Sponsored By: The Information

This essay is brought to you by The Information, the biggest dedicated newsroom in tech and business journalism.

The Information offers access to exclusive insights from the industry's top journalists. For a limited time, subscribe and save 25% on your first year.

Whenever a disruptive technology becomes available, there is a mad dash as every company rushes to incorporate it as quickly as possible. The race makes sense: new technologies equal new opportunities for better profits. The interesting thing is that a company's starting position with their original product ends up being the most important thing for determining what profits each company captures.

Said simply, it is better to have a huge head start than to sprint the hardest.

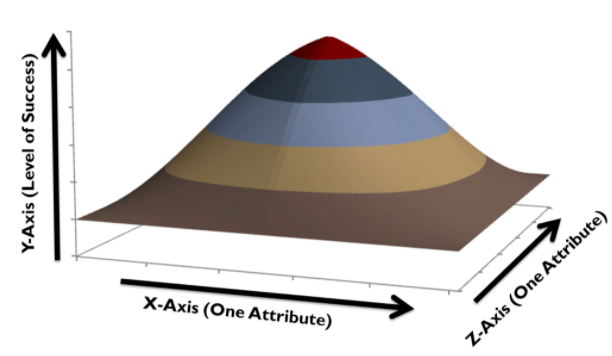

One of my favorite strategy frameworks to help grok this is a theory from 1997 called Rugged Landscapes. Picture a mountain, where the summit is the most profits available to a firm.

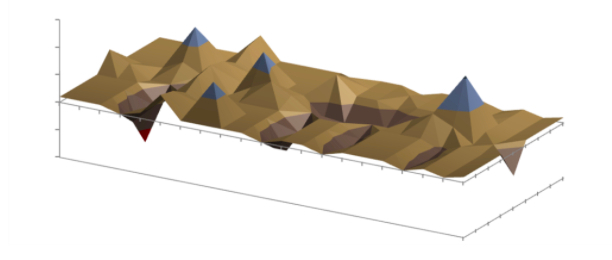

Companies navigate the mountain by changing their coordinates on the X and Z competitive axis. However, a market is not a single mountain to climb, it is a rugged landscape.

There are multiple peaks, multiple places where profitability (or pick your performance metric of choice for the Y axis) can reach its zenith. Think of how Microsoft and Intel were parts of the same value chain in personal computing but were both able to extract enormous profits. Essentially, in the landscape they occupied two different mountains.

Rugged landscapes help strategists understand that it’s not only where you start that matters, but it’s how far away you need to go. And because companies are constantly shifting, there can only be one king of the hill for an individual mountain. To make this even more difficult, a landscape isn’t static. It is constantly shifting. Mountains of profit grow or shrink.

AI is the strategic equivalent of a 10.0 magnitude earthquake—the entire landscape has the chance to be remade.

This means that all tech companies are furiously engaged in a series of moves and countermoves, trying to climb the new mountains (while blocking their competitors from getting to the top before them).

The most recent example from yesterday was the $1.3B acquisition of MosaicML by Databricks. This is roughly $21M per employee.

Unless you have the misfortune of being a software investor or data engineer, it is likely you haven’t heard of either of these companies. A gross simplification: Databricks allows companies to store petabytes of data easily and then write queries on top. Mosaic allows firms to use their data and build their own LLMs with it. Think of training a GPT model only on your own data for very cheap.

The Information offers access to exclusive insights from the industry's top journalists. Founded in 2013, The Information has built the biggest dedicated newsroom in tech journalism and count many of the world’s most powerful business and tech executives as subscribers. Their reporters focus on reporting the people, trends, and forces that are defining the future of technology and business.

As a subscriber, you'll get access to award-winning reporting, exclusive interviews, community conversations, and subscriber events and more, so you can make informed decisions anywhere, anytime. For a limited time, subscribe and save 25% on your first year.

This acquisition feels like a powered by Powerpoint™, McKinsey consultant two by two matrix, type of deal. Databricks has data, Mosaic gives you a cool way to use that data. However, there are a few details here that raise my eyebrows and I am finding coverage on this topic is lacking.

Consider my eyebrows arched

$1.3B might be a big number, but the deal is all in stock. This is very different from a cash deal.

(I also wouldn’t be surprised if it later came out that each of the founders cashed out with $5-15M in cash as a little thank-you present).

The fact that it’s all in stock is especially salient because Databricks is a private company, and its last valuation is still incredibly inflated. When software multiples crashed in late 2022, Databricks only trimmed its valuation by 7% to $31B. Compare that to their primary competitor Snowflake. From The Information:

“Databricks rival Snowflake is posting red-hot growth—revenue grew 83% in the six months to July 31 compared with the year-earlier period—and yet Snowflake’s stock has dropped 44% since August of last year. But Snowflake was more richly valued than Databricks to start with. Snowflake stock is now trading at 20 times next year’s estimated sales, down from 61, according to data from Koyfin. Databricks, though, is now valued at around 31 times forward sales.”

So yes, the nominal value of the MosaicML acquisition is $1.3B because Databricks paid in stock, and they were last able to raise money from investors at a gigantic $31B valuation. But if it went public today, it’s unlikely that their stock would get that valuation from investors.

Except, of course, if it could somehow justify that valuation. By, say, becoming a leading player in the hottest new technology around: AI. Which is exactly what Databricks has just done by making this acquisition.

So, I can’t help but wonder if this acquisition is a play to spend overvalued stock in order to protect its current value. This move could either be a brilliant acquisition of a powerful technology. Or, it could be financial engineering for the sake of stock price.

CEOs pursuing AI are mostly doing so from a belief in the tech, but part of the strategy here has to be about protecting your valuation. Investors want to ensure you are always paying attention to the hot thing, so CEOs will do transactions like this. The Databricks team traded 4.5% of their float for an asset that is probably trading at 50-100x revenue multiples. That probably will allow them to justify going out to the markets with a 30x+ revenue multiple to public markets. When you add in that they are doing 409A valuations quarterly—this typically happens when a company is getting ready to go public in the next 12-24 months—this whole deal smells like financial machinations.

It’s also about positioning themselves relative to their largest competitor. Databricks and Snowflake scheduled their customer conferences for the same this week; Snowflake purchased an AI startup a few weeks ago for (allegedly) $150M, and Databricks announced this deal soon after. That smacks of rivalry, which is not necessarily a bad thing! Salesforce used to have fake protestors marching around their competitor’s customer conference, so rival acquisitions are pretty tame.

However, when you put together the all-stock purchase, the competitive dynamics, and the timing, the deal feels a bit frothy.

Conclusion

From my sources I have only heard positive things about the leadership teams of both companies. Even if the deal was done mostly for valuation protection or for founder liquidity, this isn’t a call for a witch hunt. Instead, I would argue that we should be carefully thinking about why companies are going “all in on AI.”

Databricks saw other data infrastructure providers making moves to scale the mountain (Snowflake acquiring Neeva and just announced a partnership with Nvidia) and had to respond before the metaphorical summit path was blocked off.

In Rugged Landscapes, the Y axis (the top of the mountain) is typically profit, but in the world of startups, valuation is often used as a substitute. Most of the time this is fine—valuation is supposed to be the present value of future cash flows. However, in the wild world of cutting-edge tech, valuation becomes a means unto itself. It results in perverse incentives, to chase whatever target investors set to hit that next fundraise. It is Facebook becoming Meta, Goldman Sachs offering Crypto products they didn’t understand.

This acquisition isn’t quite there—but it is borderline. There are real synergies and it could work. However, I’ve been arguing since February that AI valuations were clearly exhibiting bubble behavior. AI fever is burning red hot. I am once again hearing of early-stage startups raising on 50-100x revenue multiples, just like in 2021.

At a certain point, the bill comes due. AI is giving companies license to spend again, but the price must always be paid. We will see if Mosaic was worth the $1.3B.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!