Last week I wrote about how tech is entering a downturn. Since then, things have only gotten worse.

Now, the main question on everybody’s mind is simple: why is this happening?

Lots of people will tell you there is an equally simple answer: “COVID stimulus and zero-interest rate policy caused the economy to overheat, global trade got screwed up and there was a semiconductor shortage, then to top it all off the war in Ukraine spiked the cost of oil and fertilizer, causing inflation to accelerate. So the Fed raised interest rates, which is triggering a correction, and possibly a recession. It’s hitting tech hardest because valuations were way beyond historical norms.”

Telling this story is an easy way to sound semi-smart. But as Richard Feynman once said, there’s a big difference between knowing the name of a thing and actually knowing that thing. So I decided now is a good time to write a comprehensive guide to what is going on. If you’re like me, you probably have roughly 100x more motivation to learn this sort of thing right now as you would on a normal week. Perhaps May 2022 is for learning macroeconomics as Feb 2022 was for learning about international relations in eastern Europe. This kind of motivation fades quickly, but what you learn doesn’t. So it’s good to take advantage now!

This is a fairly in-depth paid post written for anyone who is curious to learn about how the federal reserve system actually functions, and how their decisions end up affecting small tech startups. It includes diagrams of cause-and-effect relationships, and lots of explanatory detail. I go much longer and in much more detail than usual because A) it’s what my curiosity demanded, and B) I have a hunch there are many others like me in the same boat. Some of it may seem basic at first, but pay attention, because it quickly gets interesting.

I should also clarify that my goal here is to give an intuitive and entertaining version of mainstream economics’ narrative of how things work. It’s of course possible that the narrative is wrong. But I am not smart enough to judge, and even if it is wrong in some important way, it’s still important and useful to understand how most people think. So for today’s purposes I’m sticking to the fundamentals.

Basically, this is the guide I wish I could have read.

New! Corrections policy: I spent a lot of time researching this and I’m fairly confident in my conclusions, but there’s always a chance something here will be wrong. If you find a substantive mistake or omission (i.e. not just a misspelled word or a broken link), let me know and I will send out a correction with my next email, credit you, and I’ll pay you $50 if you’re the first to find the error. To keep me honest here, I want all submissions to come in publicly through Twitter rather than privately, so everyone can see what corrections others have submitted, with no gatekeeping on my part, and judge for themselves if they want to. Just mention @Every and include the hashtag “#EveryWasWrong”.

Ok let’s dive in.

What is an interest rate?

Say for example you want to do something that requires more money than you have—like buying a house or a car, or starting a business—you can go to people with money and promise to pay them back later. Of course there’s always a chance you might not, so those people will only tend to agree to loan you the cash if you agree to pay them a little extra. This “extra” is called interest. How much extra you agree to pay is the interest rate.

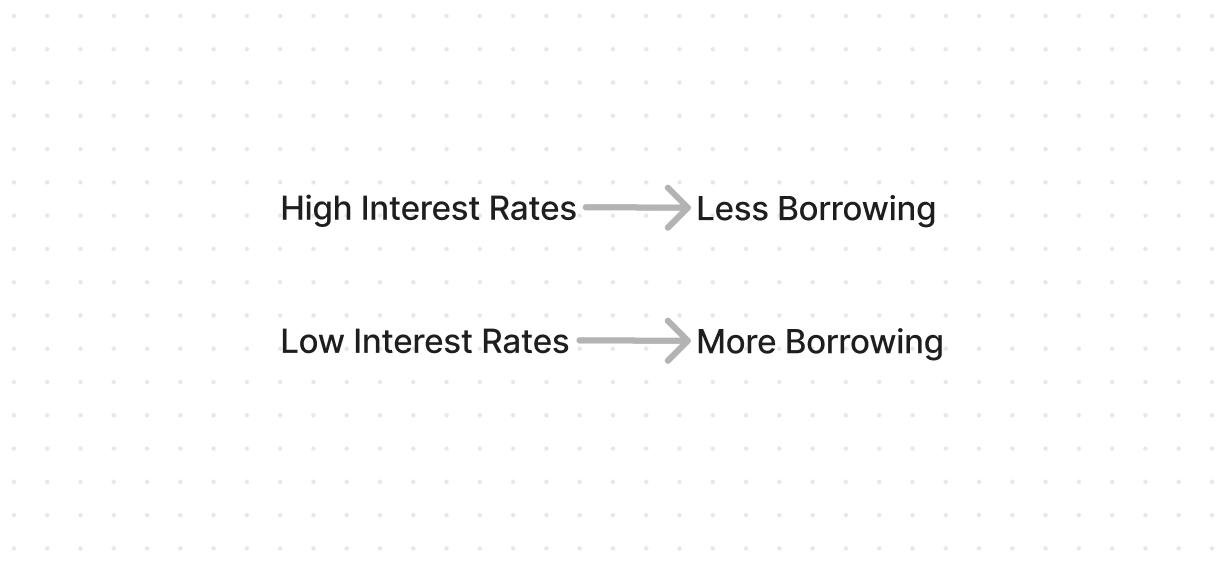

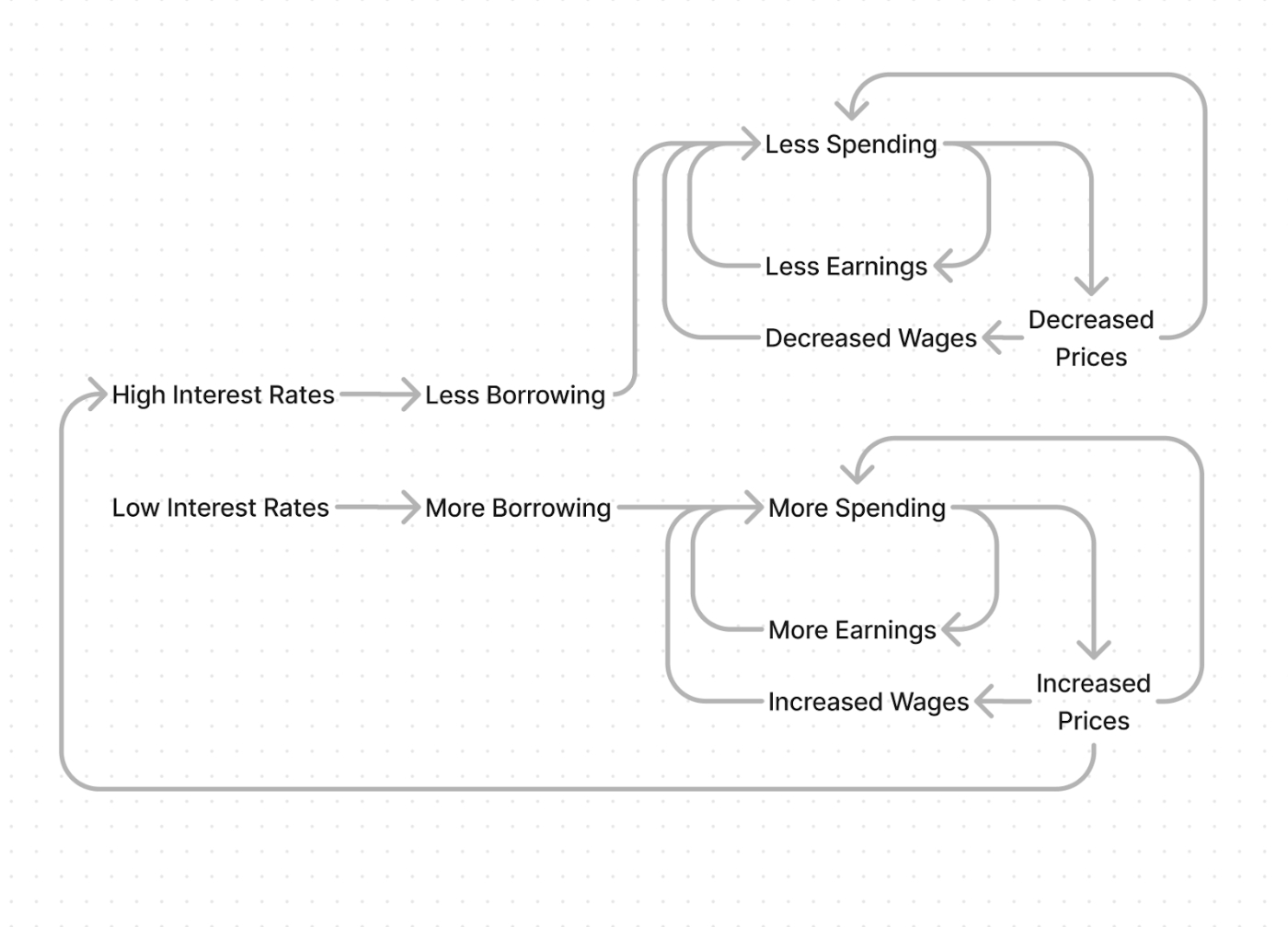

When lenders offer low interest rates, people tend to get a lot of ideas and borrow and spend a lot of money. But when interest rates are expensive, people only borrow money if they really need to.

This relationship between the price of borrowing and how much borrowing people actually do turns out to be quite important. It’s the main mechanism by which the Fed—the central bank responsible for curbing inflation—does its job.

Why does the Fed want to control interest rates?

Lots of people borrowing lots of money might sound like a bad thing—we often hear about how it’s risky to go into debt—but it actually can have a lot of positive effects.

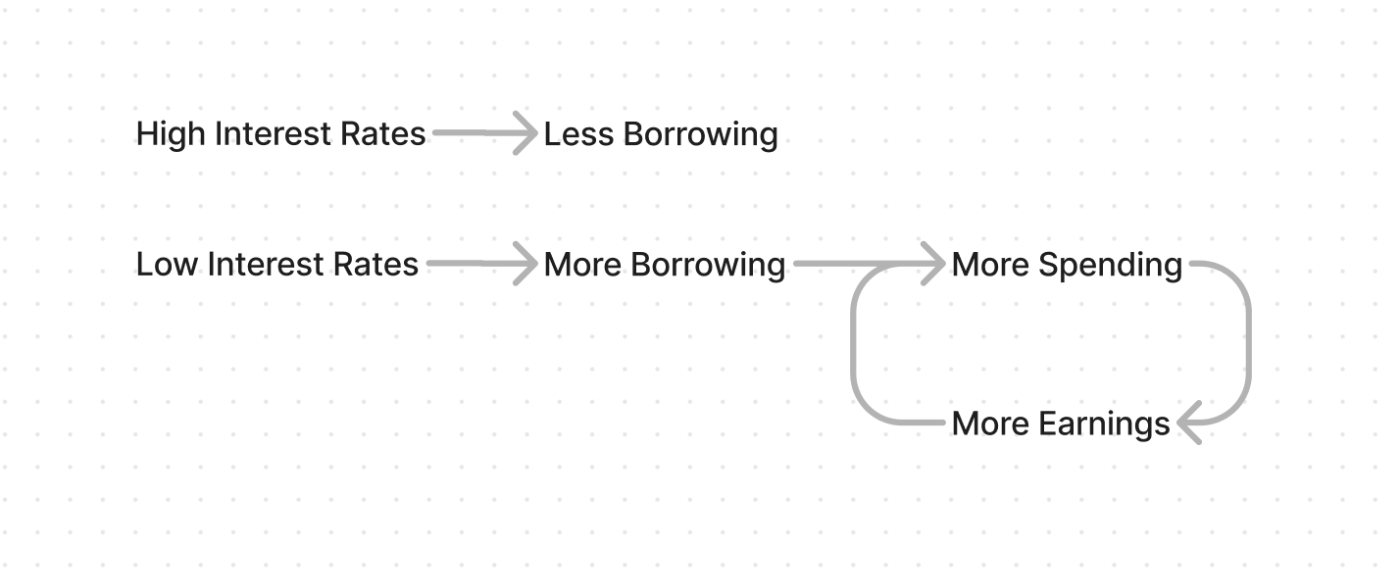

When people borrow money they usually have some specific purpose in mind: buy a home, start a business, go to college, buy a Peloton bike, etc. This means the money goes from the lender to the borrower to some other company selling something to the borrower. In other words, increased borrowing leads to increased spending. And increased spending leads to increased earnings and profits for businesses, which means they can re-invest in the business or pay profits out to owners. Both of these things cause the business to grow and become more valuable to shareholders. Also, in order to serve the increased demand the business may have to buy more raw materials, hire more workers, etc. This causes a chain reaction emanating from the original loan where more spending → more earnings → more spending.

This is good, but only up to a point: it is possible for the loop to run too fast. This is where people usually just say the economy is “overheating” as if it’s a car engine that literally mechanically degrades at high temperatures. That metaphor never satisfied me. What’s actually happening? What defines the point at which the loop above is running too fast?

The problems start when the world is not physically capable of supplying all the things people are willing to pay for. In the software and media business it’s easy to forget just how logistically challenging and time-consuming it is for most businesses to scale. Growth happens, but not instantly. There are also situations (like COVID) where normal supply is disrupted. This also contributes to inflation.

In this gap period where people are ready to pay for more than what’s available, macroeconomists would describe it as “aggregate demand exceeding aggregate supply”—in other words, the living embodiment of this meme:

Remember the great resignation and the supply chain crunch of 2021? It should start to make sense now.

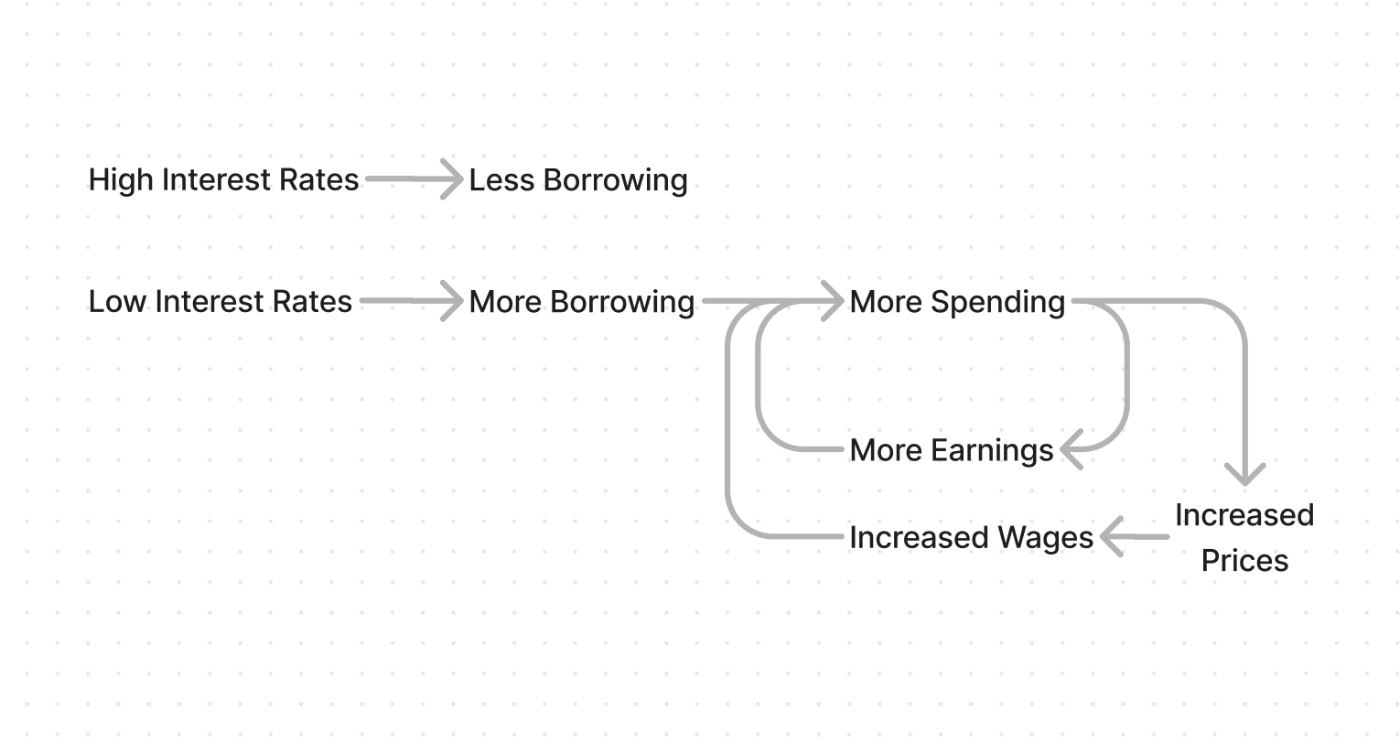

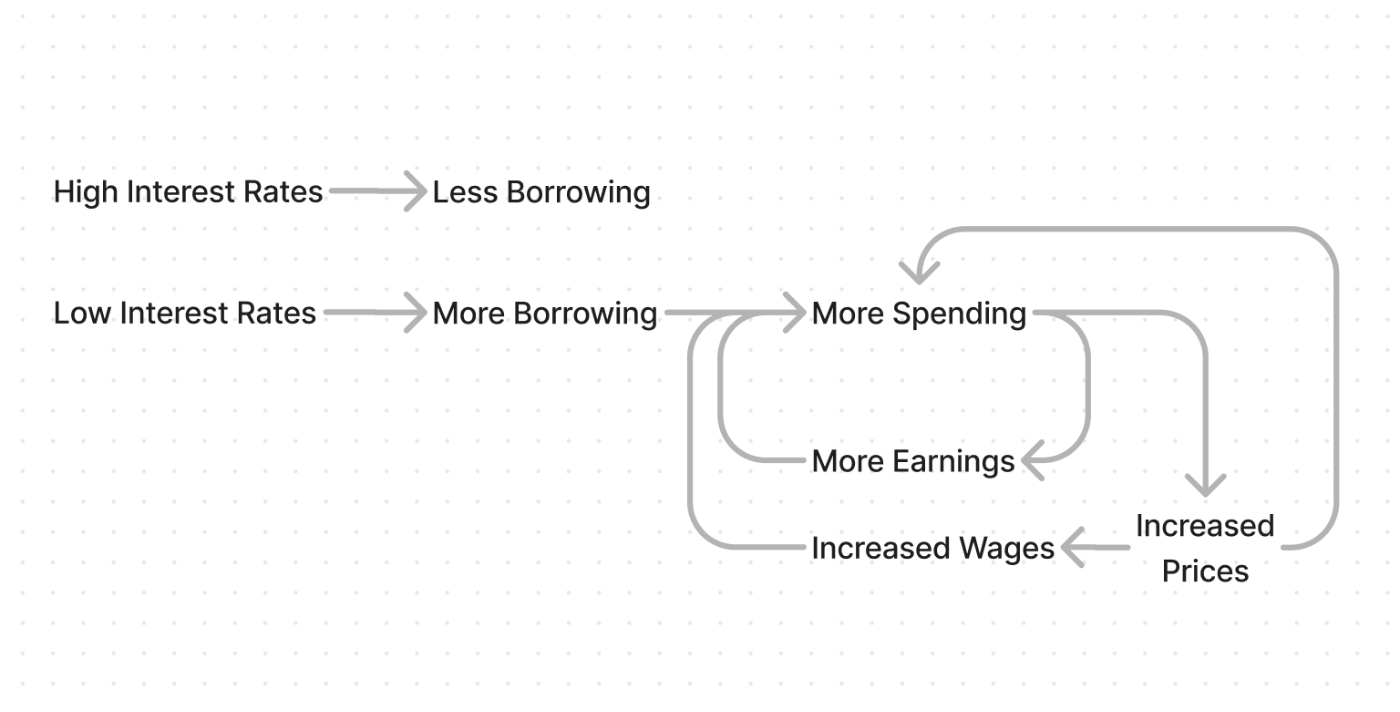

When supply fails to meet demand, most firms rationally raise their prices. It’s an easy way to make more money. But then to compensate for rising prices workers push for increased wages. Increased wages give prices room to further rise, and eventually it can spiral out of control, leading to inflation or even hyperinflation if allowed to fester.

This cycle accelerates once people realize it’s happening.

If people expect prices to rise, it creates an incentive to spend money today, because goods will be cheaper now than they will be later.

The faster this loop runs, the faster price increases start to accelerate, and the more likely it is that the Fed will step in and try to bring interest rates up, as well as other tricks up their sleeve, to combat inflation.

But before we go into how they do that, it’s worth asking…

Why is inflation bad?

I mean, think about it: companies grow, everyone has jobs, people are getting more of what they want, and the only problem is a bunch of arbitrary numbers going up? Who cares!

I mean, sure, it might be inconvenient if you carry paper bills, but most money is digital now so we won’t have to deal with people’s savings turning into wallpaper like they did back in Germany in the 1920s.

The question of why inflation is bad is actually more mysterious than it seems. A lot of the answers I found came back to the pain caused by the things the Fed usually does to bring inflation down (which we’ll get to in a minute). But that doesn’t tell us why the Fed does those things in the first place.

The answer, according to polymath economist Tyler Cowen, is actually deeply linked to the wallpaper problem: Inflation causes practical disruptions in everyday life. Yes, the numbers may be arbitrary, but society is built around the assumption that they only go up slowly. There are simply a lot of mishaps we’d run into if we lived in a world where the numbers kept going up quicker and quicker all the time—everything from the mundane (how to deal with signage, paper money, etc) to the complex (one example: companies may misinterpret inflation as increased real demand, causing them to wildly overinvest in growth).

Note: This is exactly what makes this topic so tricky—there is no universally agreed upon answer. This isn’t simply physics, where there are natural laws that determine the order of the world. Depending on what school of economics an analyst ascribes to they can have vastly different interpretations of the same data.

Another real problem is if prices are rising all the time (including your salary) then you have a persistent incentive to spend money faster, and not save very much of your salary. Perhaps this could be avoided by keeping money in ETFs and index funds, but this would be complicated and lots of people would screw it up. And even if you solve this, it assumes future wages rise just as fast as prices, which does not always happen in reality.

So basically we could, in theory, be fine with fast inflation. But it would be the societal equivalent of learning to juggle flaming bowling pins while riding a unicycle. If the pandemic taught us anything, it should be this: ain’t gonna happen.

So let’s avoid rapid inflation, k?

How does the Fed control inflation?

In a nutshell: they try to make the wage/price spiral spin in the opposite direction by raising interest rates.

A few things to immediately note:

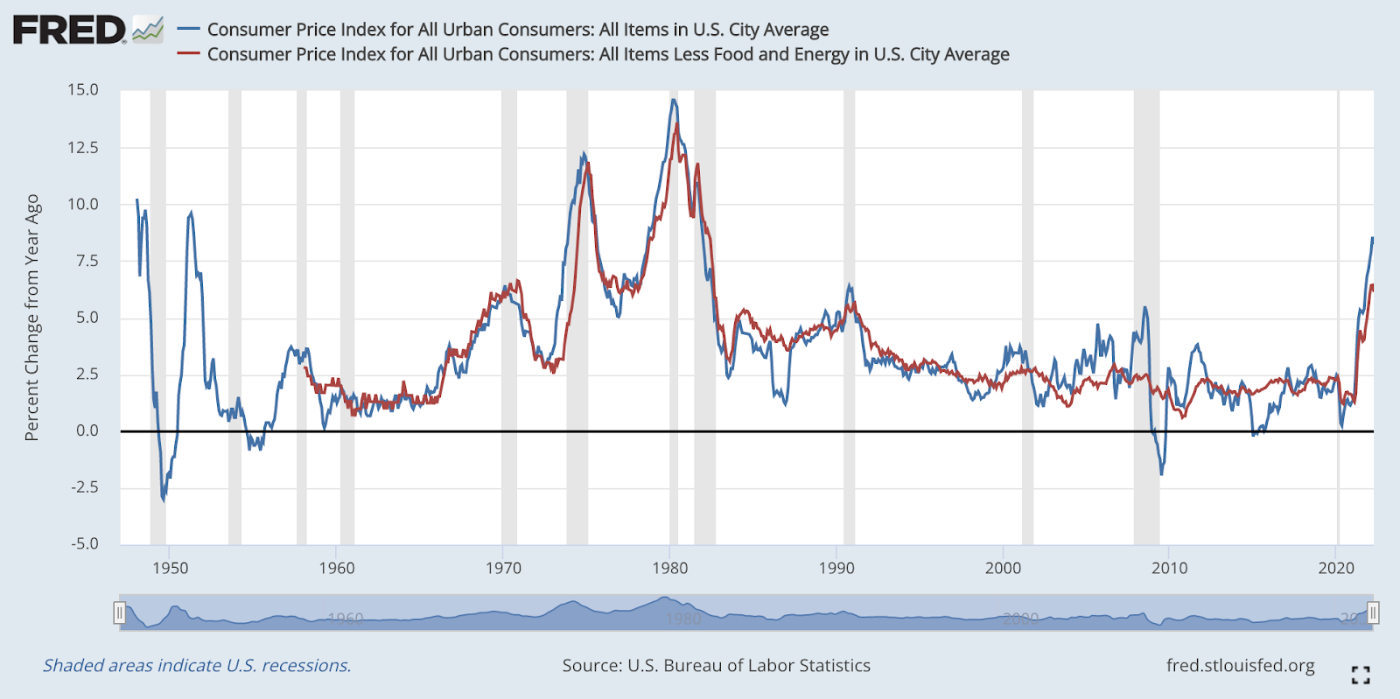

First, the spiral almost never truly spins backward, because that would be just too catastrophic and painful. People would lose jobs, wealth would be destroyed, everyone would riot and the government would be overthrown. The last time this really happened in the US was the Great Depression, where prices decreased an average of 7% per year between 1930 and 1933. Nobody wants that. These days the Fed tries to have the lightest possible touch, in order to merely slow inflation to levels that are more in touch with levels of real growth the world is physically capable of generating. The general accepted target is 2% year-over-year change in prices, and we’re currently sitting just above 8%.

Second, the Fed doesn’t directly control interest rates. They have a powerful influence over them, but it’s not like they set a mandated rate that all lenders must abide by.

In reality, they have three tools to influence interest rates. All three basically serve to reduce the amount of cash banks have on hand. When a thing becomes more scarce, it becomes more expensive to borrow it, so interest rates go up.

Here are the three ways the Fed does this. The first two are relatively unimportant compared to the third but I’m listing them all here so no one yells at me.

- Increase reserve requirements. The Fed can require banks to keep a certain amount of cash at one of the twelve regional federal reserve banks. If you have to keep your cash there, you can’t lend it. If you have less to lend, interest rates go up.

- Increase the discount rate. This is the interest rate the Fed charges banks to borrow money from it directly. Usually it’s higher than the rate they can get by borrowing from each other, so banks only use it when they’re in a bad situation. It’s more useful for speeding up the economy (by offering cheap loans) than slowing it down (because if Fed loans are expensive, banks can just go elsewhere).

- Open market operations. This is the most important category. The Fed can sell securities at a good price to banks, creating an incentive for them to trade in some of their cash. There are a bunch of complex ways this can happen, but the effect is the same: banks have less cash to lend, so interest rates go up.

Eight times a year, the Fed Open Market Committee meets and decides what they want interest rates to be, and buys or sells securities like Treasury Bills until they are within range. The specific interest rate they care about most is the Federal Funds Rate, which is what big banks charge each other to borrow reserve funds overnight.

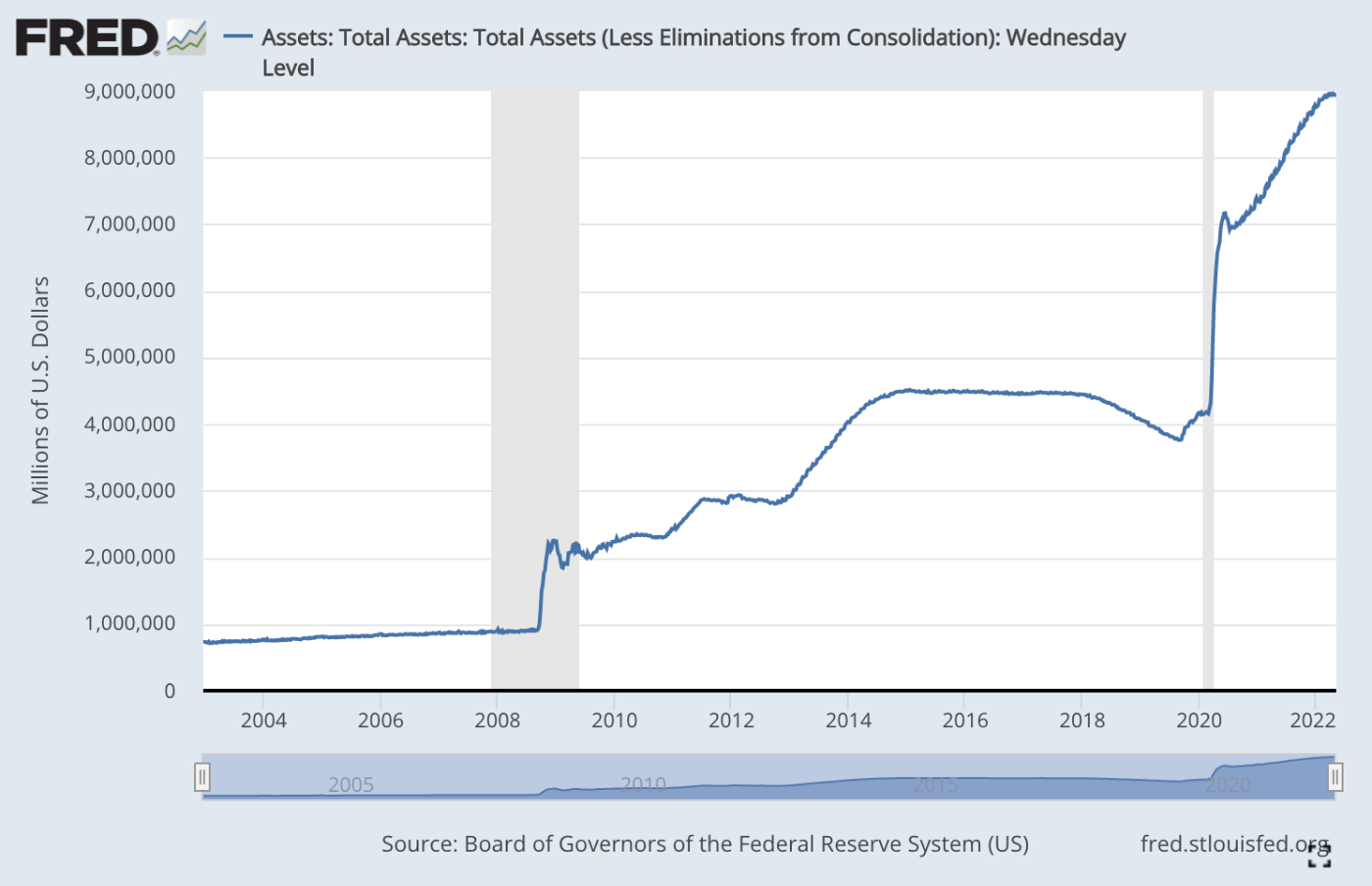

Since the 2008 recession, open market operations have taken on a much bigger role than just managing the Fed Funds Rate. Things got so bad that the rate was at 0% but the economy was still in crisis, so the Fed decided to just buy a bunch of securities and hold it on their balance sheet. For some reason they called this “quantitative easing.” They started to slowly sell this stuff off, then COVID hit and they started buying again to inject more cash into the economy. Now they are starting to sell again, which reduces cash available for lending.

Here’s a graph of the Fed’s balance sheet over time:

When people talk about the government “printing money” they’re really talking about this sort of open market operation. The Fed didn’t have to earn the cash they used to buy up securities when they wanted to heat up the economy—they got to create it out of thin air! This is extremely useful when it looks like the market is collapsing, they can be a buyer of last resort with unlimited funds. But if they go too far, it can result in inflation like we’re experiencing now. The problem is, this isn’t like engineering where it’s easy to know what effect we will see for a given input. The macro economy is complex and poorly understood. We can only judge if an action was “too much” or “not enough” in retrospect.

For now, let’s focus on what happens once the Fed is able to raise interest rates. What happens next?

How do interest rate increases affect stock prices?

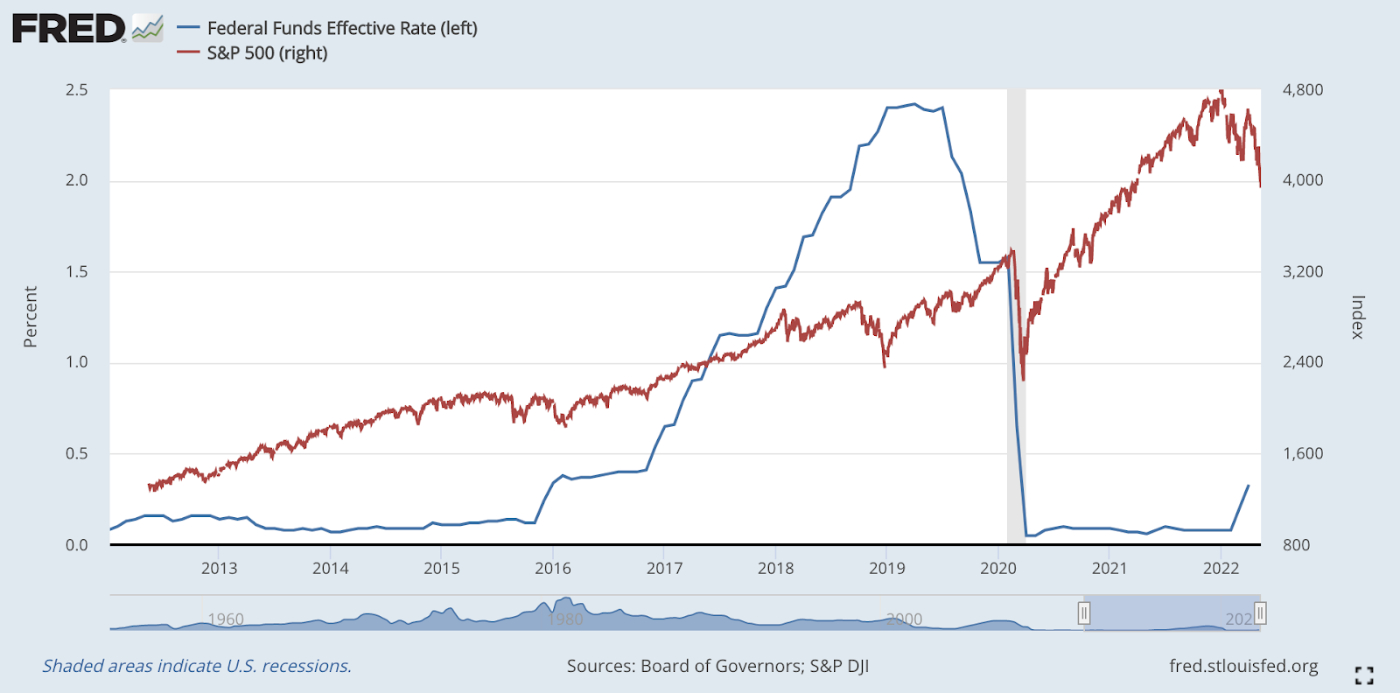

There’s a pretty tight relationship between interest rates and stock prices. Check out this graph of the S&P 500 vs the Fed Funds Rate going back 10 years:

A few interesting events to notice here:

- The market started to crash in 2018, then recovered once interest rates leveled out.

- Stock prices really started to heat up just before the COVID recession as interest rates started coming back down.

- When the pandemic hit, stock prices dropped and interest rates fell just as quickly down to zero. The Fed also started buying a lot of securities to flood the market with cash, as you can see in the previous graph, and the government also passed significant stimulus spending. All this led to an extremely sharp rise in stock prices.

- Once investors started to anticipate inflation and interest rate increases in late 2021, stock prices started to decline and have kept going down since then.

All of these suggest that rising interest rates hurt stocks and lowering interest rates help stocks. But the real world is not that simple. Just look at 2017. Interest rates were rising the whole time, but stocks kept going up for that whole year and most of 2018. Why? Perhaps it was the tax decreases, or maybe the fact that this was a historic growth era for big tech companies outweighed everything else. It’s hard to say for sure: this stuff is as complicated as it gets.

In theory, rising interest rates should be purely negative for stock prices, because it makes it more expensive for companies to borrow money, hurting their ability to expand. And it makes it more expensive for consumers to borrow money, which means they’ll spend less money, which means businesses will earn less revenue.

But obviously interest rates aren’t the only influence on the economy. There is another big reason tech stocks in particular flew so high over the past decade and are crashing now.

Why is tech hit harder than other industries?

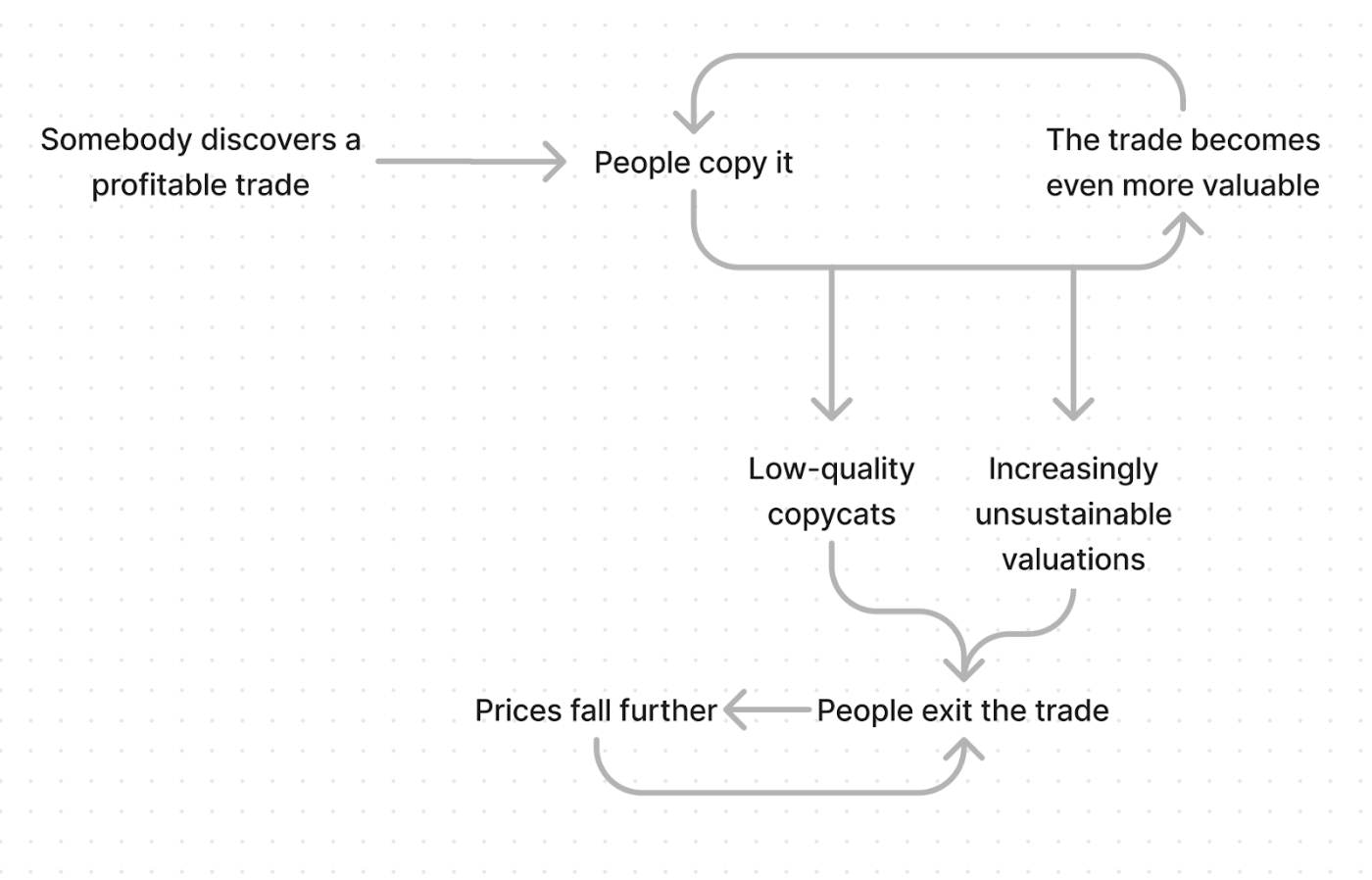

This appears to be a classic example of a business cycle:

When someone makes a lot of money, people tend to notice. And then they try to do the thing that person did.

This is why you see so many “Uber for X” and “Facebook for Y” type startups, it’s why $SHIB copied $DOGE, and $DOGE copied $BTC. It’s why everybody wants to be a VC. It’s why Every copied Substack, and why Substack copied Stratechery. Everybody copies.

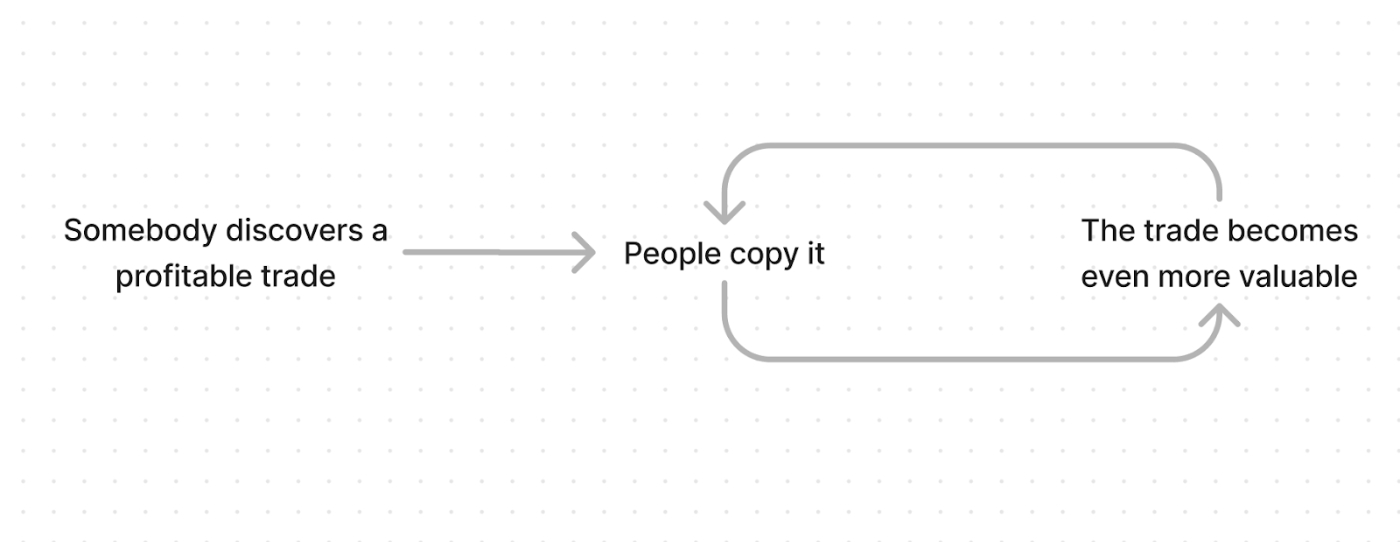

If the thing people are copying is a business model, then the copy tends to work less well than the original unless it has a unique twist that helps it scale. You can’t just exactly copy and expect it to pay off. But if the thing people are copying is buying a certain stock, or a certain type of stock, then the effect is almost the opposite: as more people pile in, the price goes up, making the originator even richer.

This is pretty much what happened with tech investing over the past 20 years. Every successful tech company increases the appetite for investors to plow money into the next set of prospects, which increases their chances of success. It’s been a steady increase in real value (and hype) since the dot-com bust.

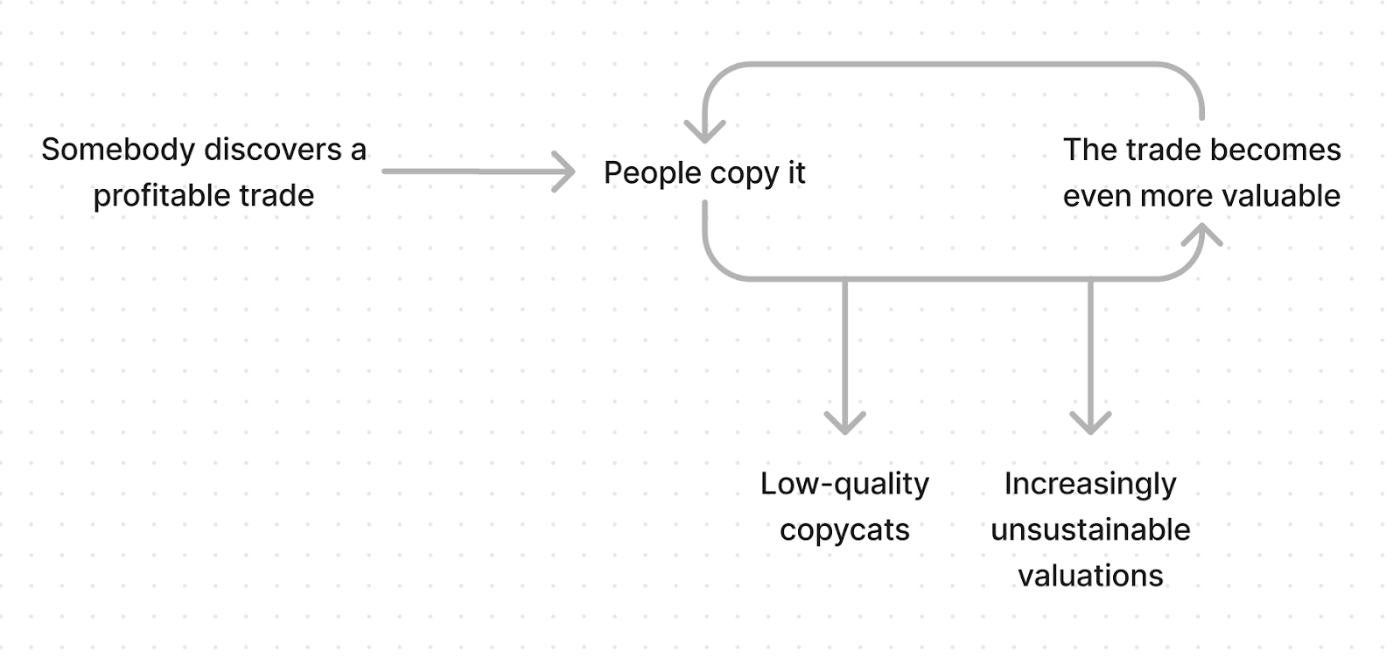

But at a certain point, the loop runs into external limits. Companies can only grow so fast, and there are only so many good companies that can be created. It’s quite similar to inflation, in the sense that fundamentals get left behind by the numbers, and there are too many dollars chasing too few investments.

Things can go on like this for a while, but eventually there is a shock to the system that triggers a correction. In this case, it’s a combination of factors. Rising interest rates is definitely part of it. But also tech valuations in particular have been sky high due to the loop in the diagram above, so when investors look at their portfolio and decide what to sell, tech stocks make an easy target. This is only amplified by the fact that revenue growth has been relatively weak in recent quarters compared to peak pandemic, when tech companies provided people’s sole connection to the world.

This leads to a cycle that runs in the opposite direction, where selling begets more selling:

It gets even worse when large players have taken on a lot of debt to trade with, because if the market goes down quickly they may be forced to sell stocks in order to pay off their debts, which causes stock prices to go down even faster, which forces more people to have to sell more stock, etc.

How does this affect crypto?

What tech is to the rest of the economy, crypto is to tech. It’s got everything: wildly increasing valuations, players trading with massive leverage, and it’s entering the end of a long bull run. The big difference is tokens are mostly unregulated right now so there’s a lot more risk in the system.

I won’t go into details about everything going on in crypto right now, but it’s not looking good. Long run, crypto may well end up being fine and an important part of society, but right now there is likely going to be more losses.

How does this affect startups?

Think of the startup ecosystem like a giant conveyor belt. On the one end, founders hop in with ideas. On the other end, giant public companies emerge.

There are many steps along the way where companies fall off the conveyor belt or get stuck. Most of the time this doesn’t reflect anything systemic, and it’s just about the strength of that individual company. But when there are major issues at the “public company” end of the conveyor belt, it eventually affects all the previous steps in the chain, because they’re all connected.

Imagine you’re a VC talking to a company that might go public in a few years about an investment. If this was the fall of 2021, you might look at similar companies and think “ok I can expect this company will probably be worth about that much when they go public,” so you’re willing to offer a price a bit lower than that.

Now imagine this conversation is happening today. The public companies you’re looking at are worth 50%, 60%, sometimes 80% less than they were mere months ago. This is obviously going to dramatically change what price you’re willing to pay. And if you’re not willing to pay as much, there’s somebody behind you who’s talking to younger companies and basing their price decisions on yours. So it cascades through the entire ecosystem.

Additionally, the people who give you money are starting to pull back for the same reasons you are. So now there is less money to give to startups, which puts investors in a relative position of power, which makes it harder for founders to negotiate higher valuations. Also, less money means less startups get funded, and the startups that do get funded may raise less money.

What’s the end game? Is there any hope?

So far the picture I am painting may sound a bit scary. And it’s true that corrections and recessions (whatever this ends up being) are painful. People get laid off, it becomes harder to find new jobs, retirement funds shrink. But don’t get too scared. Life will go on. Tech is deeply entrenched in our world. It’s not just hype anymore. Some of the most powerful and valuable businesses in the world are trading at deep discounts these days. This is not investment advice, but it would be highly unusual if the number did not go back up at some point.

Of course, a lot of things will go out of business or stay low forever. So be extremely careful about what you put your money into and don’t take excessive risk.

Also, nobody knows what black swan events may await us in the coming years. Trying to predict the exact course of the future is futile. What’s more important is to focus on becoming as resilient as possible, and exposing yourself to asymmetric upside when you can while limiting downside risk.

When things get turned upside down, there is also a lot of opportunity. Many of the greatest businesses of our generation were built through the last recession. I’d be shocked if something similar doesn’t happen now.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!

Good primer, for sure. While I knew most of this stuff in a summary fashion, it was helpful to read through. That said I'm a bit disappointed you did what most people writing and theorizing about economic theory do and more or less hand-wave away the concerns around inflation. I think it's worth interrogating those assumptions further. But I also think you could simply have provided some examples of what *has* happened with runaway inflation in other countries (aside from the minimal to wallpapering with money). What have been some of the worst examples of inflation in other countries and were their unique, specific, or otherwise mitigating circumstances that make those situations unlikely to happen in the US, or are we likely to be just as subject to those same end-game problems if we don't try to control inflation the way we do? This deserves further exploration, in my view. And obviously there is plenty of debate about it all, but I'd be curious your opinion on that topic, specifically. Of course it's all theoretical, the US model of this is not about to change, so if your goal is practical and to give some kind of advice, even if general, it may not be relevant to your aims.

Thanks again!