Sponsored By: Flatfile

Today's newsletter is brought to you by Flatfile, the customer data onboarding platform.

Clients can’t use your application without being able to populate their data, causing the CSV import problem to present itself at the most inopportune time—during onboarding.

Slash time-to-value, onboard customers faster, and cut product churn with a 1-click data import experience from Flatfile:

- Cut hours off data cleaning and focus on growing your company.

- Import customer data in less than 60 seconds.

- Migrate data using stringent compliance standards

Since launching in 2018, Flatfile has onboarded data for over 1.5 million customers spanning 400+ of the best companies around the world. In just a few clicks, Flatfile intelligently imports, transforms, and validates your customers’ data, solving the most critical part of onboarding, in seconds.

TL;DR Because 99% of creator revenue accumulates at the top .01% of creators, creator economy startups have to find a way to justify taking a % of revenue. This is not an easy task and only a select few will succeed in the coming bear market.

From 2020-2022, it was relatively easy to raise a seed round for your startup. All you had to do was cryptically tweet out the password, “I’m building something new in the creator economy,” and $5M would magically appear in your bank account. Even the A round would generally be that easy with crossover funds vomiting capital everywhere.

That was then, this is now. Interest rates are up! Digital monkeys now only sell for 100K instead of the millions they are worth! Founders are looking at 20x revenue multiples and shaking, crying, throwing up. Venture capitalists are learning what the phrase “cash flow” means. It’s terrible out there! I’m being more than a smidge facetious, but in all seriousness: private market capital is going to be in short supply for sometime.

My friends, a creator economy winter is coming. The result will be a thinning of the creator economy herd. In the short run, many of the buzzier startups will fold. In the long-term, the gritty teams will pull through this period with superlative companies serving this emerging class of digital entrepreneurs. The difference between the two will come down to how well these startups are able to answer one question: what are you doing to earn revenue share?

In researching this piece, I’ve talked with dozens of management teams, over a hundred creators, and the most prominent investors in the creator space. Thanks to all those who were so generous with their time..

Now, to business: to understand why revenue share is so important, we must go in depth of what creators are like as customers.

Small customers, smaller wallets

The good news for the creator economy is that there is a strong positive tailwind. More and more individuals are pursuing a life of creativity online. A report from Linktree pegs the total number of creators at ~200M. Another report by Kajabi puts it at 50M+. (Much of the difference is determined by how you determine the split between social media user and “creator”). Regardless, this is a huge number! And on an emotional level, there is something deeply satisfying about helping individuals build their own businesses and pursue their passions.

But as the space has developed past the initial craze in 2020, the negative aspects of the market have become more clear. Startups serving creators face multiple challenges around customer concentration, the importance of demand aggregation, and the low earnings of the creator middle class.

99% of creators won’t generate meaningful revenue: In constructing a venture capital portfolio, even for the very best investors in the world, only 3ish of every 20 companies will have truly stellar outcomes. This is considered a highly risky asset class. In contrast, over 90% of the gains accumulate with the top .01% of creators. Put another way, trying to invest in an early-stage creator will have something like 10x the risk of a typical early-stage startup risk. Note: Yes, there is more nuance to funding creators, but you get the general idea. This sector is riskyyyyyy.

We can look to Twitch as an example of what this looks like in practice. In a hack in Oct 2021, Twitch’s creators' earnings were leaked onto the internet. The results were shocking:

- 50% of revenue was made by the top 1% of streamers

- 75% of accounts that are making money made less than 120 dollars this year

- 896,261 accounts made no money at all

- Only 0.06% received over the U.S. median household income of $67,521.

- A quarter of all revenue was earned by the top 1,000 accounts.

Twitch’s results are not unique. I’ve found similar dynamics play out in writing (Subtack), adult entertainment (Onlyfans), video (Youtube), etc. In my entire career, I’ve never seen a power-law effect as extreme as in content creation. If a company is looking to capture the top end of the market, it will be looking for a needle in a haystack.

You can’t offer what creators want most (demand aggregation): In my own experience as a creator, and in my discussions with over 100 creators in the past year, every creator has had the same desire: more fans. The hunt for new fans is the most challenging and draining aspect of the work. When a creator embarks on their new career, they don’t typically envision days filled with marketing. They want to make stuff! Not convince people to like their stuff.

Unfortunately, the reality is that a significant portion of creators’ labor is in finding and converting new fans. Any platform that can funnel new fans towards a creator has an immediate advantage over any other tool. And, conversely, if the most important thing to a creator is demand aggregation, then all other tools come secondary. A startup can’t just offer software to help a creator and think they will win.

Sponsored By: Flatfile

Today's newsletter is brought to you by Flatfile, the customer data onboarding platform.

Clients can’t use your application without being able to populate their data, causing the CSV import problem to present itself at the most inopportune time—during onboarding.

Slash time-to-value, onboard customers faster, and cut product churn with a 1-click data import experience from Flatfile:

- Cut hours off data cleaning and focus on growing your company.

- Import customer data in less than 60 seconds.

- Migrate data using stringent compliance standards

Since launching in 2018, Flatfile has onboarded data for over 1.5 million customers spanning 400+ of the best companies around the world. In just a few clicks, Flatfile intelligently imports, transforms, and validates your customers’ data, solving the most critical part of onboarding, in seconds.

TL;DR Because 99% of creator revenue accumulates at the top .01% of creators, creator economy startups have to find a way to justify taking a % of revenue. This is not an easy task and only a select few will succeed in the coming bear market.

From 2020-2022, it was relatively easy to raise a seed round for your startup. All you had to do was cryptically tweet out the password, “I’m building something new in the creator economy,” and $5M would magically appear in your bank account. Even the A round would generally be that easy with crossover funds vomiting capital everywhere.

That was then, this is now. Interest rates are up! Digital monkeys now only sell for 100K instead of the millions they are worth! Founders are looking at 20x revenue multiples and shaking, crying, throwing up. Venture capitalists are learning what the phrase “cash flow” means. It’s terrible out there! I’m being more than a smidge facetious, but in all seriousness: private market capital is going to be in short supply for sometime.

My friends, a creator economy winter is coming. The result will be a thinning of the creator economy herd. In the short run, many of the buzzier startups will fold. In the long-term, the gritty teams will pull through this period with superlative companies serving this emerging class of digital entrepreneurs. The difference between the two will come down to how well these startups are able to answer one question: what are you doing to earn revenue share?

In researching this piece, I’ve talked with dozens of management teams, over a hundred creators, and the most prominent investors in the creator space. Thanks to all those who were so generous with their time..

Now, to business: to understand why revenue share is so important, we must go in depth of what creators are like as customers.

Small customers, smaller wallets

The good news for the creator economy is that there is a strong positive tailwind. More and more individuals are pursuing a life of creativity online. A report from Linktree pegs the total number of creators at ~200M. Another report by Kajabi puts it at 50M+. (Much of the difference is determined by how you determine the split between social media user and “creator”). Regardless, this is a huge number! And on an emotional level, there is something deeply satisfying about helping individuals build their own businesses and pursue their passions.

But as the space has developed past the initial craze in 2020, the negative aspects of the market have become more clear. Startups serving creators face multiple challenges around customer concentration, the importance of demand aggregation, and the low earnings of the creator middle class.

99% of creators won’t generate meaningful revenue: In constructing a venture capital portfolio, even for the very best investors in the world, only 3ish of every 20 companies will have truly stellar outcomes. This is considered a highly risky asset class. In contrast, over 90% of the gains accumulate with the top .01% of creators. Put another way, trying to invest in an early-stage creator will have something like 10x the risk of a typical early-stage startup risk. Note: Yes, there is more nuance to funding creators, but you get the general idea. This sector is riskyyyyyy.

We can look to Twitch as an example of what this looks like in practice. In a hack in Oct 2021, Twitch’s creators' earnings were leaked onto the internet. The results were shocking:

- 50% of revenue was made by the top 1% of streamers

- 75% of accounts that are making money made less than 120 dollars this year

- 896,261 accounts made no money at all

- Only 0.06% received over the U.S. median household income of $67,521.

- A quarter of all revenue was earned by the top 1,000 accounts.

Twitch’s results are not unique. I’ve found similar dynamics play out in writing (Subtack), adult entertainment (Onlyfans), video (Youtube), etc. In my entire career, I’ve never seen a power-law effect as extreme as in content creation. If a company is looking to capture the top end of the market, it will be looking for a needle in a haystack.

You can’t offer what creators want most (demand aggregation): In my own experience as a creator, and in my discussions with over 100 creators in the past year, every creator has had the same desire: more fans. The hunt for new fans is the most challenging and draining aspect of the work. When a creator embarks on their new career, they don’t typically envision days filled with marketing. They want to make stuff! Not convince people to like their stuff.

Unfortunately, the reality is that a significant portion of creators’ labor is in finding and converting new fans. Any platform that can funnel new fans towards a creator has an immediate advantage over any other tool. And, conversely, if the most important thing to a creator is demand aggregation, then all other tools come secondary. A startup can’t just offer software to help a creator and think they will win.

The only companies with robust consumer demand aggregation efforts are the social giants. Youtube’s recommendation algorithms, Twitter’s trending topics, and Facebook’s recommended pages are the most powerful agents in Hollywood. They dictate who wins or dies in the cutthroat market of content. Organic discovery still occurs and fans can be incentivized to share content, but the most effective way to grow a creator business is to use a platform like Twitter to grow a large, free audience and then convert said audience into the product of choice. For a creator economy startup to offer similar capabilities, they would have to build a whole social media platform themselves. If you have a way to disrupt Facebook, you should probably just build that and become a bajillionare.

Zero to One, Peter Thiel’s canonical book on startups, says:

“As a good rule of thumb, proprietary technology must be at least 10 times better than its closest substitute in some important dimension to lead to a real monopolistic advantage. Anything less than an order of magnitude better will probably be perceived as a marginal improvement and will be hard to sell, especially in an already crowded market.” Emphasis Added

In order for creator economy startups to break existing platforms’ stranglehold over audience acquisition, they would have to build something 10x better—and that’s really, really hard to do!

To make the role of creator economy startup even more challenging, many social platforms are starting to build out a more robust sweet of creator tools. Platforms like Facebook are taking the sector seriously, offering enhanced profiles and new monetization options. Twitter has acquired a direct Substack competitor. These may not be as good as specialized software a startup can provide, but creators will forgive a ton if the platforms funnel them new fans.

Low Earnings and High Price Sensitivity: In a perfect world, a customer would have an unlimited budget and no price sensitivity. Creators are the exact opposite. Especially for the 99% long tail, every dollar is precious. According to the same Linktree survey I mentioned earlier, only 12% of full-time creators are making more than $50,000 per year, and 46% of the same cohort makes less than $1,000 a year. Even more brutally, 66% see this as a side-hustle. There just aren’t that many dollars per average user to go around for technology providers. You are stuck charging prices closer to Spotify’s then Salesforce’s.

When you mix all of these factors together you get two distinct customer profiles within the creator economy:

- Power Creator (1%) : Someone making north of $70K per year from their content. Can be a solo operation, or can have a team around them. They will likely be multi-platform with various levers of distribution and different products for monetization. Can scale all the way to earning millions of dollars with just them or a small team.

- Long-tail hobbyist (99%): The other 99% of the world’s creators, who make very little and don’t have much cash to spend.

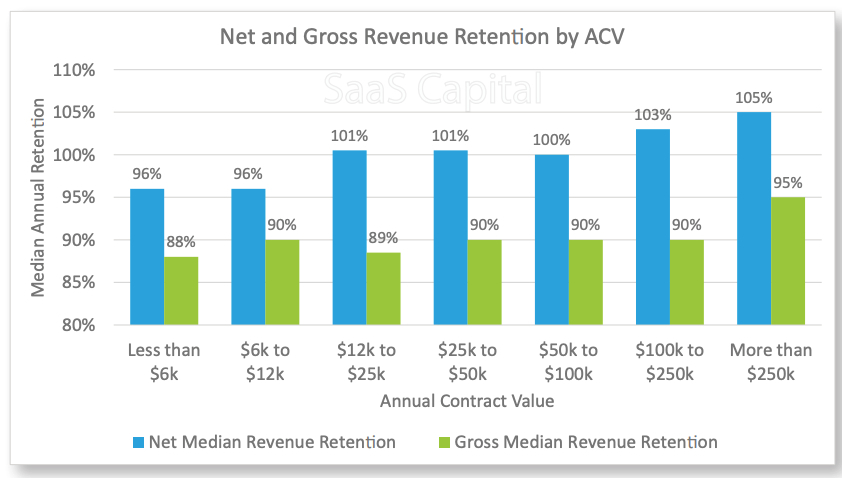

So we have these two creator types with vastly different average contract values for creator economy startups to target. But regardless of who you are targeting, you can’t build a traditional SaaS business because of the low annual contract value (ACV). In most charts, the ACV of a creator economy tool wouldn’t even register on the list.

Because creator earnings are so low, and their price sensitivity is so high, creator economy tools are only going to be able to charge consumer subscription prices. This ain’t great.

Money Modalities

Regardless of which cohort of creator a startup is serving, the interesting thing is that the creators make money with identical methods: ads and gated access.

Contrary to popular belief, ads are a beautiful thing! They allow content to be offered for free, increasing distribution for the creator. They also scale beautifully—whether you have 100 subscribers or a million, there is an ad product for you. Ads result in a virtuous flywheel where your content can have the maximum amount of distribution, drawing in new fans while simultaneously bringing in a healthy income.

That being said, there are a ton of downsides too. Ads can introduce perverse incentives to grow the top of the funnel at all costs even if they have negative externalities. (Looking at you Fox News.) Though to be fair, those same incentives are present in subscription models. Ad models are also painfully cyclical. When the boom times are roaring, ads are a great business to be in. When we are in a bear market? Say like right now? Not so much.

The best creators produce a generous amount of free content to grow their audience while simultaneously layering on higher-revenue products. Usually, these products are what I call “gated access.” By paywalling portions of their content, community, or courses, they can upsell existing fans, dramatically increasing their average revenue per user. Subscriptions also allow creators to monetize a smaller audience if their product is high value enough.

Still though, these numbers are small. A well-run ad-exclusive company will typically see roughly $10-$20 in annual revenue per user. On the subscription side, conversion rates at the very best content shops are somewhere between 5-10%.

All of these numbers change based on your audience, but they are useful as an illustration: this stuff is hard. The media industry has always been an absolutely ruthless place to build a company. Being a creator doesn’t change the industry forces, it only changes competitive positioning. The startups serving these creators must be hyper-aware that their customers are not as numerous as they would like, and will be unable to pay enough in subscription fees to build a traditional SaaS startup.

Earn the Right to Rev Share

On an average day in the stock market, the typical high-growth SaaS stocks trade at ~20x sales. If your goal is to build a $5B creator economy business, you’ll need ~$250M in ARR to make that happen. Again, no easy task when you are selling to the customers we have described above.

I’m not going to try to map out all of the potential software applications utilized by a creator, as the context is highly dependent on medium/size/etc. But in broad terms, a creator is an SMB media business. Anything that a small media shop would need, so would a creator. In this regard, a creator economy tool is no different than any other vertical SMB SaaS product. They’ll be subject to the same market dynamics: high churn, low average contract value, and smaller TAM.

10 years ago, that would have made the sector a non-starter for venture scale outcomes. Now though, the playbook is different. SMB SaaS has been proven to work, prominently by companies like Toast, because they can use payments to capture a percentage of revenue. Capturing a percentage of revenue allows the sector to not just be viable, but to be lucrative for creator economy startups. It frees startups from the constraint of subscriptions. It allows companies to serve the long tail of hobbyist creators and scale up with the power creators.

Currently, the company that is the best at using revenue share to its advantage is Youtube. They take 45% of the ad revenue for themselves and give the other 55% to the creator. While many creators feel this take rate is too high, it is actually the best in the business because the company performs a dual role of aggregation—aggregating both demand and advertiser supply. In other words: Youtube provides real, indispensable value to creators. Youtube’s power is so strong that on other platforms like Instagram and TikTok, creators will frequently try to port their audience from those other platforms to Youtube.

Within smaller startups, the current trend is to mix a variety of different software modules, sprinkle in some very mild demand aggregation, and then take a percentage of revenue. However, to survive the oncoming fundraising winter and to increase its runway, a creator economy startup needs to find a way to increase its take rate. This can happen is a variety of ways:

- Host spicer content: OnlyFans currently has a best-in-class 20% take rate. Because they are willing to take on a higher administrative burden by navigating banking regulations and content moderation, the majority of their revenue comes from adult entertainment. In a similar vein, Substack currently has anti-vax newsletters earning an estimated $2.5M on their platform with a 10% take rate. By being willing to take on riskier content, platforms unlock a kind of monopoly power that enables them to increase rev share.

- Target solopreneurs: No one starts their career as a creator and says, “Man, I just can’t wait to hire an accountant.” Even if you do absolutely nothing to help a creator to find customers, the more you handle administrative tasks, the more likely you are to succeed in asking for revenue share. There is a level of trust that comes with being the company that helps someone get started. One frequent comment I got when I asked Substack writers why they don’t just use a cheaper service: “They handle all the little stuff for me and I’ve been with them since the beginning.”

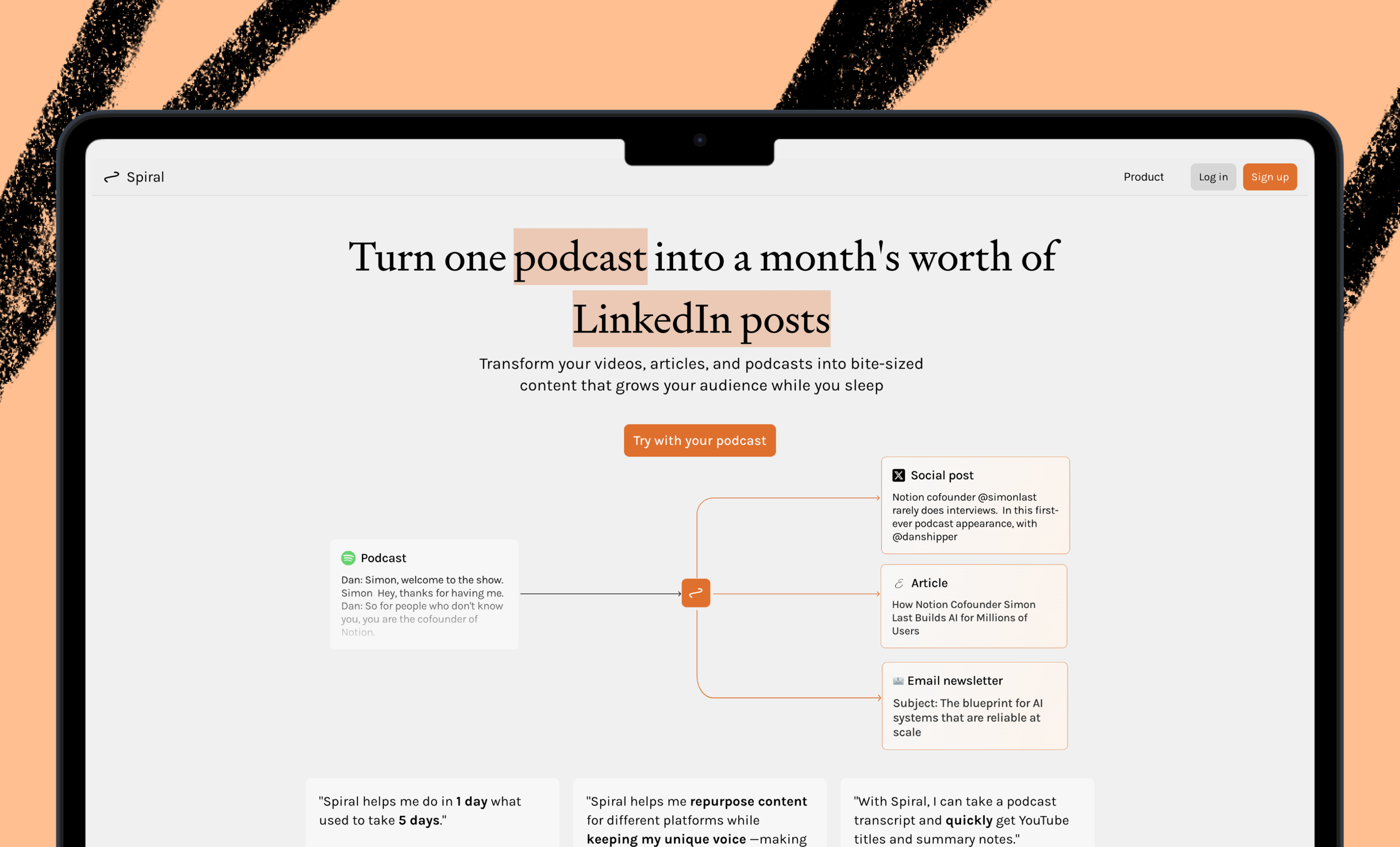

- Build a micro-SaaS attention wedge: Startups can find places to gather the creator’s fans, whether through a community platform, or through a Link-in-Bio tool, and charge a nominal fee. (Link-in-Bio companies can range from $75 ARR to community platforms charging $5K) Regardless, once they have gathered enough attention in these fan gathering points, the software acts as a monetization meta-layer in which other products can be sold. Whether that is merch, courses, or content subscriptions, creator startups can take a slice of that.

- Become a Creative Partner: One of the most interesting methods of gaining revenue share is becoming a creative partner. By helping creators create and sell their work, a company can capture significant portions of the revenue. One of the most prominent pioneers of this method was Creative Artists Agency in 1989 with packaging movies like Jurassic Park. Agents would help script writers think of ideas, pair them with directors and producers, and then sell these film packages to major studios. A more modern iteration is cohort-based-course platform Maven, which helps prospective instructors develop their courses all while demanding a percentage of revenue.

- Become a Financial Partner: The banking and financing needs of creators are incredibly unique. They’ll receive a flurry of 1099s, will need cash upfront for special projects, and struggle to get a mortgage. Because their finances are so unpredictable, traditional institutions and software tools are ill-suited to handle their needs. This problem is so mission-critical that creators are more willing to share revenue if you can solve it for them. There are a variety of takes on this problem with companies like Karat, Stir, and Spotter.

- Form an Ad Network: If the major social platforms have an exclusive hold on consumer demand, companies may have a crack at the other side of the equation by building up ad inventory for creators to tap into. Take rates for ads sold range from 5-30% depending on the medium and revenue volume. Startups like Pearpop are helping fulfill this need.

As a last ditch effort to scale, if a startup is unable to gain significant revenue share from creators, they can invert their vertical software serving creators exclusively towards a more horizontal platform serving businesses generally. Creator-led Growth (patent pending on this term) allows companies to leverage their software initially meant for creators into a broader use case. Startups like Circle started with a software product for creators but have since expanded to more traditional enterprises.

Conclusion

I do recognize that there is an element of doom and gloom at the start of this essay, but hopefully, this list of options saved it! I’m incredibly bullish on the creator economy. The wave of people leveraging the internet to fund their passions isn’t going anywhere. For the special companies that learn to be partners and not just rent extractors, there is a huge opportunity ahead.

To survive the creator economy winter a startup must scale their revenue with their customers such that they can properly serve the power creators. Otherwise, you are stuck being a micro-SMB SaaS, which just isn’t a good business model. But for those who do this right, revenue share can be used to build an incredible company while helping tens of thousands of people build their own digital media empire.

Ideas and Apps to

Thrive in the AI Age

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Ideas and Apps to

Thrive in the AI Age

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!