The TL;DR

- This piece is part of our deep dive into financial metrics and their application. Previous pieces covered Revenue and Cash Conversion Cycle.

- Today we are moving one line down in the income statement to Cost Of Goods Sold. COGS is far trickier than it appears and can act as an indicator of market power. In isolation, it is kinda useless but within the right context can be incredibly powerful.

- Also, in case you missed the announcement, Adam Keesling has moved on from Napkin Math and Evan Armstrong has taken over as Lead Writer. (You can follow updates from Adam on Twitter or on his email list.)

MoviePass is my favorite business of all time. For a brief, glorious period between 2017 & 2018, the company sold an unlimited movie watching membership for <$10. All you had to do was pay the fee and you’d go see all the flicks your heart could possibly desire. My favorite theater in Mountain View, California sold a ticket for a leather recliner for 15 bucks. Essentially, MoviePass was selling dollars for cents. Unsurprisingly, people enjoy being given free things! Their subscribers jumped from 20,000 to 3,000,000 in the span of a year. All of my friends had it. We would go to Century Cinema 16 at least once a week just to chill. Each of us were easily costing MoviePass north of 60 dollars a month, all for the low price of 10 bucks.

As it turns out, giving away money for free is quite stupid. The company burned through tens of millions of dollars and collapsed by 2019. MoviePass is my favorite business because I, the consumer, happily took the clueless executives’ money for my own personal benefit. It was awesome for me, but it sucked for them.

Side Note: There is an argument to be made that MoviePass actually wasn’t a terrible idea! If they had been in the funding environment of today there is a chance they could’ve pulled this off. Get the audience big enough, add advertising on top, plus a pinch of price negotiation with theater companies, and there is a chance this is something. But alas, the Fed had yet to turn on the unlimited money spigot and MoviePass ascended above to the land of dead technology businesses in the sky (this is not the cloud).

Put simply, the cost of the item MoviePass was selling (access to squeaky, sticky seats) exceeded the price they sold it to me for. No matter how cheap they got their servers, no matter how much they streamlined their marketing and operations, they could never turn a profit until they got their revenue to cost of goods sold (COGS) ratio right. Honestly though, we can’t blame them! They didn’t have this newsletter.

So today, we are going to dive deep into COGS. While seemingly an easy concept, it has some serious complications. A thorough understanding will help you be a better business practitioner and (if something as absurd as MoviePass ever comes again) be a better value extracting consumer. Let’s dig in.

How to Spot Cogs in the Wild

MoviePass failed, but there are actually tons of great businesses that lose money for years and are still successful. Pretty much every large tech company over the last decade started off at a loss. Shoot, it took Google three years to get profitable (while simultaneously growing revenue from $220K to $69M). Ergo, MoviePass just needed more time and it obviously would’ve been the next Google. This whole argument, which is dumb btw, is the exact reason COGS was invented. To illustrate why, here is a simple example.

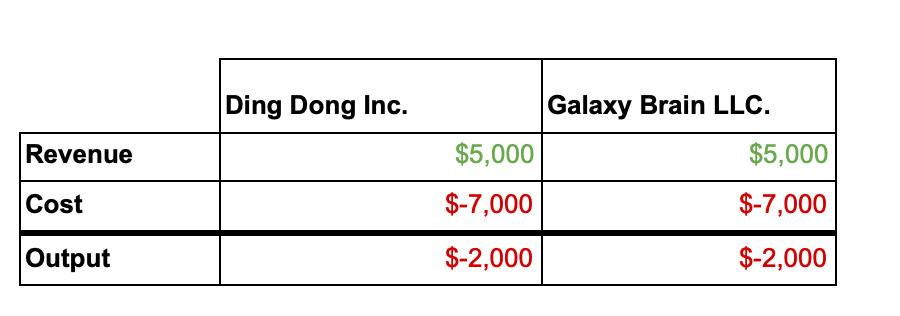

Imagine we are looking at the income statement of two businesses, Ding-Dong Inc. and Galaxy Brain LLC. You are told they both lost $2K in their first year of operation.

“Ah” you say, as you sensually rub your Patagonia vest like it's an investing 8 ball, “these both must be the next Google.”

But wait! One of your nerdy, bespectacled interns is a paying Napkin Math subscriber and they send you a revised statement.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!

Hi Evan,

When I learned that focus of Napkin Math changes to deep dives into financial metrics I thought "meh". I've done enough of Financial Analysis during my MSc and when studying for CFA - and there's Investopedia for the rest, right?

But you are doing a great job of explaining a very dry topic like COGS in an easy-to-follow and fun manner - well done. Really enjoyed this, and look forward to more.

Best

Dmytro

@dmytro.ason Thanks Dmytro! Incredibly kind and let me know if there are topics you would like to see covered! Is there anything from you CFA days that you feel like most people misunderstand?

@dmytro.ason Thanks Dmytro! Incredibly kind and let me know if there are topics you would like to see covered! Is there anything from you CFA days that you feel like most people misunderstand?

@ItsUrBoyEvan I think a cool combo would be some metric + a case study of a company that nails it. I remember there was a really cool post about how Gymshark (British sportswear brand) aces negative cash conversion cycle to fund own growth. I am sure there are lots more examples like this for other metrics. Like Peloton and churn, for example (I know churn is not strictly a financial metric, but still). Just a thought!

@ItsUrBoyEvan I think a cool combo would be some metric + a case study of a company that nails it. I remember there was a really cool post about how Gymshark (British sportswear brand) aces negative cash conversion cycle to fund own growth. I am sure there are lots more examples like this for other metrics. Like Peloton and churn, for example (I know churn is not strictly a financial metric, but still). Just a thought!

@ItsUrBoyEvan I think a cool combo would be some metric + a case study of a company that nails it. I remember there was a really cool post about how Gymshark (British sportswear brand) aces negative cash conversion cycle to fund own growth. I am sure there are lots more examples like this. Just a thought!

@dmytro.ason I will definitely be doing the non-financial terms at some point. I'm thinking Net Dollar Retention and snowflake would be cool!

Great work! Love this as a founder who’s very deep into our financials

What a great set of articles on financial statements!

BTW, Is Galaxy Brain referring to Roam research?