completely in the background, doing the intellectually murky task of selecting the next video to play. Everything in its design, from the simplicity of the interface to the length of the content, is built in service of the AI. It is done to ensure that the product experience is magical. Invisible AI is when a company is powered by AI but never even mentions it. It simply uses AI to make something that wasn’t considered possible before but is entirely delightful.

The original thesis for this piece was that asset prices are out of whack in both public and private markets. You can see it on the surface with some of these stock price jumps, and it is also clear upon deeper investigation. The prices and capital amounts that I hear going into AI startups are staggering. I liked how one growth investor put it to me: “Investing in AI right now means taking on venture capital risk with growth equity check sizes.”

I sincerely believe in the power of this technology. But, if you look at my four forecasted categories of value accrual, you’ll note that almost all of the value goes to incumbents. Microsoft, Amazon, and Google will do quite well selling pure-play AI products because they invent or replicate the underlying techniques while simultaneously storing all of the fine-tuning data. As an added bonus, they already sell their products to every company on the planet, giving them a distribution advantage.

The final stage of a bubble is the pop—when suddenly and dramatically, asset values crash back to earth. In this case, I think we are a long way from that occurring. Private technology investors have the most cash they've ever had. Tech giants are hunting for new growth. All of this points to a world where these values go even higher for some time longer. But when it does pop and valuations come back to earth, remember that you read it here first.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!

Great article. Loved the walk through on C3ai. CEO Tom Siebel was on Bloomberg a couple days ago - bigtime word salad.