This essay is brought to you by Burb

Do you run a membership community or course on Circle, Slack, or Discord?

Burb can help you streamline and automate your member journey so that you can focus on what’s most important: making your offering great.

The job of a tech CEO is equal parts therapist and fortune teller.

They must simultaneously motivate a bunch of tech employees in the near term (a near impossible task unless you have a masseuse and green juice handy) while also making sure those employees are working on the things that will be beneficial in a far-off horizon. The CEO balances the present needs of employees with preparing the organization for a future that only the leader can see. Not easy.

The best executives are able to either accurately time trends or motivate their employees better than their peers can when trends become obvious.

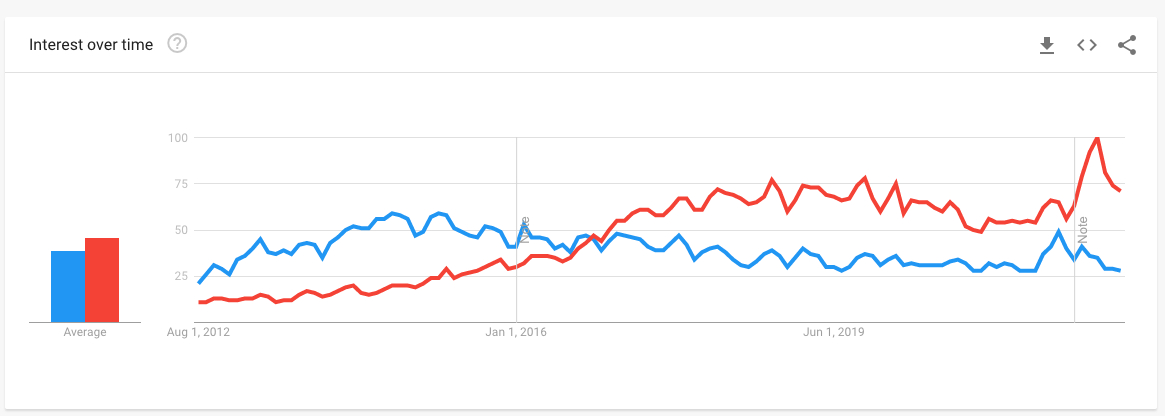

To help in this effort, executives often resort to vague, verbal gesticulations I call meta-narratives. These are stories that become popular, regardless of their relation to the truth, and can be used to convince lemming-esque employees and investors that the company is doing the right thing. Meta-narratives are huge, sweeping statements. You can always tell one is happening when, rather than solid math, company presentations are filled with grandiose soliloquies about the way the world will be in the future. A recent example is big data versus machine learning. Look at the Google trends data below (big data=blue, machine learning=red)

The golden years for the “big data” companies were 2012-2016. I remember so many earnings calls and strategy decks at the time, all purporting the value for big data. It was the meta-narrative that execs would cite to justify their strategy. Around 2018, with the rise of Waymo and autonomous vehicles, the meta-narrative shifted to machine learning. Yet again, the same song and dance were trotted out. “This will change everything!” “We are an AI company now.” etc., etc.

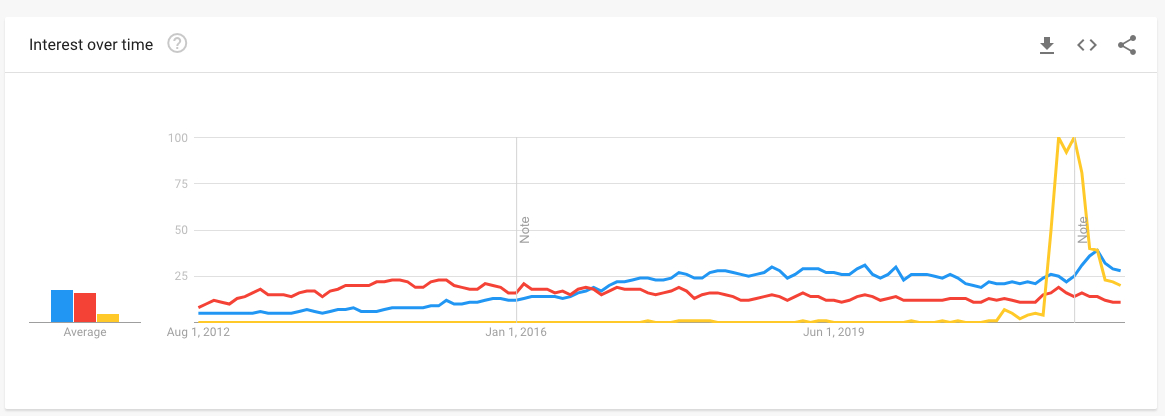

I am pleased to announce that the era of machine learning is now over. The meta-narrative is now…the Metaverse (in yellow).

Prior to October 2020, the term Metaverse had only appeared 5 times in SEC filings. In 2021, the term was mentioned 260 times. Around the same time, Facebook changed its name to Meta, Microsoft pitched the “enterprise Metaverse,” and the term suddenly seemed to show up everywhere. Crypto projects galore started touting how the blockchain was central to the future of the internet, and thus the Metaverse. (You can find my analysis of that pitch here).

You could argue that all of this recent interest was spurred by one man’s essays: Matthew Ball. His writing on the topic has been used by essentially every major entertainment and tech CEO. When executives are weaving their meta-narratives about the Metaverse, they typically cite him.

Being the guy who pumped a meta-narrative is a great job. He has paid speaking engagements, a venture portfolio, an ETF he manages, and now, a best-selling book. The Metaverse and How It Will Shape Everything is his attempt to summarize his perspective on what the hell this word even means.

His primary argument is that the digital world will consume the physical one. That our virtual selves and virtual economies will be orders of magnitude larger than physical ones and most importantly, this will happen sometime soon. This is a bold claim and one worth examining. Thankfully, I did it for you. This is a review of the book itself and an exploration of whether his ideas are right.

A Book Review

Let’s get straight to the good stuff. Ball defines the Metaverse as

“A massively scaled and interoperable network of real-time rendered 3D virtual worlds that can be experienced synchronously and persistently by an effectively unlimited number of users with an individual sense of presence, and with continuity of data, such as identity, history, entitlements, objects, communications, and payments.”

That is a lot. If it’s easier, you can basically think of the movie Ready Player One and you’ve got the gist of it.

Metaverse (Real life)

Metaverse (Digital life)

In typical tech writing fashion, he then usually takes each individual descriptor such as “real-time” or “individual sense of presence” and turns that into a chapter in his book. The result is a work that feels more like a set of essays than a cohesive narrative. Note: This is becoming more and more popular in B2B media but it does make me sad. In our pursuit of making our content digestible, our industry is putting craft and prose on the sacrificial altar.

Usually, when you see someone espousing a meta-narrative, their incentive is to make the definition as broad as possible. The more generic the definition, the easier the thinker can get consulting gigs at companies. To Ball’s credit, his definition is highly opinionated and structured such that many other interpretations of the Metaverse term are not applicable.

For even more credit to the author, Ball is generally clear-eyed about the risks of his vision not coming true. Chapters 5-11 are exclusively about the technical requirements for the Metaverse to come to be. He goes to a fairly extreme level of detail for the level of technological improvement that will be required ranging from topics like networking and computing power. If you feel like skipping these chapters, you can read this sentence: We aren’t even close to Ball’s version of the Metaverse. Let’s look at the example of latency to illustrate.

In the Ball’s coded utopia, everyone will be interacting synchronously. Because this interaction will be digital, the speed at which user inputs are relayed to other Metaverse participants is really important. Even 50ms delays can make the experience subpar: minute differences in performance can have major impacts on usage.

“Subspace [a gaming network company] has found that an average 10 ms increase or decrease in latency reduces or increases weekly play time by 6%. What’s more, this correlation holds beyond the point at which even avid gamers can recognize network latency—if their connection is at 15 ms, rather than 25 ms, they will likely play 6% longer.”

If the goal is to have a global Metaverse that all of humanity can participate in, we will have to invent entirely new modalities by which to transmit data. Even fiber optic cables aren’t powerful enough for a cross-continental Metaverse. We start to run into limitations that are physics related. Take for example transmitting data from New York to Tokyo:

“At a distance of 11,000–12,500 km, this commute takes light 40–45 ms. The physics of the universe only beat the target minimum for competitive video games by 10%–20%. This doesn’t sound like we’re losing to the laws of physics. But in practice, we fall far short of this 40–45-ms benchmark. The average latency of a packet sent from Amazon’s northeastern US data center (which serves NYC) to its Southeast Asia Pacific (Mumbai and Tokyo) data center is 230 ms.”

I actually believe this isn’t all that important! I don’t know why my Metaverse experience would need to involve someone from Tokyo, but again, this is for Ball’s definition. For nearly every other part of the technology stack, from GPUs to Virtual Reality headsets, I walked away convinced we are at least 10+ years away from achieving the Ballverse.

Despite my pessimism on the topic, the second act was actually the strongest part of the book. The author did a great job using currently trendy companies as narrative flairs to illustrate the Metaverse in its current infancy.

The final act of the book veers more philosophical with pontifications on what things like sex, creators, crypto, and identity will mean when we move our being online. I enjoyed it! But I mean, who knows right? It is fun to read forecasts of the distant future if you are into that sort of thing. However, when you move beyond a 7-year financial forecast, you start to move beyond my interest in evaluating a book as a serious study, and more as a fun intellectual exercise.

For what it’s worth, this is probably the best book on the Metaverse, written by the best person to write it. However, I have a variety of reservations.

Meh

In all honesty, predicting tech trends is pretty frickin simple. With basic monitoring of research labs, patent filings, and manufacturing capabilities, anyone with a Google alert can tell you what is coming down the pipeline. If you have been following Apple’s or Meta’s patent filings, you can have a loose idea of how they are predicting the future of the hardware.

What makes a work of strategy analysis impressive is its timing. Ball abstains almost entirely from identifying when or even how the Metaverse will occur.

“We can confidently say only that the Metaverse will not suddenly arrive. There will be no clear “before Metaverse” and “after Metaverse”—only the ability to look back at a point in history when life was different. Some executives argue that we have already passed this threshold with the Metaverse. Their argument feels premature. Fewer than one in fourteen people today routinely engage with the virtual world—and these virtual worlds are almost exclusively games, have no meaningful interconnection (if any at all), with only marginal influence over society at large. But something is happening. There is a reason why even the executives who think the Metaverse remains far off in the future, such as Zuckerberg, Sweeney, and Huang, believe now is the time to publicly commit to making it (a virtual) reality. As Sweeney has said, Epic Games has “had Metaverse aspirations for a very, very long time. It started with text chat in real time [sic] 3D with 300-polygon strangers. But only in recent years have a critical mass of working pieces started coming together rapidly.”

Still, that would be totally fine! Writing a book about something interesting that may come true in the far-off ambiguous future is very normal. However, Ball accompanies his book by offering financial products.

In June of last year, he launched a Metaverse Index Fund that average retail investors bought into. This makes me deeply uncomfortable. When it launched, the documentation promised hyperbole like “virtual goods will reach $400B in spend by 2025.” For Ball, the fund has done pretty well with $527M in AUM! For the people who actually invested? Not as much. The fund is down 46.7% since its inception last year.

It is incredibly difficult for me to square the intellectual position offered in the book,

“The danger in assessing the preparedness of today’s leaders for tomorrow’s future is that they always look prepared. And that’s because they are—they have cash, technology, users, engineers, patents, relationships, and more. Yet we know that some of these companies will falter, often because of these many advantages (some of which will turn out to be encumbrances). In time, it will become clear that many of the leaders in the Metaverse weren’t even mentioned in this book—perhaps because they were too small to be of note, or unknown to its author.”

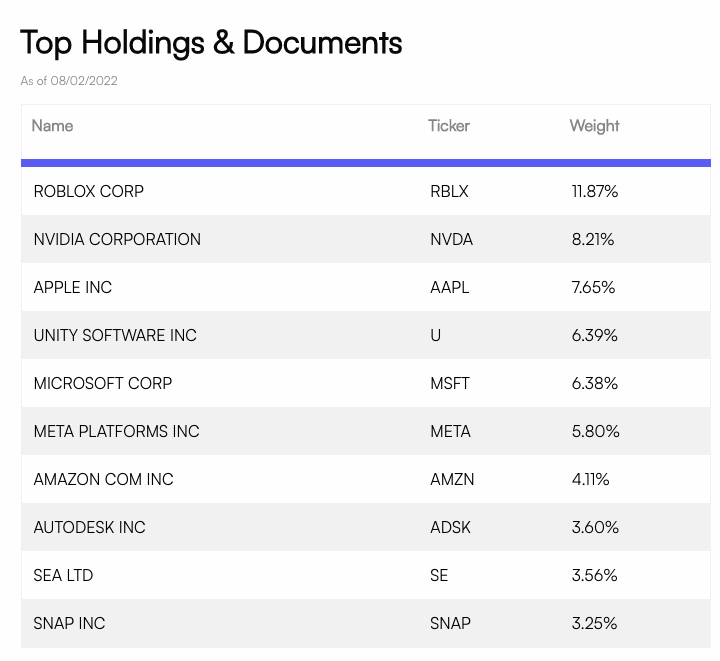

This argues that some of the companies that Ball discussed won’t even make the Metaverse jump. In the book, he analyzed Roblox, Meta, Unity, Snap, Nvidia, Apple. If I’m reading him correctly (and I believe I am) he thinks that some of these current leaders won’t make it. Let’s compare it to the current top 10 holdings.

If the author thinks some of these companies won’t make it or that some of the winners are unknown to him, then why are they all represented in the top 10 positions of his fund? It just feels icky. Even if you think I’m wrong there, the fund has a long tail position in all 43 companies that vaguely resemble the Metaverse. Nike? Bentley? Planet Labs (a satellite imaging company)? Why not? Maybe the thinking is that the Metaverse will be so big that it doesn’t really matter the portfolio weight, just make sure to have exposure? The contrast between the book’s arguments and the investing strategy is pretty stark.

I know this reads harshly, and honestly, it’s meant to. The intellectual and ethical bar has to be higher for capital allocators. I believe that someone giving you their money is a semi-sacred trust. We have to hold investors to a more rigorous standard then that of people who just write a hypothesis.

I have further disagreements with Ball’s position beside the ethically dubious nature of the ETF.

Meh 2

Frankly, I just flat out think his definition of the Metaverse is wrong. I disagree with the central crux of his argument, that the Metaverse will be a 3D environment. The hardware we use, either VR headset for smartphone, does have important implications. However, I agree with Shaan Puri: the Metaverse is about assignment of value, not form factor.

If the Metaverse is “when our digital life is worth more to us than our physical life” what does that actually look like? It is a world where we sacrifice in-person interactions for online ones. It is one where we rather spend our dollars on digital comforts, rather than physical necessities. It is one where our online username is more important than the one on our driver’s license.

I would argue that the Metaverse is already here but isn’t evenly distributed.

Picture a software engineer, who works remote, only hangs with friends via Call of Duty, orders their food through Doordash, and Facetimes their parents back home. Would their life be that different if some of those interfaces were 3D? The only thing I can imagine is maybe higher enjoyment of that already existing screen time. Sure it might be easier if they had a “continuity of data, such as identity, history, entitlements, objects, communications, and payments” as Ball said. But it wouldn’t materially affect their online usage patterns.

Nielsen data currently pegs the average American as spending roughly 12 hours a day in front of screens. Note: I have some doubts on this data but it feels directionally accurate that we are rapidly approaching peak screen. There isn’t all that much time left to devote to screens! Moving to 3D, and all the technology jumps that need to be made for that to occur, are not necessary for us to become more online. I think the Metaverse is measured by the percentage of people that live online, not the percentage of people who live online in a 3D format.

Ball’s book is interesting to read on two factors. First, this is a strong, well-reasoned opinion (that I coincidentally don't agree with). Second, the book is a strong, well-reasoned opinion that all the most powerful tech CEOs in the world do agree with. The book is endorsed by the CEO of Unity (6.39% of Ball’s ETF), the CEO of Microsoft Gaming (6.3% of ETF), CEO of Sony (2.15% of ETF), CEO of Electronic Arts (1.31% of ETF), and I’ve even heard through the grapevine that Zuck has read it too.

The writing is an encapsulation of the Metaverse meta-narrative that CEOs are using to justify tens of billions of dollars of spend. Whether it is real or not isn’t what matters to these executives, it's that they are deploying capital like it is. My guess is that most of these companies are just tired of the current internet paradigm. They are sick of paying of the Apple tax, of having to work on someone’s else's rules. These CEOs are trying to rush the Ballverse because if it happens the way he says it does, there is an enormous amount of money up for grabs. For that alone, you should probably understand what the book argues.

If you are interested in a stock that is betting the farm on the Metaverse, I’ll have an analysis of Unity coming out next week for paid subscribers. Click the button below to get it in your inbox.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!

I think the line colors of the second chart are wrong. Blue and red should be swapped.