Sponsored By: Flatfile

Data onboarding stifles growth in even the largest companies.

One of the worst ways your team spends time is manually formatting customer data before it can be imported.

B2B companies spend tons of effort trying to fix this data onboarding process, usually, by hiring services teams, building custom import scripts, or asking customers to spend hours formatting data with CSV templates.

What if you could:

- Save your team from wasting hours formatting spreadsheet data.

- Import and migrate disparate data in as little as 60 seconds.

- Onboard sensitive data safely with HIPAA, GDPR, SOC 2 Type II and Type II compliance.

Flatfile’s data onboarding platform solves these problems, transforming customer, partner, and vendor data from messy and unorganized, to clean and ready to use, with 1-click.

At every party in San Francisco, you’ll hear the same argument from dudes with ponytails:

Crypto is important because it “financially incentivizes human coordination mechanisms.”

I want to give crypto the benefit of the doubt—I am an unabashed technology maximalist that is all in favor of anything that gives the human species better chance at avoiding extinction—but this statement, so painfully ivory tower that it makes a Harvard professor blush, is a bunch of jello words. They have no meaning or shape to anyone who doesn’t have a severe case of Twitter brain.

But underneath the word salad there is an important insight: society faces many hard problems that capitalism as it currently exists does not seem capable of solving. Perhaps new ways of organizing the flow of value could help?

I’ve watched carefully over the last 5 years, waiting, reserving judgment. And so far…I’ve been disappointed.

A few random samplings of news stories over the last few months:

- $25B+—yes, BILLION with a b—was lost over the last 72 hours by crypto traders of Terra and Luna. Numerous retail traders have lefts posts across social media contemplating suicide after losing their life savings.

- $182M was stolen from the Beanstalk protocol in less than 20 seconds without a single hacked password.

- $625M was stolen from Axie Infinity, a play to earn crypto video game that has become the primary source of income for many folks in developing countries.

- A NFT gaming project that charged new users ~9K to mint their initial NFT. They are currently trading for ~$500. This project initially raised ~$90M.

I recognize that I am cherry-picking the bad things (there have been lots of good things too!) but these incidents taken together, along with the dozens of other concerns, have raised the question: Why isn’t crypto living up to its lofty ambitions?

Today, I’d like to offer an answer.

Crypto has failed to achieve its promise because of the flattening of its output. What that means is all the success of crypto gets flattened into one simple metric: IRR. It is that most devilish of metrics, that insidious indicator, the internal rate of return (IRR) that has been the poison at the very heart of Cryptoland. Every single project, from digital art to social organization, is ultimately asked to do one job: enrich its participants.

To explain why this is so bad, we must alter the paradigm by which we evaluate crypto projects. Rather than treating these things like startups, the correct lens is to view them as digital nation-states. When an organization introduces a new crypto protocol, it is not offering a mere technology product. Instead, it is building a series of immutable economic laws that just so happen to be written in code. Thus the phrase, “Code is Law.”

The problem is, code is a flawed means of enforcing the law.

To understand why it doesn’t work, we must turn to a favorite book of Silicon Valley.

Seeing Like a CryptoState

In James Scott’s book Seeing Like a State, he examines why so many large-scale government interventions fail. The basic idea is that the modern administrative state has to simplify problems because the scale of their intervention is so large. This simplification manifests itself as a simple metric that is optimized to hell and ends up giving net negative results.

Crypto is undergoing the exact same problem. There is so much interesting innovation and ideas in the space, but ultimately, all that matters is that it has the highest IRR regardless of what the token is supposed to do. There are trillions of dollars on the line here, there is no bigger intervention than this.

Scott’s argument isn’t perfect, and I think he is overly generous with how powerful his theory is, but it does act as a useful framework for today. He cites examples as diverse as city design in Brazil and German forestry practices to argue that “certain schemes to improve the human condition have failed” because four things happen simultaneously:

- Administrative Ordering: To design large-scale systems is to be reductionist. You got to KISS (keep it simple stupid). It isn’t possible for someone creating a policy to account for all of the details, data points, and nuances of local communities. Out of necessity, these policies end up systems of infinite complexity into simple metrics.

- High Modernism: Accompanying this metric reduction must come a belief, an almost absolute faith, in the system of progress—a belief that a government is offering something that is “backed by science,” that is is the best we have to offer, and must therefore override local objections.

- Authoritative State: Once you have the metrics and beliefs in place, implementing large-scale interventions requires a strong government. Having absolute power allows an administration to do what it thinks is best.

- A Prostrate Civil Society: Equally important, those being affected do not have the power to fight back. Power here can mean both military and intellectual might.

When you map these 4 conditions over the current state of crypto, it is remarkably similar:

1. The Administrative Ordering

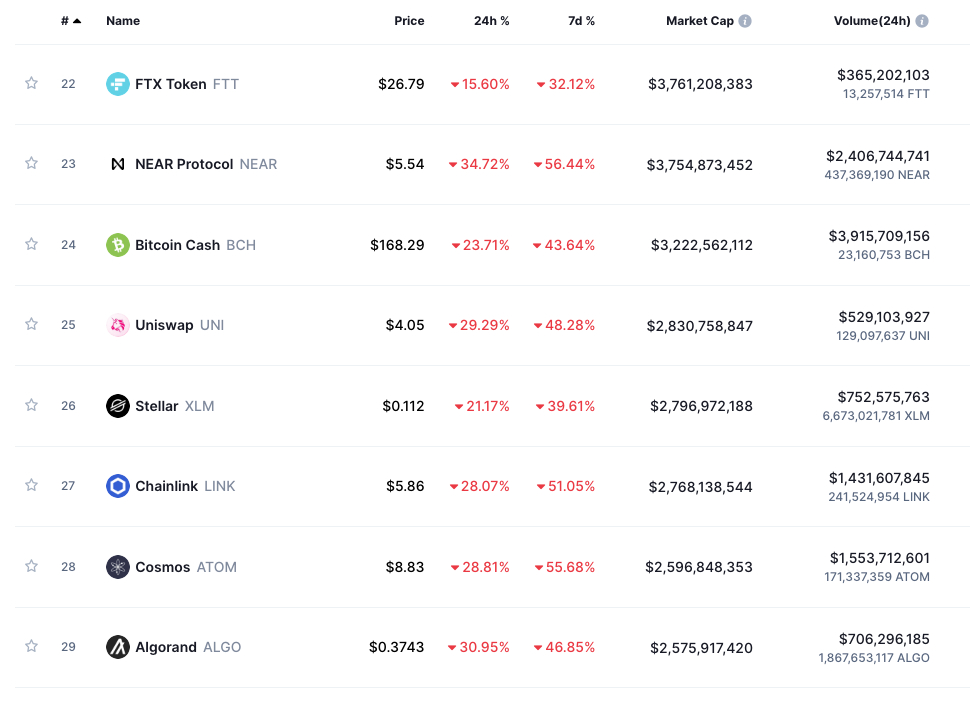

As I mentioned above, this is the most pernicious sin currently permeating Cryptoland. Whatever you may be trying to build, whether social club or stablecoin, you are put on the exact same price comparison chart as everyone else.

Note: These results are BRUTAL. Crypto is being crushed.When I look at these I know what some of them do, but only like, kind of. And, really, why would I need to know? Because cryptocurrencies tend to act as equities, their real-world utility is completely disconnected from their economic performance. There is no link between the two. If these were stocks, that would be totally fine! People buy stocks all the time without having a clue what a company actually does. But the difference is that so, so many of these coins don’t do anything at all. Because they are primarily evaluated by the lens of IRR, it entirely changes the conversation that a founding team could have.

Founder with MBA: Hey I think we should do something with crypto

Technical Founder: What did you have in mind?

Founder with MBA: I don’t really know, something that makes us a lot of money.

Technical Founder: ….you don’t have an idea? I left Google for this? I thought by joining you I was going to get rich!

Founder with MBA: Eureka! That’s it! That’s what we should do.

Technical: Do what?

Founder with MBA: Join us and get rich! That’s the product!

Technical: That’s not a product! That’s not anything. That’s just a scam.

Founder with MBA: What if we sold a butt ugly picture of zebra with it.

Technical: *Answers phone call from unknown number*...Would you believe that a16z just offered us a term sheet for that?

It seems kinda pesky to have to actually build stuff. Rather than bother with that, the IRR administrative focus encourages teams to just do a bunch of marketing and convince people that they will get rich by joining. Because in so many cases the line between the cryptocurrency and the actual job to be done is so blurry, it makes it really hard to determine whether any of this shit does anything at all.

To make this problem even worse, this IRR is calculated down to the minute. Crypto markets never close and you can liquidate your position at any point for any reason. Normal tech startups will also be judged by their IRR, but to get a fat IRR, they have to do it over a long time frame. You can get by with only marketing for a year or two, but eventually, the reaper comes knocking. Crypto doesn’t have to bother with that at all. If a team can launch with sufficient hype, the crypto’s price will skyrocket, and then suddenly what it does doesn’t matter at all. Now the skyrocketing price is the product and the management team can exit at any time.

Crypto teams don’t end up competing on their product’s utility but on its IRR.

2. High Modernism

The fervent, beating heart at the center of Crypto is belief in the blockchain, decentralization, and shared upside. Blockchain technology allows transactions and code to be immutable. Once published to the blockchain, it can never be changed. There are absolutely some situations where this approach is superior, but to the outside observer, it is obvious that this isn’t always better.

In web3 though, the meme “web 3 fixes this” gets applied to every industry. I’ve seen pitches for dating shows, movies, religions, and software companies, all built on the back of crypto. When I chat with entrepreneurs about whether their company needs to be a web3 thing, the answers split into two camps. The first camp is populated with grifters who happily admit to using web3 because there is money to be made. The other is filled with ardent missionaries who think web3 makes for a better product no matter what. Crypto obviously fits the label of high modernism because it is seen as “the right way to do things” regardless of whether that is true or not.

3 & 4. Authoritative State and A Prostrate Civil Society

Cryptoland is a nation with strong states’ rights. Within individual protocols, the rules are absolute. In some cases, they can’t ever be altered even if the majority of the community wants it. To participate is to agree to play by the protocol’s rules. However, I will admit that it is a little more complicated than that. Because many different projects are trying to accomplish the same thing, end users are welcome to switch between any one they want.

A large portion of the authority of these projects lies in how they target the unsophisticated investor. Many of these things aren’t trying to get hedge funds to join; instead, they’re looking for retail investors to supply the cash. This matters, because much of the pitch is cloaked in a language of sophistication that probably fools most people (see algorithmic stablecoins) but is very obviously a bad idea if you know your stuff. However, people act incredibly irrational when money is on the line. The siren song of easy and quick money has ensnared many an investor.

With all of these elements mixed together you get Cryptoland, a collection of digital nation states of laws that are written in code, all built around maximizing IRR regardless of their practical utility. But, that isn’t all.

I kinda think it’s even worse than that

If there is one criticism of Seeing Like a State I agree with, it is that Scott oversimplifies. He argues that instead of relying on large state interventions, local communities should semi-reject scientific progress in favor of local custom/knowledge. However, virtually everything good about our society today comes from incredibly large-scale, simple networks that have certain agreed-upon conditions.

We grow monocrops that have allowed us to support far more people. The shipping container dramatically decreased the price of shipping anywhere in the world. It is fair to say that without large-scale government inventions the world would be much worse.

In my opinion, what Scott misses is that these things can improve. Sure, many countries get city design wrong, but other cities learned from their mistakes and do it better. Interventions are populated by human beings and eventually, on a long enough time horizon, human beings will be able to fix the mistakes of their government.

However, in Cryptoland, it isn’t that easy. Laws aren’t laws. They aren’t rules of engagement or orders given to individuals to carry out. In Cryptoland, code is law, not prose. The assumptions that you bake into the system design are forever present in the ongoing effects. There are ways to issue patch updates or to fix obvious vulnerabilities, but it is just way more inefficient than typical governance procedures. The surface area of attack for a crypto project is everything.

Consider the case of the Beanstalk exploit that I mentioned above. The thief was able to gain access to all that money by taking out a massive loan, buying all of the voting tokens in the protocol, and then voting to give themselves the money. This is obviously morally wrong, BUT—and this is a big but—all they did was take the system to its logical conclusion. They just played the Beanstalk game better than anyone else and walked away a millionaire for it. Note: I’m not even sure that what they did was illegal!

What makes Crypto so darn complicated to analyze is because everything is smushed together. The token is the equity is the product is the user is the data. It is every component of a startup, all at once, all on the blockchain.

And all of this glorious, fascinating mess is evaluated with one metric: IRR.

How could there not be problems?

Where we go from here

Watching all these people be hurt by Crypto projects has admittedly left me fairly jaded. I am very comfortable when VCs lose all their money. I am deeply troubled that so often it is regular consumers who are hurt in Cryptoland.

To resolve this problem, Crypto projects need to take a cue from traditional tech startups and restrict selling for many, many years. It is the easy availability of liquidity to token owners that has broken the industry. By severely restricting when/how you can sell a token, a project will be able to care less about 3 month IRR and more about the 10-year version of it.

Even as I describe this solution, I doubt its efficacy. While that may work for an individual project, no startup is built in isolation. They are all competing for the attention of investors. If I had to choose between an investment that gives me instant liquidity and one where I have to wait 10 years, I’ll pick the first option every time.

I am confident that crypto will bounce back from its current slump. There is too much momentum and talent for the sector to be repressed forever. However, I don’t know the answer to solving the problem of IRR. But when someone smarter than me comes up with the answer, they will build something spectacular.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

.08.31_AM.png)

Comments

Don't have an account? Sign up!

This all seems fairly correct. But isn't there something even deeper at the heart of this, that underlays most of the problems with Crypto *and* "traditional" (modern) government? I'm talking, of course, about our economic model. You say at the start: "...society faces many hard problems that capitalism as it currently exists does not seem capable of solving" and then never really return to that.

I know this is an article specifically about the failings of crypto, but I tend to feel that those failings are just sped-up and magnified versions of the failings of the root system it is based on. We had "hypercapitalism" before crypto, so I don't know what we can call Crypto in relation, maybe it's just approaching Übercapitalism 😄 Blockchains and digital contracts and code as law essentially just further extend the speed and fluidity of capitalist activity to a further logical end. The fact that horrible things are happening because of it and that IRR is king in that world is actually literally no different from capitalism in general, as a whole. You have the obvious examples, like how most people just relate to a company in terms of its balance sheet, as well as the huge negative consequences for millions or billions of people (the various bubbles and crashes, like the one we're living through now, the massive and growing inequity, stagnant wage growth, etc.).

So sure, crypto is disappointing, but is it really more so than the growing clarity of disillusionment we are coming to at the beginning of the 21st century as we see that the system that has brought us here (for better and worse) seems unable to bring us much further without destroying ourselves, the planet, or both? What truly comes beyond this? Can blockchain be part of the solution? Whatever it is, I think we need a new understanding of "value" and how to exchange it.