Sponsored By: Stacker Studio

Stop wasting your time and money! We know growing through Facebook and Google ads is expensive and improving SEO and increasing site traffic is extremely time-consuming.

This is why savvy brands are opting for media coverage as a way to build brand authority and boost web traffic because now readers and Google see those brands as experts.

It wasn’t easy to streamline this process until Stacker Studio. They create newsworthy stories on your brand’s behalf and then syndicate them to top publications like SFGate, Chicago Tribune, MSN, and more. Each story gets an average of 150+ media pickups and helps your site rank higher in search.

Join other brands like Experian, Angi, and Vivid Seats and accelerate your organic growth with Stacker Studio.

In the last 6 months over $2 trillion in crypto value has been wiped off the face of the earth. In the investment business, we would consider this outcome “bad.”

You may expect me to take this chance to toot my own horn. Over the last year, I have written about how NFT art was just MLMs for rich people, how raising capital via token sales is mostly advantageous in that you can easily get money from morons, and how the pursuit of IRR has corrupted the crypto movement. Many other commentators have utilized this market downturn to do exactly that and dunk on crypto. And honestly, I get it! Many (most?) crypto people are annoying in their zeal. When confronted with uncomfortable facts about web3’s problems, most believers turn to vague hyperbole rather than concrete evidence as a rebuttal.

However, crypto isn’t a religion, it isn’t a movement, it is a tool. A highly specialized, novel tool that can be used in a specific set of circumstances. Many of the so-called use cases offered today are garbage, but there is one that works beautifully: kickstarting a niche network.

1.

The worst project I ever had was for a former Engagement Manager from McKinsey. He wanted to know the square footage of every UPS warehouse in the United States for a presentation to our executive team. No data set like this existed, so I had to make it.

I spent four days—four. whole. days.—tracking down the address of every UPS warehouse then using a tool on Google Maps to measure the building. To double check my work I would compare the number of docking bays and then estimate the volume going through the facility. By the end of that experience, I presented my manager with my best estimate. He promptly decided that we would skip that portion of the presentation and my work went into slide 45 of the appendix. Note: Murder is technically legal if they deserve it.

This was obviously a stupid exercise. Stupid because my methodology was flawed. Stupid because the manager hadn’t thought far enough ahead about what he would actually do with this data. However, it was mostly stupid because I was being paid $85K a year—I was a very expensive way to do this. We could’ve easily outsourced the labor to a freelancer for faster and cheaper. However, it wasn’t like we could just post “need someone to click on Google Maps for 4 days” on Twitter—the person willing to do this task is not obviously available. We simply didn’t have the time or resources to find/vet candidates. Note: I recognize that this is a long intro for a section but I have wanted to vent about this for five years and now I have 50K people that read this column. Who needs a therapist anywho?

Freelancer marketplaces exist to solve this exact problem. You have some constraint-bound task to get done, you post a job on a marketplace, and the service matches you with a freelancer.

The market size is basically all guesswork, but public companies in the industry ballpark it somewhere between $815B and $1.3T. Regardless, the number is stupid big enough to justify many large companies. Even if you pare it down to just currently online freelancing work, a market size of $100B+ is reasonable.

For today, we will look at three organizations tackling this space. Two public companies, Fiverr and Upwork, and one web3 example, Braintrust. The most common criticism of web3 lately has been “thEreS nO uSE cASe” and this is the best example of a use case that I’m willing to give the Napkin Math stamp of approval.

2.

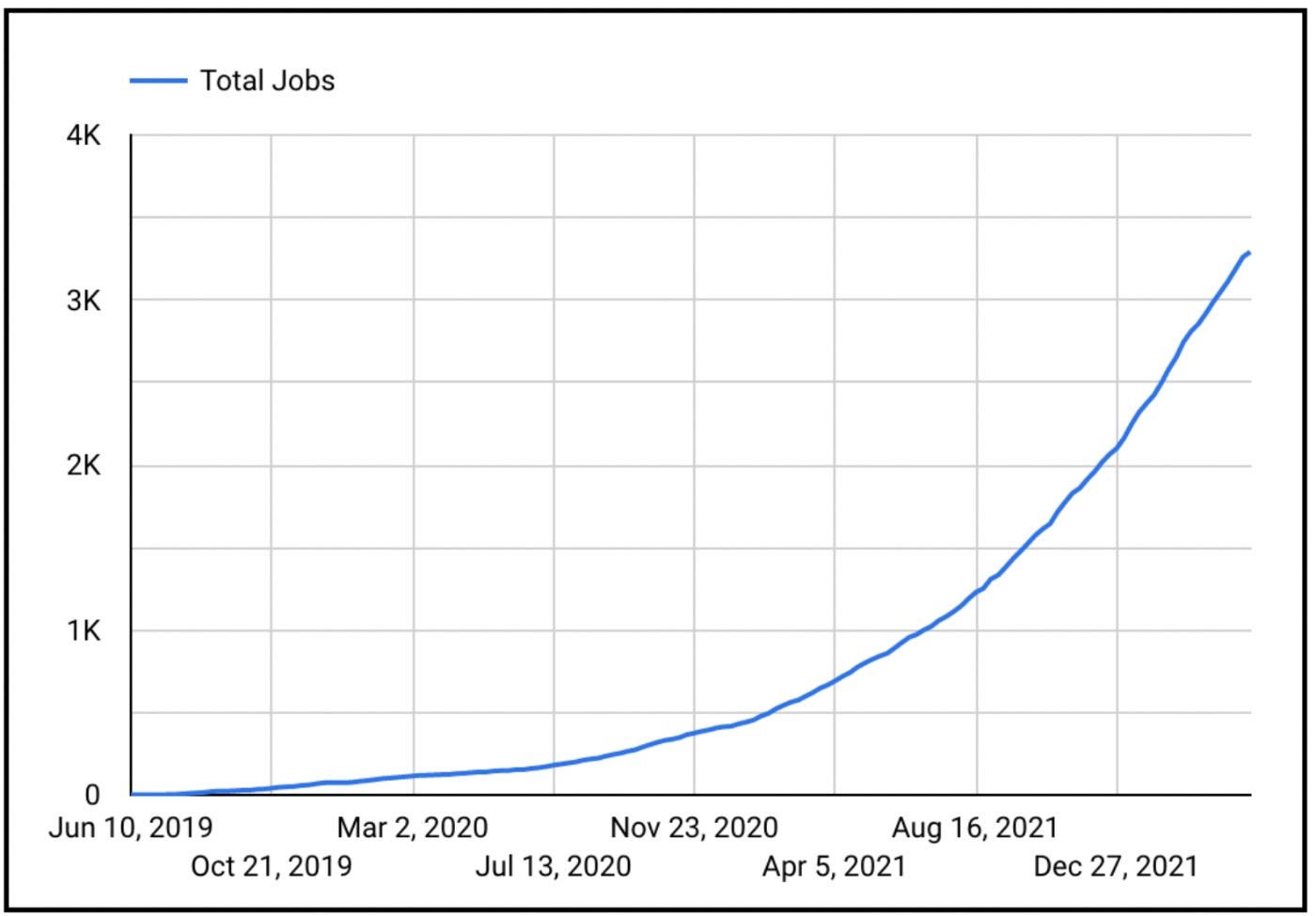

Braintrust is a freelancer marketplace that focuses primarily on highly skilled technical labor. Since publicly launching a few years ago, they have had a steady increase in jobs posted:

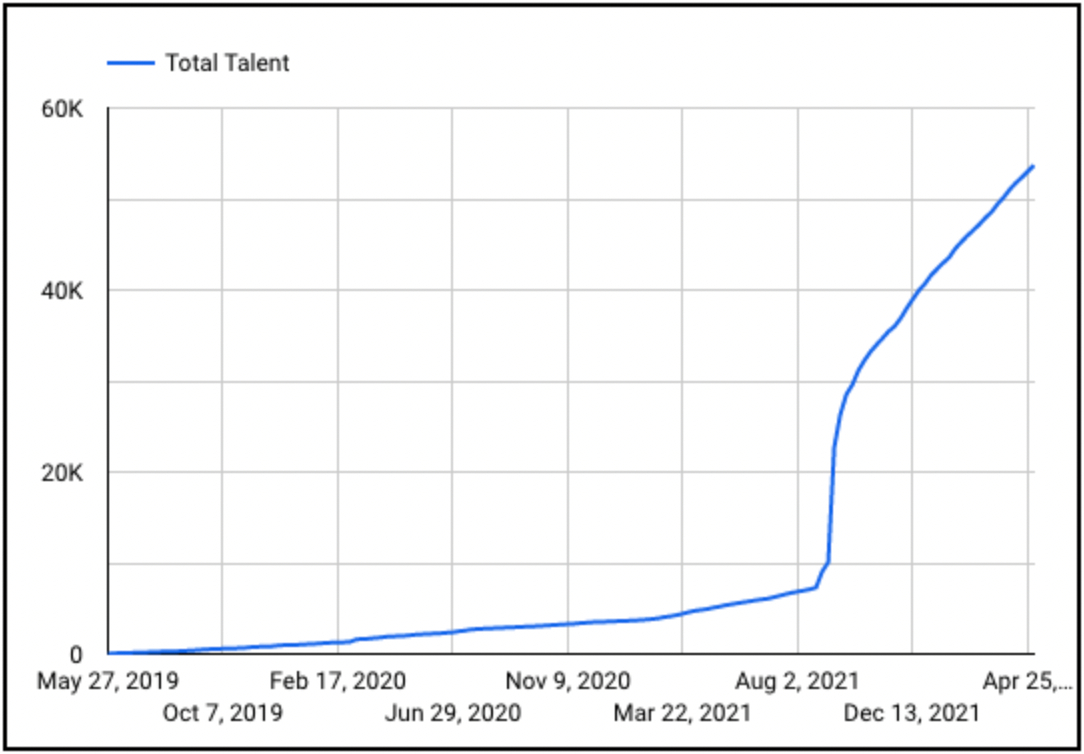

And talent on the network:

In its first 18 months, the network drove over $40M in gross service volume (GSV). This is incredibly impressive!

Most, if not all, of the network’s initial success can be traced to its crypto roots. We will explain how in a second, but first, we need to examine Braintrust relative to its peers.

3.

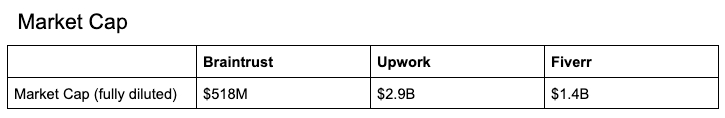

Fiverr, Upwork, and Braintruist are all valued in the sub $3B range.

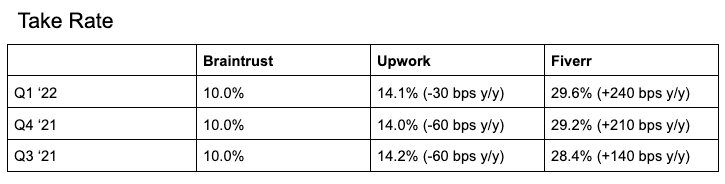

A marketplace’s financial viability is primarily determined by three variables: Dollars that pass through the market (gross service volume, or GSV), take rate on said dollars, and cost to acquire those dollars.

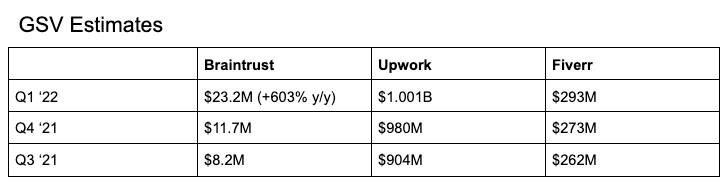

Braintrust is just an itty bitty little thing relative to the big boys.

Let me be clear: Braintrust’s valuation is insane. There is no logic for it based on its public peers. Having 1/10th the volume and ⅓ the valuation makes no sense to me.

Even the take rate is relatively tiny.

I recognize that many people in web3 see low take rates as a good thing. I do not. I am of the controversial opinion that businesses exist to make money and businesses that can simultaneously have high retention and high take rates are vastly superior.

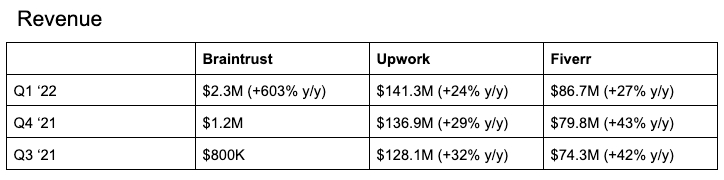

This all translates into a revenue profile where Upwork does the most volume, Fiverr has the highest take rate, and Braintrust is the fastest growing.

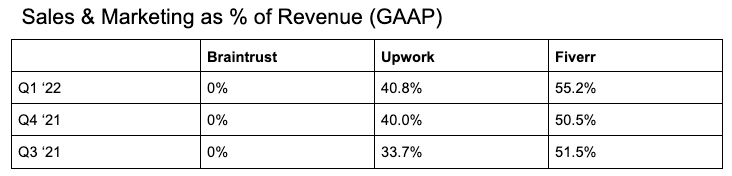

However, there is something remarkable when comparing the cost to acquire those dollars. Look at this:

Braintrust’s ability to not spend (fiat, at least) on S&M comes back again to the crypto differentiation. We are almost there! But I still need to lay a few more pieces of groundwork.

Comparing a public company’s performance to a startup probably isn’t fair—Upwork and Fiverr have like a 10ish year head start. Data is scarce for the early years, but Fiverr allegedly had 600% growth in transaction volume and 2-3 years after their launch had more than 1.5M active sellers and buyers. Numbers aren’t available for Upwork but I don’t think it is unfair to think they had similar growth seeing how they are so large now. Braintrust is likely growing at similar if not slightly smaller rates then its peers did in their early years.

Regardless, this is a real company making real money roughly in line with the path that strong, public companies laid out.

4.

Ok, I lied.

Technically, Braintrust isn’t a company at all. It is a protocol, controlled by a DAO, that uses crypto as an economic mechanism to coordinate activity.

That is the sort of word jello that typically accompanies a web3 essay so allow me to translate.

Braintrust uses internet reward points, controlled by a bunch of people with voting rights, to run a freelance marketplace. It is governed by a digital constitution that says what you can use those reward points for.

In comparison, let me word jello the public companies.

Fiverr and Upwork use dollar bills, controlled by a leadership team appointed by people with shares, to run a freelance marketplace. They are governed by what the U.S. paper constitution says you can use those dollar bills for.

These…are not that different.

There are 2 easy to explain advantages that Braintrust has over typical companies.

- Reward points are free: Whenever Fiverr and Upwork want to incentivize someone to do something, they have to dip into their bank accounts and pay in dollars. Want someone to tell their friends? $10 referral bonus! Need a salesperson? $100K a year. When the DAO that controls Braintrust decides they want someone to do something, they can just pay in their native token. These tokens don’t do anything outside of voting rights and staking within the Braintrust ecosystem! But that doesn’t stop anyone from giving them away. They currently go for ~$2.33 a pop. This is what allows Braintrust to have a “0% sales and marketing” as a percentage of revenue. By using reward points as the reward for labor, they were able to scale their acquisition efforts much more easily then someone else trying to do this with fiat.

- Reward points (crypto) are programmable: In my opinion, this is what makes web3 so cool—by making the reward points tradeable, open, and programmable, you can ascribe all sorts of utility to them. Braintrust gives people who own their reward points voting rights and allows them to boost their application for a freelance job. This would be the equivalent of me being able to sell my Delta Skymiles on a marketplace and also using them to vote for what routes for the company to open next.

These two variables combined are why kickstarting a network with crypto is great.

5.

Most people in tech don’t know this, but businesses are supposed to make a profit sometimes.

The only way to make profits over the very long term is to have a monopoly. Or as Peter Thiel puts it, “competition is for losers.”

You can retain a competitive advantage via government cronyism or cornering a scarce resource, but tech’s favorite monopoly method is network effects. A very simple explanation of a network effect is that the more people that use a product, the more valuable it is. At critical mass, it means that customers can’t leave because the network’s value is so large. It’s a great way to have a monopoly.

Entrepreneurs have chased network effects since the railroad and telephones. They show up in tech all over the place, from Tinder, to Uber, and Salesforce’s App Store. Network effects can be weak or strong, but generally, the stronger the effect the stronger the monopoly.

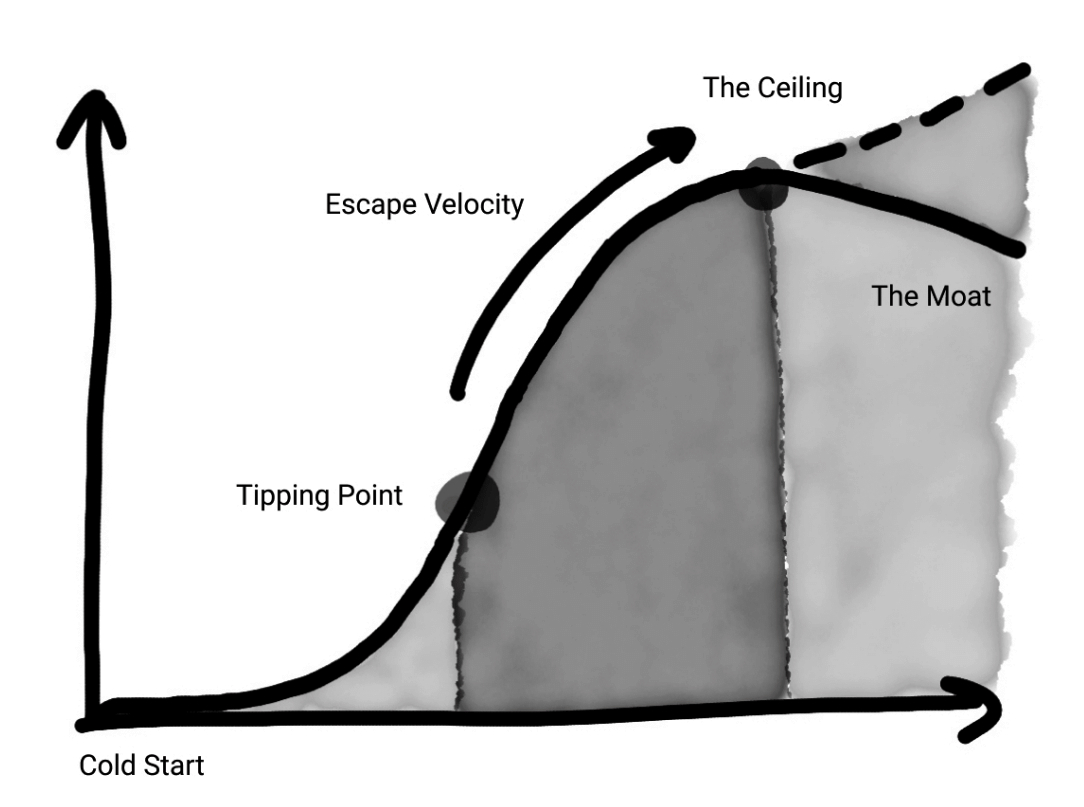

Perhaps the hardest problem with network effects is getting started. Andrew Chen of a16z calls this “the cold start” problem. A network is only valuable when there is sufficient density on both sides to provide utility aka the chicken or the egg problem.

Once you overcome the cold start phase of network effects in your initial market, you have to expand. For Braintrust this may mean they have incredible front-end engineers, but want to tackle the designer market.

According to this interview with UpWork’s SVP of marketing, Upwork overcame this problem by merging two companies, utilizing press, and word-of-mouth referrals.

“Upwork was formed as a result of the merger between Elance and oDesk, each of which had sizeable freelance communities. But starting each of those communities was a classic example of a ‘chicken and egg’ dilemma — we needed to try to balance marketing our website to both clients and freelancers. We built out both sides at the same time, knowing that clients wouldn’t join a network without freelancers and freelancers wouldn’t join a network without clients.

The concept of online work was quite new in 2005 and it attracted a lot of press, which we took advantage of to build our initial freelance customer base. At that stage, we individually reviewed every freelancer, which gave everyone a good chance of finding clients. We started a customer referral program early on and, to those freelancers that were successful, we offered a reward if they referred other successful freelancers. This gave our website another burst of highly-qualified freelancers, after which word of mouth drove increases in the number of freelancers.”

Crucially, for Upwork, all of this initial user traction was free.

Marketplaces win if they can more cheaply attract demand/supply then their competitors and are then able to extract the most value possible from the network without increasing churn. Upwork did this via the press. Fiverr did it via viral growth loops. Braintrust does it with crypto.

Crypto’s advantage for the initial stages of network expansion is that issuing tokens is free. There is no inherent value in some random token, but founders, with sufficient hype/marketing, can get buy-in from a crypto-native audience, and utilize that hype to kickstart the network. Braintrust has a word of mouth that it utilizes via the narrative network effects of crypto. By saying, “We use web3!” people like me will cover them, giving them free publicity, thus giving them more network participants. Once people are bought in and hold sufficient amounts of the native token, they are unlikely to leave because they are literally invested into the protocol.

Fiverr and Upwork built freelance marketplaces when the internet was still young and uncompetitive. Braintrust is matching similar growth rates while simultaneously competing against dozens of active and strong competitors, all through the strength of crypto. That doesn’t mean that crypto is the only method to do this! It is simply a new one that has worked well for Braintrust.

6.

Let me head off the criticism this post will receive.

This is a very narrow, very niche use case! It only worked for Braintrust because both sides of their network were highly technical and were able to grok the crypto component. It has only worked for their initial year or two and the arc of success or failure for startups is long.

The use case for web3 that works is taking a network from a cold start to the tipping point of a hyper-local market. In short, crypto works best when crypto is in the background. Crypto is basically a database: maybe we should just evaluate it the same as we would any other tool.

Crucially, another freelancer marketplace could set everything up that Braintrust has done not on the blockchain. However, this would miss the narrative network effects to kickstart the market. Additionally, you would have to use fiat for initial growth rather than tokens, thus making acquisition more expensive. Remember, the victory conditions for a marketplace are acquiring and retaining supply/demand as cheaply as possible while simultaneously extracting as much value as is long-term healthy.

And to be clear, I don’t think this approach isn’t without potential serious, long-term downsides:

- Programmatic lock-in: When a founding team is designing a crypto project, their most important skill set is being fortune tellers. They have to gaze far into the future and predict the effects their design will have. In the business, they call this tokenomics. The only thing is that economics is more art than science. We can’t even get inflation right! Why on earth would a group of random developers be better at economic design then our smartest minds? The basic version of Braintree’s tokenomics is that the 10% takerate is used to purchase BTRST on the open market to hopefully drive up the price of the token. So far that hasn’t worked (the token is down 95% from its all-time high) but this is a long game. Maybe it will over time! Still though, that is the fundamental bet and it had to be made at the very beginning of the company. In twenty years, when the world looks entirely different, I’m not sure how or if this will work.

- Very tough to expand to the next market: At the tipping point from Andrew Chen’s book, you have to expand beyond your initial atomic market into additional ones. Geographies and verticals will all have different flavors that will likely have vastly different economics. Upwork and Fiverr can completely change their GTM model, sales, and marketing as they expand. Braintrust won’t have that same ability because crypto is so core to their acquisition model.

- DAOs are bad: This is more of a personal gripe but DAOs are just a terrible idea to me. Has there ever, in the history of humanity, been an organization that thrived without a leader? Or one that was completely subject to the whims of the masses? A startup is so hard and tough that it requires an all-in leader who focuses exclusively on the thing. Being governed by a community that isn’t nearly as invested as a leader would seem sub-par. I don’t think there is sufficient data to say one way or another, but this is what my gut tells me.

What Braintrust has accomplished is impressive. They have learned the lessons of web3 well and proved that this works. If you are building a technical marketplace and want to initially scale it with dramatically reduced acquisition costs, crypto is a great tool.

Special thanks to Matt Martin for all his help on this piece. I couldn’t have done it without him.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

.08.31_AM.png)

Comments

Don't have an account? Sign up!