Whenever a CNBC talking head starts pumping a company, it is a reasonable strategy to immediately short said organization. This holds especially true for Jim Cramer. His trades are so notoriously sub-par that multiple meme accounts are dedicated to recommending the exact inverse of what he talks about. There are lots of ways to cut the data depending on what you consider a stock pick, but, as of a few months ago, this reverse index is outperforming the market by ~7%.

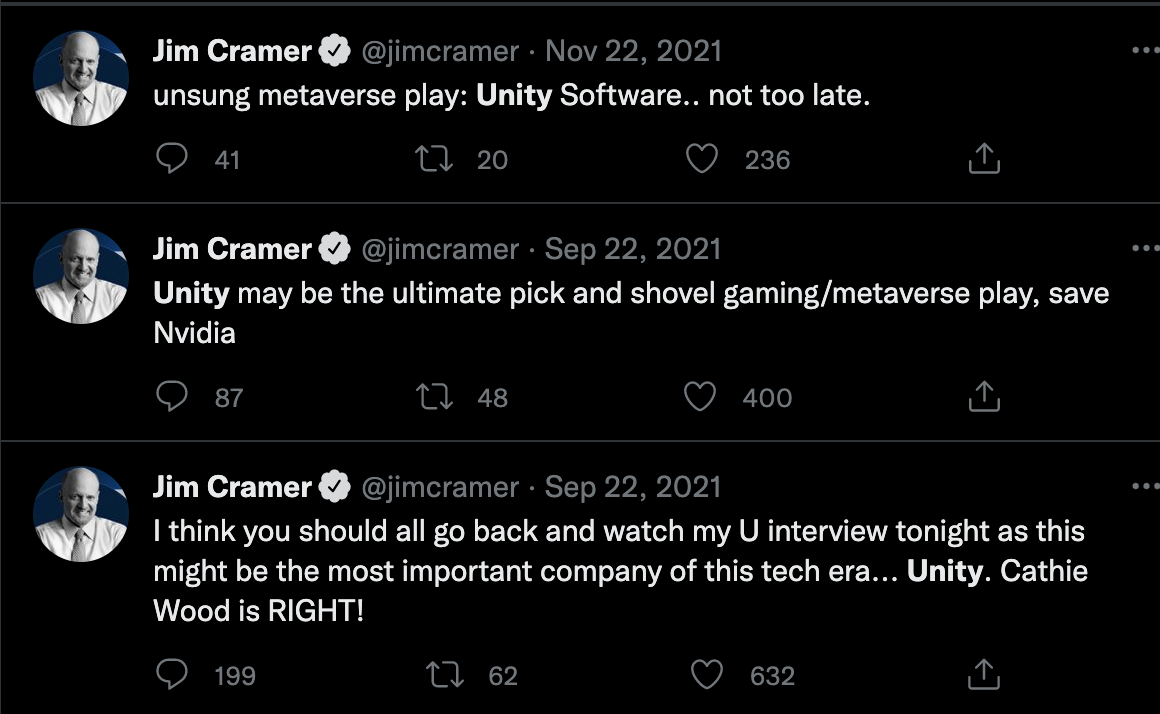

This phenomenon has the interesting implication that workers in the technology sector should evaluate their employers by the volume of their mentions by Cramer. The more the little man on the TV shouts the organization on your paycheck, the more urgently you should be reaching out to recruiters. If you are such an individual who is working for Unity Technologies, I come bearing bad news:

These tweets represent the holy trinity of ill-begotten trades: Jim Cramer, Cathie Wood (one of the worst fund managers alive), and the Metaverse buzzword. If the reverse-Cramer index thesis is correct, employees should follow the example of Iron Maiden, and run to the hills.

Even ignoring the media coverage, Unity is a company that is a study in contrast. All that is great about their ambition, of being the software that the Metaverse is built on, of being a platform that empowers creators, is the exact thing that is killing them. The focus on a distant, possible future has them fumbling the present with their stock price down 57% over the last year. Even their most recent drama, of having competing merger offers between Applovin and Ironside are competing visions of what Unity can be.

Today’s (paid) post will be analyzing the company on multiple fronts. Properly executed, Unity has a chance to be one of the defining companies of the next generation of technology and represents significant upside. However, the path there is anything but easy.

Vertical SaaS Product With Horizontal Ambitions

For the unfamiliar, Unity’s best-known product is a game engine. Think of this as a Lego set for video game designers. Sure you could do all the plastic injection molding of bricks yourself, but if you want to build an 8000-piece Death Star it is easier to just build it and not worry about brick assembly. Similarly, if you wanted to make a video game you could write all of the code yourself, but it is easier if you use building blocks pre-made by someone else. That’s what Unity’s game engine does. It makes it easy to assemble digital, 3D assets and the logic governing them.

In their investor presentations, this is called their “Create” segment. It is priced as a traditional SaaS product and accounts for ~40% of their $297M Q2 revenue. Once someone builds their video game, Unity offers a variety of follow-on offerings under the banner of their “Operate” segment. The biggest portion of this segment is a robust ad network that mobile games can plug into. It really is as simple as checking a box and a game built on Unity can have monetization. There are other products but they are almost universally based on consumption pricing. This segment represents ~$158M or ~53% of their Q2 revenue.

When put together you have a company that allows digital assets to be built and then captures a portion of every sale that they helped facilitate. This is a great business that is rapidly approaching $500M in ARR with the Operate segment juicing the growth on top.

This is a vertical SaaS play that we’ve seen pulled off with great success in segments like restaurants by Toast where you offer compelling software as a product wedge and then take a percentage of revenue facilitated on top.

However, there is a central tension to being a vertical SaaS provider—TAM. Typically with vertical SaaS companies, the primary concern is that the market you are serving is too small. To solve this you can employ an expand and extension strategy. Companies expand by layering on additional products. After that, they can extend towards consumers, towards suppliers, towards employees, or towards horizontal adjacencies, but eventually, a company needs to push to new horizons.

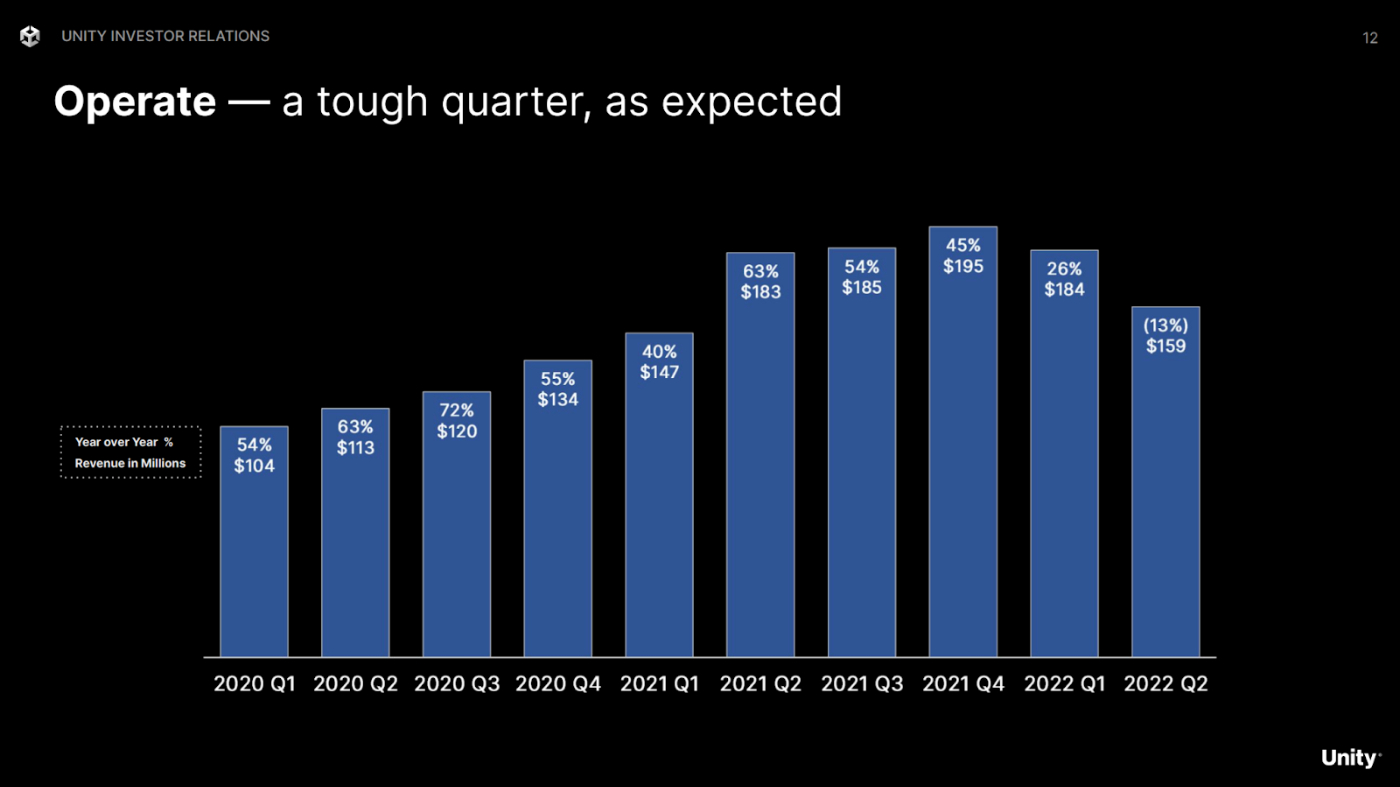

Even these two segments represent two competing visions of simultaneously expanding and extending. Operate is focused on expanding the level of service by offering more and more products to its creators. However, since so much of this segment is contingent on usage pricing, any dip in the quality of the service offered means an immediate effect on their business. Meaning that any wavering in focus means an immediate blowback. So say you had a total breakdown in your ad model? Say like last quarter? You get this.

Slide from Q2 Investor Deck From this Week

A 13% YoY decrease in revenue is an all hands on deck emergency situation. And to be fair to the company, they are saying that they should have the issue resolved by Q3. However, this happened because of the company’s own error. Aka execution issues.

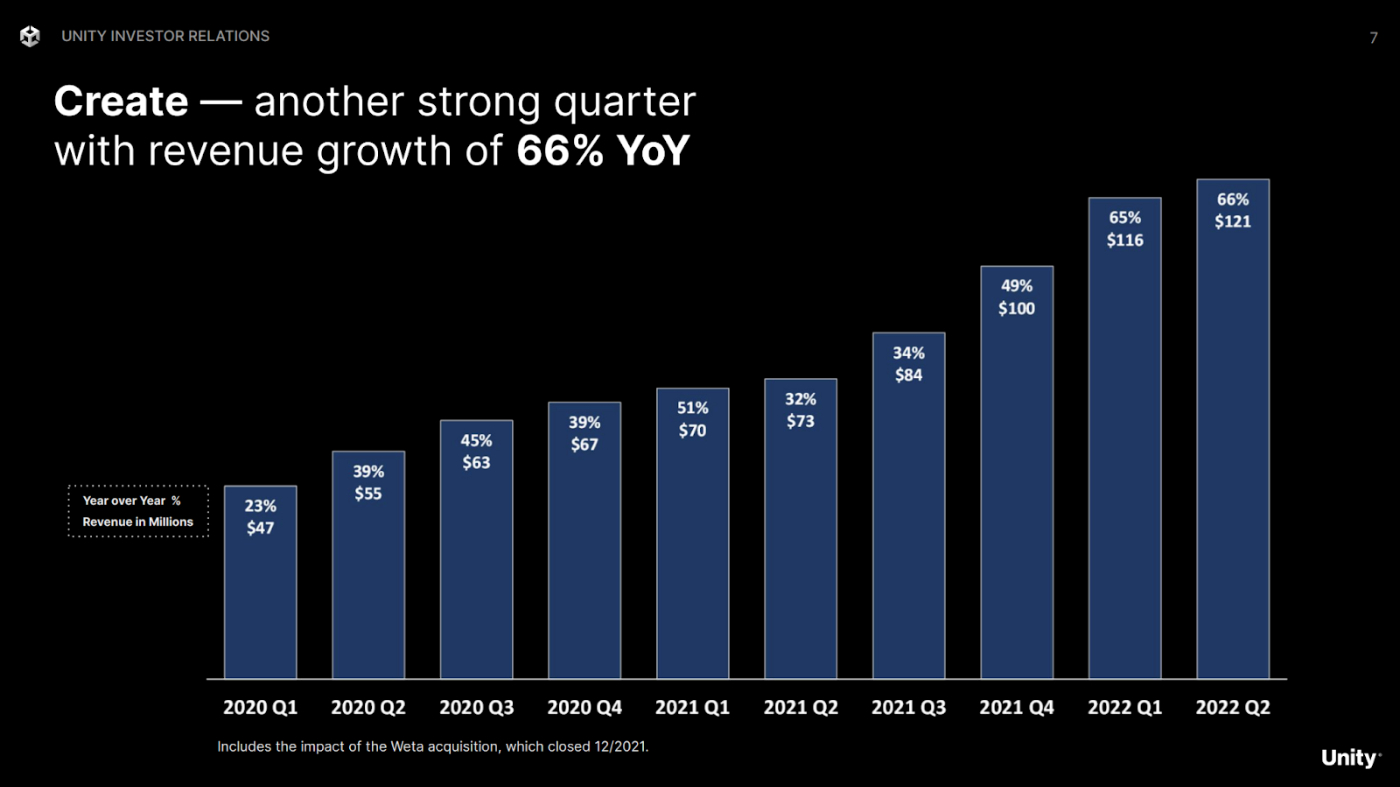

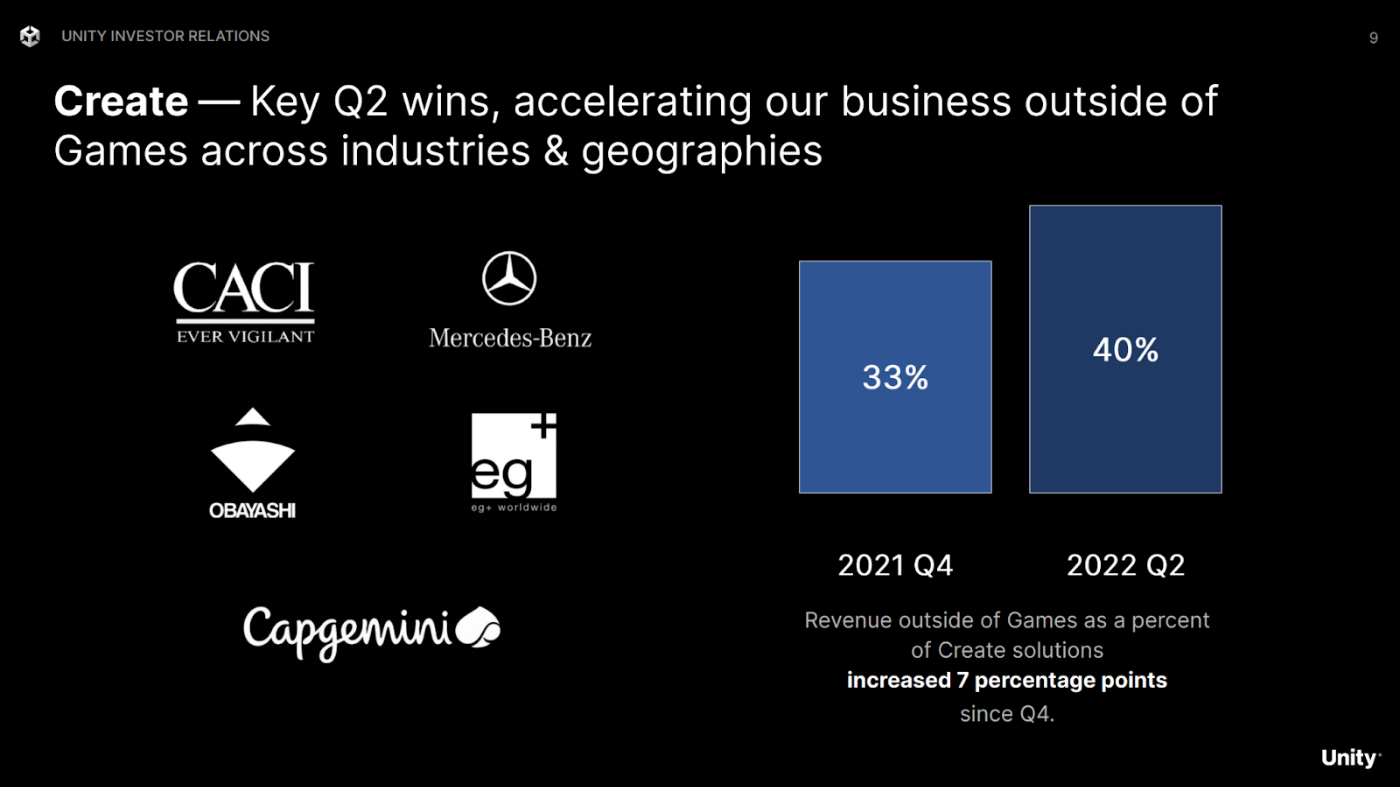

These execution flaws stand in stark relief to the success of the create segment which is pursuing a horizontal extension strategy.

They have experienced 66% growth…

Fueled by expanding Create revenue outside of Games with 40% of the Create Software now coming from non-gaming industries. Having ~$47M in ARR from non-core industry customers is signs of a really great product.

And these aren’t just lots of exploratory software contacts. They are seeing repeat business from a variety of industries. Their leadership team said the following on their earnings call this week.

“We've gone through a pattern over the last few years where we were originally doing things that were -- they didn't know who we were. They didn't know how to use real-time 3D. And the deals are very, very small. . Now what we're seeing is a continued inbound from the top of the funnel and we got a good go-to-market strategy. Mark will talk about that. And we're seeing second and third deals with the same customers. So we got a land and expand going. And we're also writing larger deals as we continue to progress because people are understanding what they can get with real-time 3D community. So -- the reason we're seeing the gain as a percentage of our business, more customers, larger customers land and expand.”

This contrast, of stunning horizontal success and unexpected vertical failure, highlights the core tension this executive team has to navigate. The more tools they build for their grand ambitions the worse they will serve their core audience. It is unlikely that the ad network that they have developed for their mobile gaming customers will be of any interest as they start to sell 3D tools to car manufacturers or architects.

Financial Performance

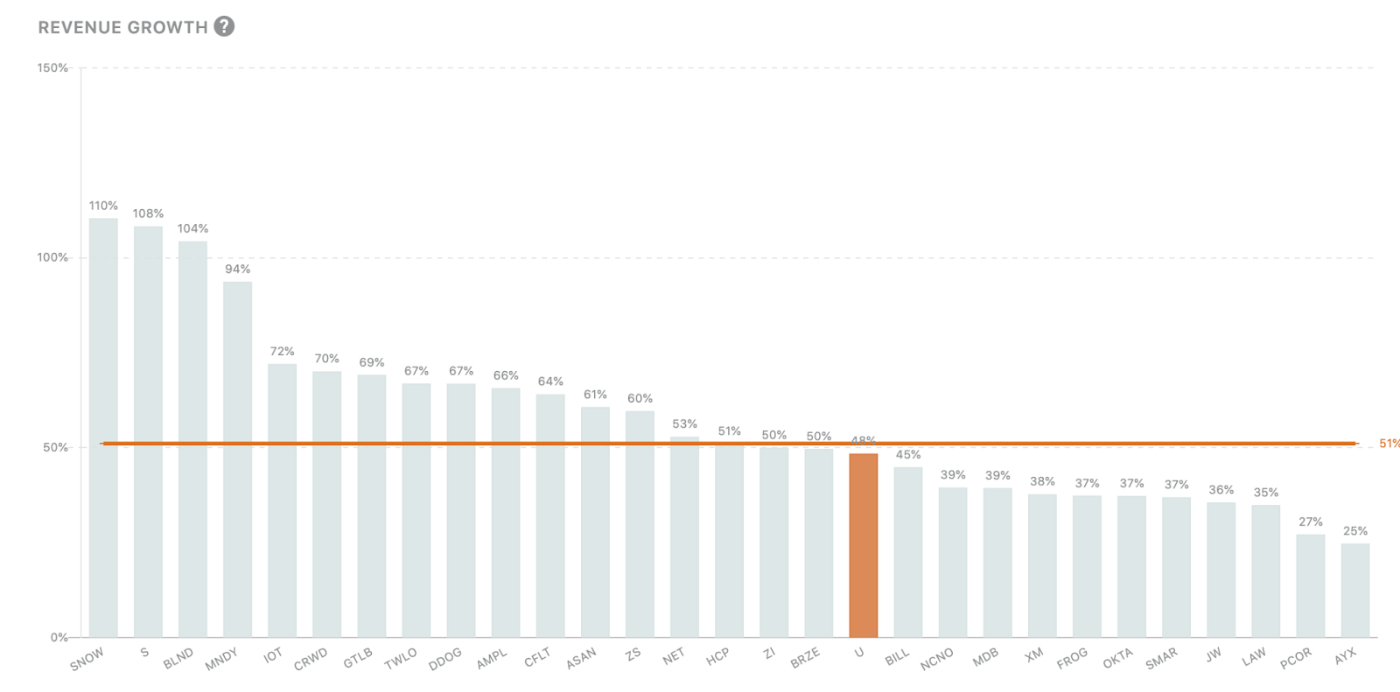

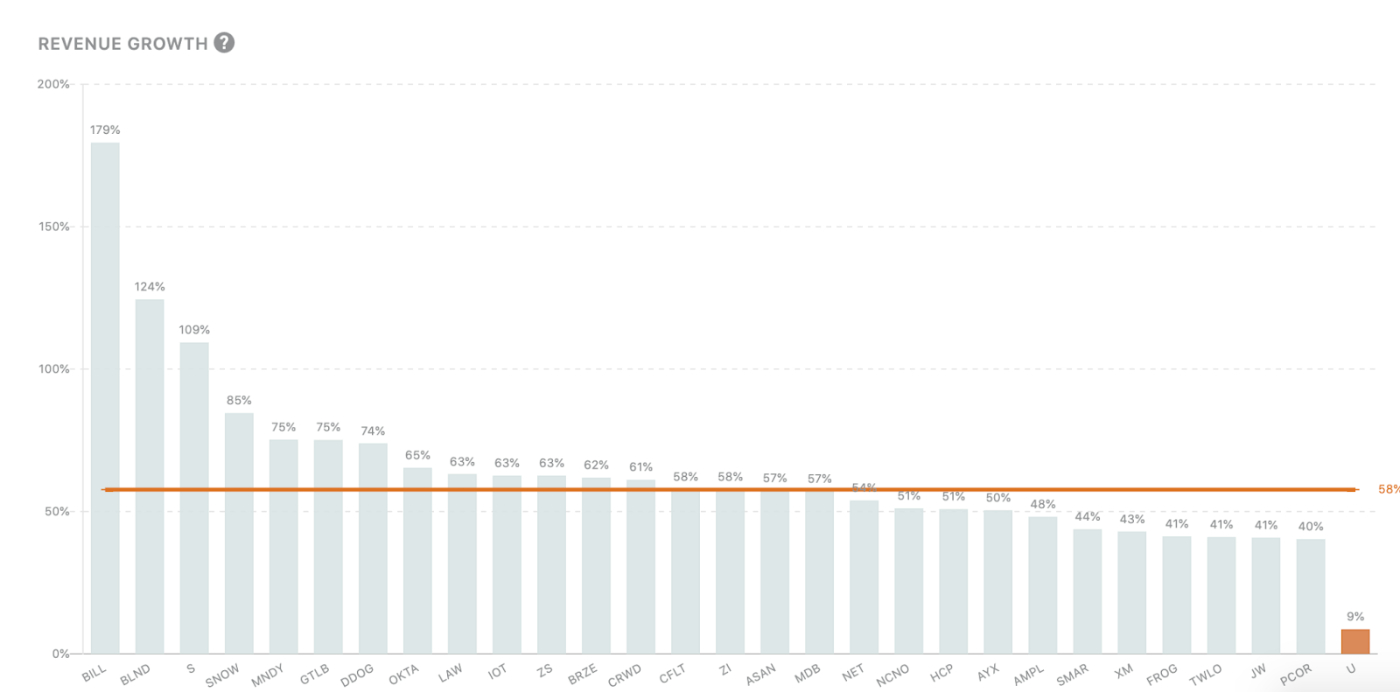

This split focus and resulting poor execution has taken this to a company with good growth last year

To the absolute bottom of the pack

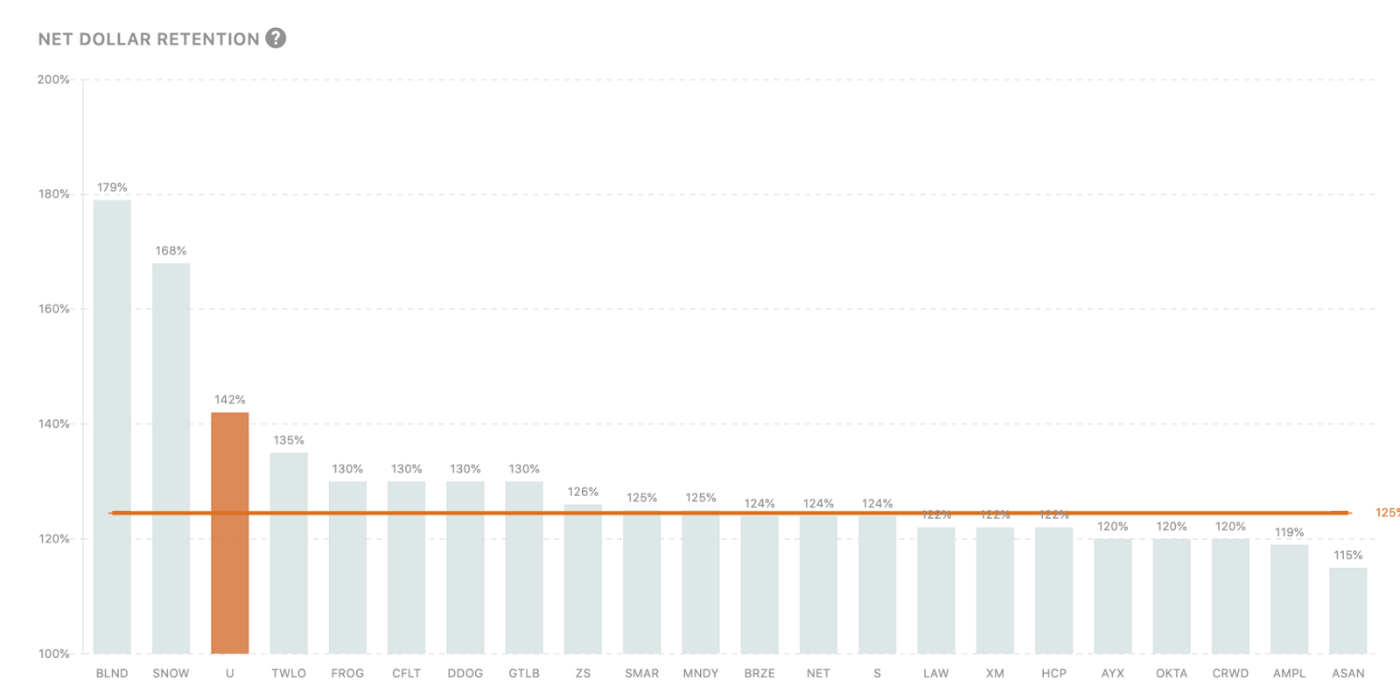

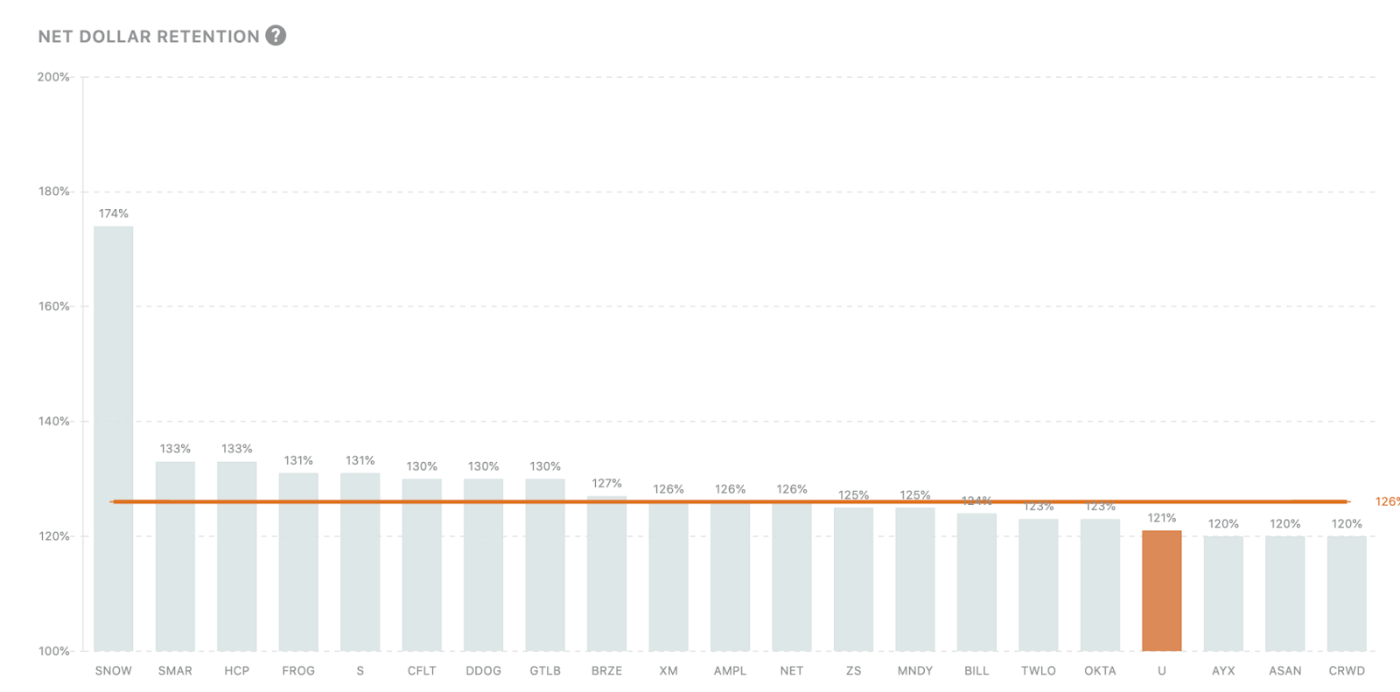

The Net Dollar Retention (my favorite metric by which to evaluate SaaS businesses) was one of the best in the world last year among high-growth SaaS stocks.

To now being entirely unremarkable.

But perhaps the example of the contrast in the business is the two most recent acquisitions.

A Tale Of Two Acquisitions

In a perfectly economic world, an acquisition would be purely calculated upon the ROI. In the real world, there are a huge host of non-fiscal reasons that these deals happen. Just from the CEOs desk I’ve seen rationale such as:

- The new CEO needs to make a quick splash

- The CEO doesn’t believe in the product team to build what is necessary

- CEO is unwilling to set a precedent of buybacks or dividends and looks for a way to deploy cash quickly

This list of maleficence goes on from there but sometimes, just sometimes, the deal is for rational reasons. There have been two major attempts by this executive team that once again show this company’s central struggle.

Weta Digital:

In an interview with Ben Thompson over at Stratechery, the Unity CEO made sure to defend his move with the following language,

“So just to make the first point that I wanted to make is that we’re investing for a ten and twenty years horizon [emphasis added], we don’t have to balance, like we’re just going to spend a little bit less on our existing customers in order to afford this, we’re not doing that. We’re investing for the best outcome for our customers and we’re not going to lose a dollar or a person against our core business, or our original core business, of supporting the game companies and for what it’s worth these tools are going to be a godsend to the game companies, so I’m not really worried about losing anything in the way of balance, I think there’s just more, as long as we execute really well.”

This just didn’t turn out to be true. While I don’t have access to department budgets and can’t speak to where dollars were allocated, the “long as we execute really well” didn’t happen. When Unity had their Operate revenue decrease that actually represented that their ads were not performing as well. That same pain would be directly transferred to their customers because they are receiving less dollars per ad too. But I digress, back to Weta.

Weta started off as the software component of a movie special effects studio in New Zealand. Over time, they developed unique digital assets and software tools relating to 3D visualization used in films like Lord of The Rings and The Avengers. The synergies are clear between Unity’s game engine and what Weta had developed. Better and more beautiful digital assets fit nicely in the long-term vision of the company to expand beyond iPhone puzzle games. The acquisition gives Unity a nice toehold in the movie business, all press for the deal spoke in much grander terms for other markets.

The company was bought for $1.625B.

Ironsource

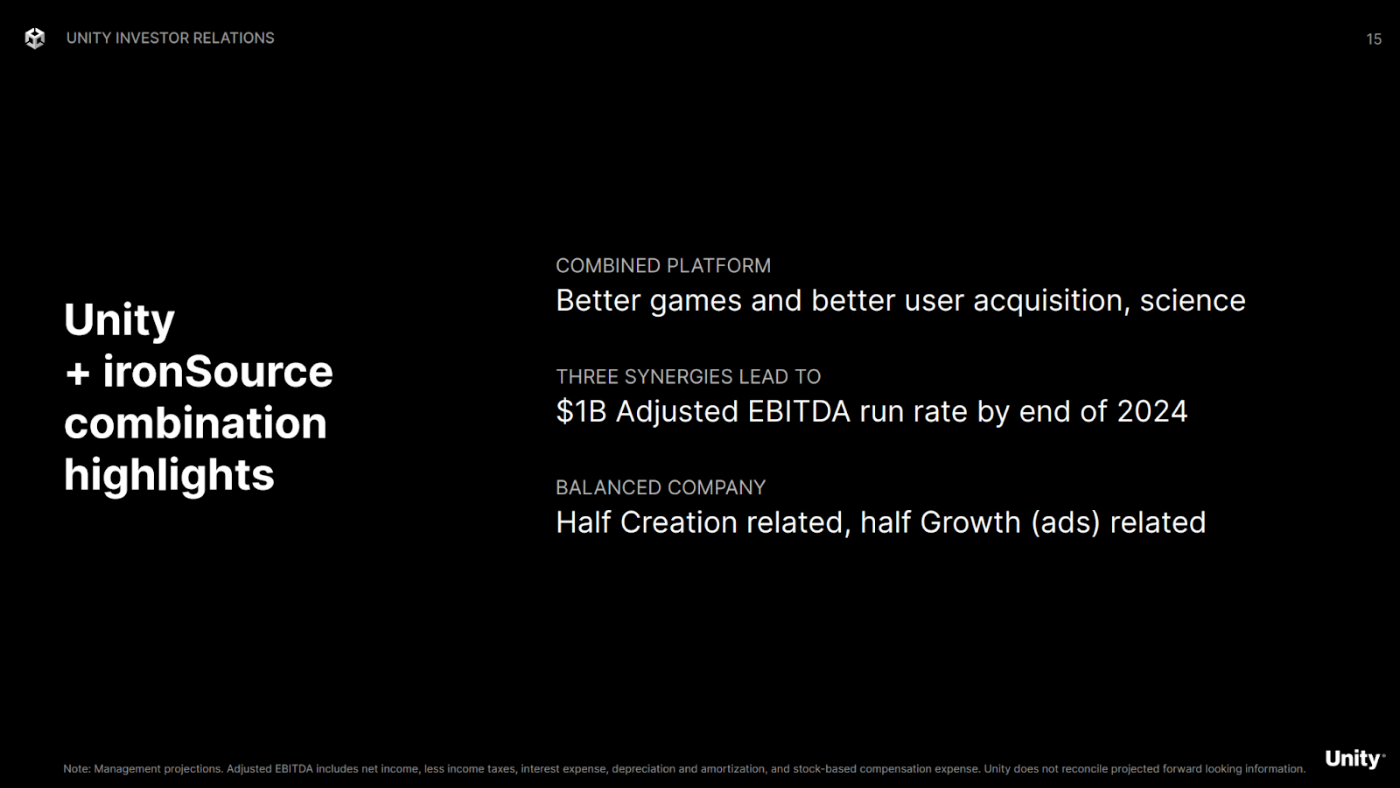

When a mobile game wants to run an ad, it can select inventory from a variety of ad networks. It is a terribly tricky technical problem to manage all the integrations so most companies rely on an ad mediation platform that handles all of that for them. Unity had been building one for some time but it got delayed two quarters ago (another execution error) and so the company went shopping. Ironsource was the number 2 player in the market and the companies announced they were merging a few weeks ago.

This is a deal I understand! Can’t do it yourself? Buy it! Tech has a long history of profitable ad tech acquisitions with Google’s Doubleclick acquisition being the foundation of their entire empire and probably one of the greatest M&A events of all time.

This deal could have been avoided if the company built better stuff sooner, but here we are, and combining the two organizations will help right the ship on the Operate side of the house. (As the company argued also in their most recent investor presentation)

Still, this deal distracts them further from their Metaverse vision.

What Does This Company Want To Be?

When I envision the Metaverse, I don’t picture billboards. I don’t crave popups or video reels. It is something grander in scope. Beyond financial growth, I don’t see how ever growing the Operate division serves the long-term vision. The goal of Metaverse dominance is ultimately why I am against the Applovin merger offer. For the unaware, just this week, Applovin offered to merge with Unity in an even larger transaction than Ironsource. For all the reasons that the first deal made sense this one is even better. Applovin has a robust mediation platform and also has the benefit of a large original mobile games business that can lend first-party data to ad targeting. While I imagine Unity may push for more control, the deal makes a ton of sense for the immediate future.

However, digesting a deal this large in scope will distract the company for multiple years. It will firmly cement the organization as just a gaming company and maybe even one focused primarily on mobile gaming.

An ad platform is a sure bet, a Metaverse is an unsure thing. Ultimately, it comes down to what risk the long-term shareholders are willing to stomach. Personally, I’m voting for ambition.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

.08.31_AM.png)

Comments

Don't have an account? Sign up!