TL;DR

There are four problems with financial information:

- Financial information no longer accounts for stock price fluctuations.

- It’s not valuable even when it does come out because other information (analyst recommendations, non accounting reports) has larger impacts on share price.

- Even ignoring capital markets effects, past earnings growth doesn’t predict future earnings growth.

- Analyst price estimates are dispersing, implying that information quality is decreasing.

The main cause is intangible assets. We have shifted from an industrial economy to an information economy, yet the investments in information assets aren’t recognized in financial statements. They are expensed instead of capitalized. It’s beneficial for investors to change accounting to capitalize intangible assets, but incentives for corporate managers and auditors make it unlikely to change.

The implication for investors? Legacy financial metrics should play a lesser role in analyzing businesses. Instead, use many quantitative and qualitative analytical methods and study how top performers have succeeded.

On December 31 2010, Amazon stock (NASDAQ:AMZN) closed at $180.00. It implied a market cap of almost $81 billion. They reported over $1.15 billion in net earnings for the year and traded at a 72.1 P/E multiple.

In the subsequent years, Amazon’s P/E ratio would fluctuate between well below zero to over 3,000. Anyone familiar with the story is aware that Amazon purposefully keeps earnings low, partially for tax reasons and partially to pass savings back to customers through lower prices.

But what if you had tried to trade their stock on the P/E ratio?

At times, like at the end of 2010, Amazon was expensive for an online retailer. Perhaps you, as a savvy investor, would assume the stock is too expensive and decide to pass on it.

At other times, it just didn’t make sense. The P/E ratio was useless when it came to analyzing Amazon.

And despite earnings metrics being meaningless, Amazon was one of the best performing stocks of the past decade, returning over 1,000%. If you relied on this information, you would’ve missed out.

The Amazon situation highlights a bigger issue with accounting: financial statements aren’t useful anymore. The best businesses in the world have built their wealth on intangible assets. And half the time accountants don’t recognize they even exist.

In this article I summarize and build upon The End of Accounting by Baruch Lev and Feng Gu, a book about the decreasing value of financial statements for investors. It’s never been more relevant as we continue to see high-multiple companies outperform over and over. Let’s get into it.

Problem #1: Financial Metrics Don’t Influence Stock Price

The first point The End of Accounting makes is on the deterioration of the predictability of financial information on market prices. Financial statements (and accounting) are no longer serving their original purpose: to inform investors of the operations of a business.

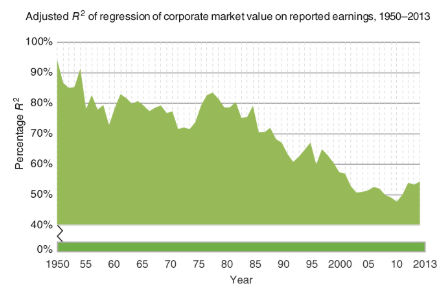

The first thing they analyze is the effect that reported earnings has on market value. As you can see, the impact has moved from highly predictive (80-90% R squared in the 1950s) to loosely predictive (45-55% R squared in the 2010s).

As a reminder, an R squared of 100% means that a change in the independent variable perfectly predicts the response in the dependent variable. So in this case, 60 years ago a change in earnings would account for 80-90% of the change in market value where in the early 2010s it only accounted for 45-55%.

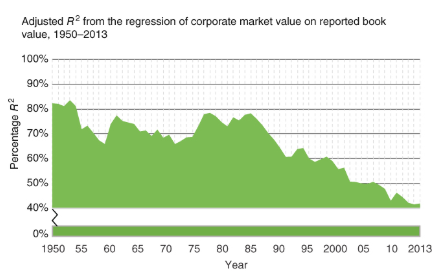

Reported earnings isn’t the only financial metrics that follows this pattern. Here we see the impact of reported book value on market value.

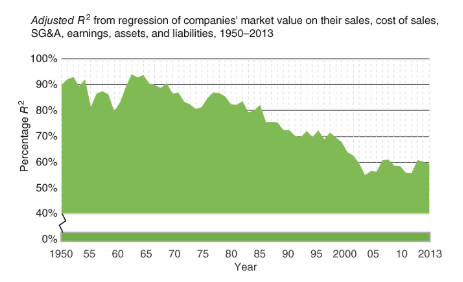

And then a multivariate model that compares sales, cost of sales, SG&A, earnings, assets and liabilities to market value.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

.08.31_AM.png)

Comments

Don't have an account? Sign up!