Today, Californians can call an Uber. Tomorrow, they can’t.

Last September, California Governor Gavin Newsom signed the controversial Assembly Bill 5 (AB 5). In this bill, California required companies to reclassify independent contractors as employees. As evidenced by the substantial list of exceptions, the bill was designed to regulate tech companies like Uber and Lyft, which employ hundreds of thousands of gig workers and rose to prominence over the past decade.

The bill took effect on January 1, 2020 but these tech companies had been resisting the requirement. Early last week, Uber and Lyft were ordered by a California judge to classify their contractors as employees within 10 days. The companies haven’t been able to reclassify their workers in that time and so they are shutting down operations in the state. As of August 21, if Uber and Lyft employee independent contractors as drivers, they will be breaking the law.

These companies claim that they are shutting down because they can’t reclassify workers fast enough. The sheer amount of logistics and administration of turning a workforce from contractors to employees is immense. Especially when there are over 100,000 workers.

But the other reason they are stopping operations is to gain support for Proposition 22. In November, California citizens will decide with their vote whether or not app-based drivers that are classified as contractors should become employees. If drivers are unemployed for two months, and residents don’t have ridesharing services for two months, that will help gain support for Prop 22 (in favor of Uber and Lyft). These constituencies could feel the pain for themselves and want it changed.

In this article, I outline what makes a contractor different from an employee, analyze what Uber’s business might look like if their labor costs increased on a global scale, and explain why each side has a good argument. Let’s get into it.

Independent Contractor vs Employee

Most people have an intuition for the difference between a contractor and an employee. A contractor works by the hour and has many clients. An employee has a set amount of hours and works for one company. However, when we get into labor laws, the differences need to be precise. And that precision causes disagreement.

The first nuance is that there are different definitions between federal and state laws. This makes it even harder to parse out: each state is a bit different.

But generally the distinction between contractor and employee comes down to which party owns key decisions. Does the worker decide the rate of pay? Can the worker work anywhere, or do they have to come to an office? How does the work relationship (scope, rate, etc.) change over time? HBR notes that another defining feature of an independent contractor is if their decisions have significant impacts on opportunities for profits or losses. Employees makes the same amount; contractor rates determine if they make money.

In the ridesharing case, California is evaluating Uber’s through the ABC framework. To classify as contractor, the worker must pass three qualifications:

- A) The worker is free from the control and direction of the company in connection with performing the work, both in reality and under the terms of the relevant contract.

- B) The worker performs work that is outside the usual course of the company’s business.

- C) The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work being performed for the company

If you look at just about every industry, gig workers and contractors have become more prevalent. The number of workers engaged in “alternative work arrangements” — defined as temporary help agency workers, on-call workers, contract workers, and independent contractors or freelancers — rose from 10.7% in 2005 to 15.8% in 2015 (source).

And it’s becoming a big problem. The Internal Revenue Service estimates that worker misclassifications costs them $16 billion in revenue each year. And that’s not mentioning the effect on workers. Many contractors want to be employees: it comes with benefits like paid time off and health insurance.

But on the other side, employers often prefer contractors. It’s just cheaper. When companies hire full-time employees, they have to pay more than their hourly wage or yearly salary. A short list of employee-related expenses that don’t exist with contracors:

- FICA tax: Federal tax to fund Social Security and Medicare, programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

- Federal unemployment (FUTA) tax: a Federal tax to help fund state workforce agencies.

- State unemployment tax: a State tax to fund unemployment benefits

- Worker’s compensation insurance: insurance providing wage replacement and medical benefits to workers who are injured on the job.

- Health insurance: insurance for medical expenses. The requirements for this vary by company size.

- Retirement savings plans: 401(k) matching.

- Vacation and holidays: contractors are only paid for the time they work, while full-time employees (FTEs) are paid year round.

Additionally, there are other expenses related to on-boarding, such as recruitment and training costs. It’s estimated that the real cost of an employee is between 1.25x and 1.5x the base salary (source 1, 2). Employees are expensive.

Uber’s Existing Business

So how much does this ruling affect the financial profile of ridesharing companies? Let’s use Uber as an example.

The first thing we need to understand is how Uber reports their financials. We’ll be looking at the impact of three metrics: gross bookings, adjusted net revenue and adjusted EBITDA.

Gross bookings is the total transaction size. For example, if a customer calls an Uber and pays $25 for it, the $25 is categorized as gross bookings on Uber’s financials.

However, this isn’t Uber’s revenue. Instead, their revenue is the proportion of gross bookings that they collect. The money they pay to drivers is taken out before their revenue. From their most recent quarterly report:

We generate substantially all of our revenue from fees paid by Drivers and Merchants for use of our platform. We have concluded that we are an agent in these arrangements as we arrange for other parties to provide the service to the end-user. Under this model, revenue is net of Driver and Merchant earnings and Driver incentives. We act as an agent in these transactions by connecting consumers to Drivers and Merchants to facilitate a Trip or meal delivery service. [Emphasis mine]

Over the past several years, their take rate (revenue as a percentage of gross booking) has hovered around 20% - 25%. So for that $25 Uber ride, Uber might keep $5 or $6. That would be classified as their revenue.

EBITDA, then, is their profitability metric after accounting for other operating expenses like marketing and G&A. Company-wide, Uber has never had a profitable quarter. In Q2 2020, they lost $326 million in EBITDA.

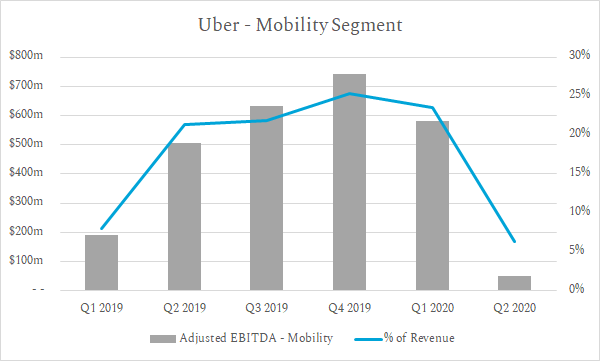

However, in this analysis I’ll be focusing on Uber’s Mobility segment (formerly “Rides”) -- UberEats won’t be shut down by this ruling and the other segments such as Freight are quite a bit smaller. And while Uber has been losing money, their ride-sharing has turned positive adjusted EBITDA basis for several quarters.

(Source: company filings. Note: we could debate the merit of some of their add-backs, but they define segment-adjusted EBITDA as “revenue less the following expenses: cost of revenue, operations and support, sales and marketing, and general and administrative and research and development expenses associated with the Company’s segments.”. )

Contractors to Employees - More Than CA?

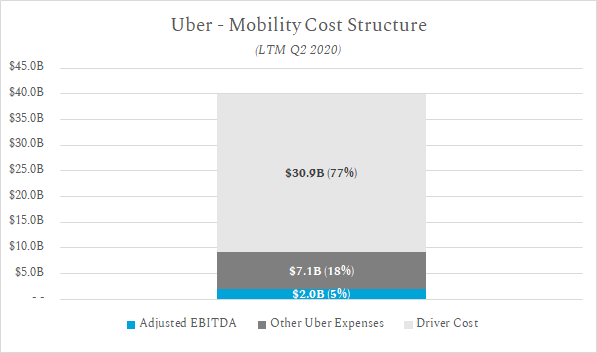

Over the past twelve months, Uber had Gross Bookings of just under $40 billion. About $30.9 billion (77%) of that went to drivers and an additional $7.1 billion (18%) went to other Uber expenses, which left $2.0 billion in EBITDA.

(Source: company filings.)

What happens if the cost of their drivers increases?

Uber isn’t like a lot of tech companies: it’s built on people. Sure, software connects drivers with riders. But it’s a service business at its core. 75% - 80% of the Gross Bookings go to drivers; they are, by far, the most important cost center for Uber.

So an increase in driver costs isn’t an expense increase like higher marketing, but is instead taken out of their Gross Bookings. It squeezes Uber’s top line.

The current regulation only affects California drivers. According to Barclays research from last year, classifying California drivers as employees could cost over $500 million per year. While this is meaningful, the bigger concern for Uber is that this law goes national.

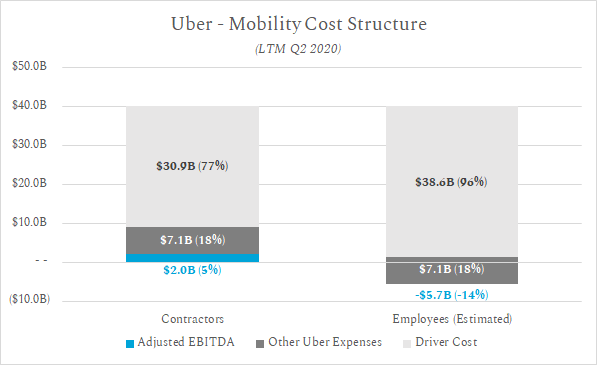

So what if that happened? If the average driver makes $15,600 a year ($20 an hour for 15 hours a week, 52 weeks a year), and the increased cost of classifying contractors as employees is $3,650 per driver, that’s an increase of about 23%. This lines up with the estimates of 1.25x to 1.50x cited earlier.

If we assume an increase of 1.25x, and no price increases, then Uber’s rideshare business breaks down.

Driver costs increase from about 77% of Gross Bookings to about 96% of Gross Bookings. Uber’s EBITDA margin goes from slim (5%) to negative (-14%).

(Source: company filings, estimates.)

The other option for Uber is to raise prices. If they are required by the state to increase driver costs, then they could charge more to riders to compensate. Of course, the tough part about this is the competition.

It’s not conclusive, but generally Uber and Lyft rides are cheaper than taxi rides (source 1, 2, 3). A price increase of 25% (to match the increase in driver costs) would affect the market in two ways: market share would shift back to taxis, and the total amount of people using automobile transportation would be lower. These are bad for Uber, Lyft and all of their investors.

A Case for Each Side

Proposition 22 has brought Uber back into the public light, putting their drivers at the forefront of political conversations.

On one side, hundreds of thousands of workers are working many hours at cheap wages, and not earning benefits. There’s a case to be made that Uber created value for shareholders and leadership off of the back of hiring contractors illegally. As discussed, Uber’s business model doesn’t work very well if the drivers are employees.

On the other side, Uber has created millions of jobs and many independent contractors enjoy the freedom of freelancing. They can work whatever hours suit them best, and they can also work other jobs at the same time. There could even be a case made that union leadership and politicians are pushing to make the drivers become employees even if the drivers themselves don’t want to.

Regardless of your stance on this issue, it’s increasingly looking like Uber and Lyft will shut down from tomorrow through the election in November. If you live in California, you’ll be without rideshare and you’ll have the opportunity to vote on this proposition in November.

This situation provides an interesting case study on labor regulation. If you are building a business with people involved, consider the risk of government changing their classification. But not just in labor; in any facet of business you could face regulatory hurdles. Make sure you are aware and proactively adjust to them.

NEW: Means of Creation

The Everything bundle welcomed a new newsletter today! It’s called Means of Creation and it’s all about the passion economy.

It’s a weekly talk-show where Li Jin and Nathan Baschez interview a guest to unpack the passion economy. Bundle members can watch and ask questions live as well as read breakdowns from the show as a newsletter.

If you’re not a subscriber yet, consider subscribing to the Everything bundle:

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!