Hi All!

Building things in public is cool, building things with your community is better. About a month ago, I sent out a beta product for my paid subscribers. It went well and I received over a hundred comments with suggestions on how to improve it. My community of readers is incredible—thank you. Today is V2 of that product, where I've incorporated all that my readers said. This time it is less focused on immediate application and is more focused on the fundamentals that undergird finance and technology news. It is broken into 3 sections.

- Micro-column: How to turn your writing into a VC fund

- Insight: Reddit's new funding and the difficulty it will face in building a meaningful business

- Insight: Analysis on a new paper from Morgan Stanley on discounted cash flow-based valuation

I'll paste the content below, but it would be much more preferable if you went to the google doc and left comments. It is important to me that this paid product accurately reflects the needs of the community. Let's get it :)

Micro-Column: The Rise of the Content Capitalist

It doesn't matter if you are a new grad or have 10 years experience, the search for a VC job and your success once you have the job are highly dependent on the one thing that you have little control over — gatekeepers. Before you get the job, it’s convincing those gatekeepers to take a chance on hiring you even though you don’t have prior VC experience. After you get the job, it’s convincing those same gatekeepers to take a chance on the startups that you’re pitching.

Today I would like to share with you a different path to quality venture careers. This is a path that is less reliant on getting past gatekeepers. It does not require that you work at a top tech company. It does not require specific degrees or a Harvard letterman jacket. It does not require independent wealth. It can be executed from anywhere and only requires hard work. It is writing.

Put yourself in the shoes of a founder at a quality startup. You’re getting a lot of cold inbound requests to meet from VC analysts, associates, and principals. And by a lot, I mean 20 times per week a lot, according to several founders I’ve recently spoken with. In this competitive, email-driven environment (and in the discussions that follow) the investor who can most quickly gain your attention, respect, and trust — via your inbox — will get the meeting.

One of the best ways to hack this competitive process as an investor or aspiring investor is by creating valuable written resources for founders. If you do this consistently over the span of many months or years, founders who have become familiar with your work will respond to your outreach with the enthusiasm that normally would be reserved for a VC who had the cache and the capital of a brand-name firm.

Allow me to say this more simply, by building an online writing presence you can compete with the best VC firms in the world.

Within my first month of writing Napkin Math that I had startups asking if I angel invested. I was incredulous. Me? Why? Soon, investors I knew were asking if there were any promising startups that I could send their way. There was something about what I was doing that was attracting attention. Writing works for a variety of reasons. First, there is a level of intimacy that comes from reading someone’s writing week after week. My readers know how I think, they have a feel for me as a person, and because of that, familiarity and trust is born. The second is distribution. On my subscriber list, I have most major VC funds, prominent Angels, and executives at every major tech company. By being able to put a Founder's startup in front of my list I am able to help them recruit, raise, etc. I did not understand this power when I started writing online. My origins in making stuff were more rooted in my personal annoyance—no one was writing what I wanted to read. Surprisingly (to me at least!), people liked what I had to say.

You might think that my experience is an exception, but there’s plenty of evidence that what has happened to me wasn’t some weird outlier. There have been numerous examples of people leveraging their personal brands — built through their writing online — into venture scale deal flow and outright VC style investing:

- Not Boring, written by Packy McCormick, recently raised a $8M fund

- Multiple large Twitter personalities have rolling funds: Pomp (185k+ newsletter subs), Austen Allred (170K twitter follows, $2.6M committed capital per quarter), Austin Rief (Morning Brew Newsletter CEO, 3 million+ subs), and tons more examples available here

- And GoingVC Partners, a bootstrapped org that started as a newsletter, has invested in close to 20 startups, with a unicorn and an an exit already on the books.

And you can plan on there being an Evan Armstrong venture fund, primarily powered by my writing, in the coming years. :)

I do want to be clear that online content creation is hard, grueling work. Writing something truly great that adds definitive value to founders is very tough to do even once. Doing it every week is even harder. For years? There are few and far between who make it that far.

To quantify why this is the case:

- Every week I have to come up with an original topic. This requires hours and hours of reading, researching, and iterating on outlines.

- From there I’ll need 5-10 hours of initial writing to draft a 2,000-4,000 word post.

- Edits will take another 10 hours of work.

So every week I am investing upwards of 30 hours to create what you see in my newsletter. And this is on top of normal life stuff (day job employment, wedding in the fall, etc)

I know that (and you should know that) putting in this much time is not a guarantee of success. Working this much is only sustainable in the long term because I have a deep passion for what I am writing about. But, it represents a path by which someone can come from anywhere to build a fund.

Insights

Reddit is Valued at $10B at ~25x Revenue Multiple With $415M in Fresh Funds

Eventually, every consumer internet company is judged on its ability to deliver effective ads. Google (28.9%), Facebook (25.2%), and Amazon (10.7%) hold such a dominant hold on the digital ad market not because they have the most users, but because they have the most users that will click on an ad. The sickly sweet temptation of ad revenue is ever present for any consumer product. Grocery delivery, food delivery, ride delivery, disappearing photo delivery—eventually everyone gives in. The trick is that attention isn’t enough! Companies need to be able to target ads accurately enough to make the ROI justified.

Reddit is a fascinating case study to examine the ROI and ad quality component of this question. The site has 50M+ daily active users and over 100K subreddits. Users spend hours liking comments and content. This, in conjunction with the communities they express interest in, should hypothetically allow Reddit to build a super efficient ad system.

This...hasn’t happened yet over the last 16 years of its existence. They are just now hitting $100M in quarterly revenue which is much, much slower/smaller than its peers.

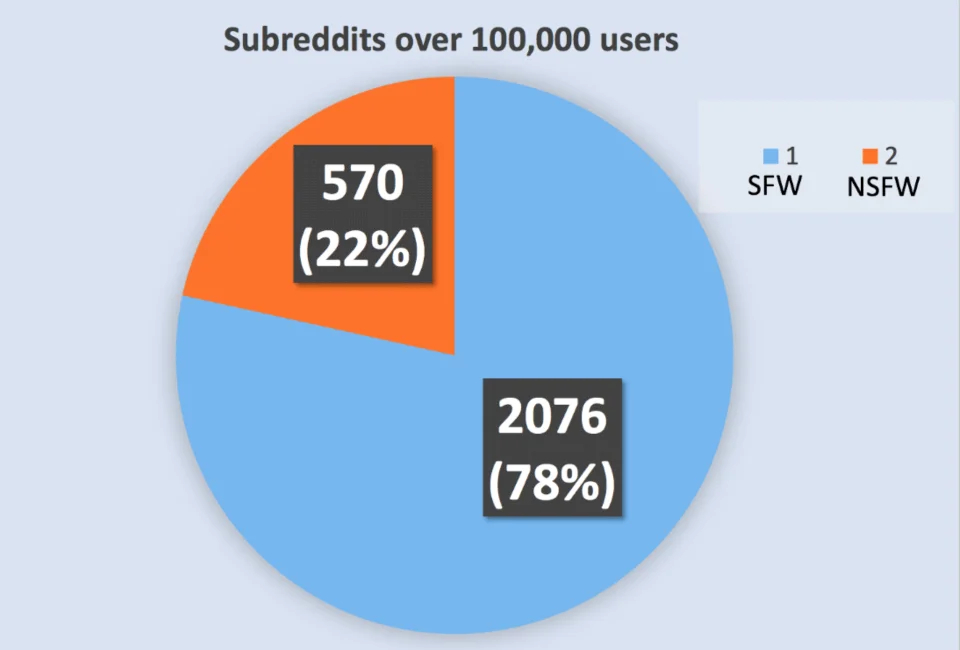

From my discussions with marketers and industry experts, there have been two primary reasons for this. First is the abundance of adult content on the website. If you are selling ads for detergent, you probably don’t want your ads popping up on a pornographic subreddit. The best estimate I found put these NSFW communities at ~22%. Most advertisers are still very, very hesitant to put money onto a site hosting pornography. Note: This is partially why Tumblr banned all these types of content.

The second reason comes back to efficacy. Marketing dollars are efficiency seeking missiles. Even if Reddit banned all NSFW content, they still would have to be more an effective spend than just putting the money into Google Adwords. These really, really work. The big 3 have such incredibly rich data sets and are so central to the shopping purchase flow, that it is incredibly difficult to honestly say “yes our ads are better.” The Reddit CEO said it best,

“We’ve grown up in the shadow of Facebook and Google, and pretty much every dollar we make we’ve had to fight for.”

This new funding represents a bet that Reddit will simultaneously improve its Ads and that they will be able to steal dollars from the big tech companies. Personally, I’m skeptical. But hey! 17th year is the charm right?

Everything is a DCF Model (But Some Are Pretty Broken)

The best method for valuing an asset is to estimate its future cash flow. If you think there will be lots of cash in the future, the asset is worth more. If that future is really far away or if that cash volume is smaller, then the asset would be worth less. There is currently a popular perception that this method has been largely ignored by most retail and private investors. Morgan Stanley recently released a paper to remind investors of how/why cash flow matters, and received immediate applause from the Financial Twitter community. The Stanley team argues that even in the more speculative assets like residential real estate or venture capital investments, that we step away from Cash Flow based valuation at our own peril. The essay is legitimately worth a read, but there was one paragraph that is worth discussing further.

“The point is that whenever investors value a stake in a cash-generating asset, they should recognize that they are using a discounted cash flow (DCF) model.

This is important because an investor, from a venture capitalist to a manager with a portfolio of large-capitalization stocks, owns partial stakes in businesses. The value of those businesses is the present value of the cash they can distribute to their owners.

This suggests a mindset that is very different from that of a speculator, who buys a stock in anticipation that it will go up without reference to its value. Investors and speculators have always coexisted in markets, and the behavior of many market participants is a blend of the two. But it is useful to keep in mind that these are separate activities.”

My fiance, a Master’s in English Literature who has much interest in the stock market as I have in Shakespeare (Nill), bought about 20 bucks worth of Dogecoin in the Spring of 2019. It was less a calculated asset purchase and more that she was bored and saw a funny meme on Twitter. She didn’t know what would happen with the asset price. However, she did hold on to it because she thought that it would be worth more one day. During the height of the mania, she decided it was overvalued and promptly liquidated her position. Note: She then used the proceeds to buy us a puppy. The symmetry of going from DOGE to DOG was appealing.

There is an argument to be made here that she (and by extension, all other retail investors) are running a somewhat abstracted DCF model. The business being valued isn’t the asset she is holding. The bet she is making is on the business of the asset picker. Speculation is the belief that you will be able to make a lot of cash in the future through the sale of an asset. If you squint your eyes a bit, this looks fairly similar to a business that will sell a product in the future. For the retail speculator, their product is a hybrid of the asset they will hold and their ability to accurately, well, speculate.

Of course, this is a bad business. Almost all stock pickers are really terrible at what they do. But it is still a business!

Again, I agree to a large extent with the paper but I think we are still scratching the surface of what a retail investor actually is. I’m hesitant to dismiss them entirely.

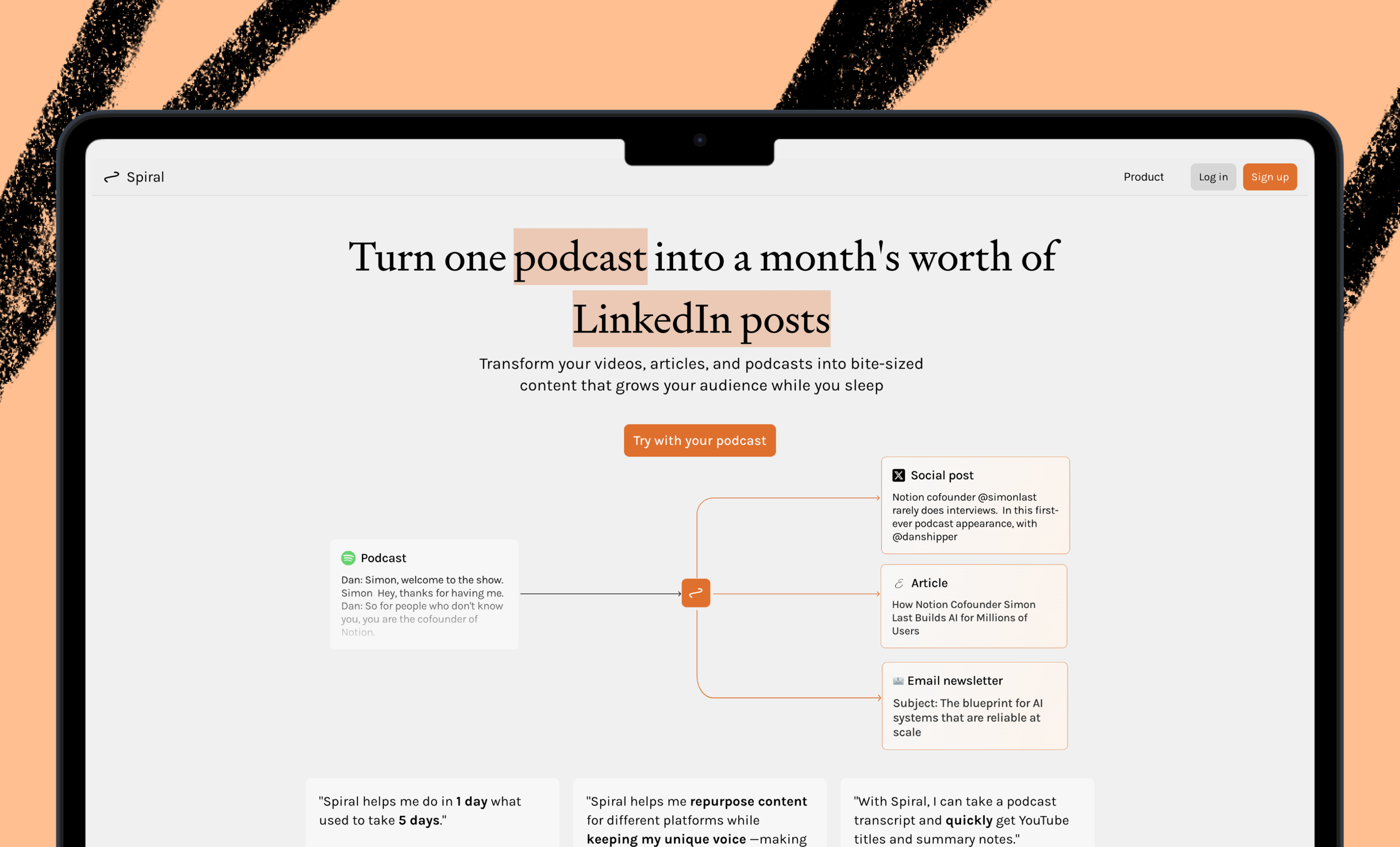

Ideas and Apps to

Thrive in the AI Age

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!

Very, VERY insightful read. I'll expand on this idea.