Hello! Welcome to Three Shorts, a recurring series where I unpack the strategy behind the news in as few bullet points as possible.

Enjoy!

Fast’s rumored $1b valuation — a hail mary 🙏

What happened?

- Last week, it was leaked that Fast, an online checkout company, is looking to raise $50–$200 million at a $1 billion valuation.

- Seven months ago, Stripe invested $20m at a valuation of $180m.

- Fast's goal is to compete with instant-pay products like Apple Pay, Google Pay, Amazon Pay, PayPal, and Shopify's Shop Pay with a solution that is platform agnostic, universal, and, uh, fast.

- It’s unclear what sort of transaction volume Fast is processing, but when asked what websites use Fast, their CEO tweeted a list that suggests adoption of Fast is likely limited to smaller brands.

Why? What’s the strategy?

- Why raise so much money at such a high valuation so early in the life of the company? My guess is Fast’s founders believe they need to, in order to overcome the massive chicken-and-egg problem their business is facing.

- Fast only saves consumers time if they’re already signed up. And consumers will only sign up if Fast is on a lot of merchant’s websites. This is a problem for Fast now, but if they can somehow reach escape velocity, the network effect becomes a huge advantage.

- Perhaps Fast is discussing raising an enormous sum of money in order to brute force a massive campaign designed to kick-start the network effect.

- Some investors (Softbank?) might entertain a $1b valuation despite extremely limited traction, because if it works, they think it’ll be worth much more. And if it doesn’t work, it’s ok, because this is a high-risk asset class anyway.

Will it work?

- If history is any guide, chicken-and-egg problems like these usually aren’t solved by brute force. Just look at Quibi and Magic Leap — they both spent tons of money developing a core platform and trying to attract creators and consumers, but failed.

- But then again, sometimes it does work! PayPal attracted 100k users in their first month by offering $20 for you to sign up, and another $20 if you referred a friend. In total they spent $60–$70 million on the campaign. Who knows where they’d be if they hadn’t.

- Another interesting example is TikTok — they spent nearly $1b on advertising in 2018 to acquire users to accelerate their network effect.

- So, will it work in Fast’s case? I don’t think so. Adding a new checkout method to your ecommerce website is a much higher stakes decision than signing up for PayPal. Their value proposition is dependent on scale, and I don’t think a huge advertising campaign or sales push would change that.

- Fast needs a better wedge, a product with more “single player” value for website owners.

McDonald’s new “McPlant” line — a power move 🌱💪

What happened?

- This week, after successful pilot programs in Canada, McDonald’s announced their new global line of plant-based beef and chicken products, which they’re branding “McPlant”.

- This follows successful moves by rivals like Burger King’s partnership with Impossible Foods, Dunkin Donuts’ partnership with Beyond Meat, which normalized plant-based offerings from fast food restaurants.

- Pizza Hut also announced this week their own plant-based sausage partnership with Beyond Meat.

- Unlike all these other partnerships, McDonald’s plant-based meats will not be co-branded with their supplier.

Why? What’s the strategy?

- The most interesting and important part of this move is that McDonald will not co-brand their products with “Beyond” or “Impossible” labelling.

- “McPlant” is a name they can own, which commoditizes their suppliers. It’s going to be much easier for McDonald’s to source from multiple providers and dial purchases up or down depending on price, rather than tying themselves to a single source.

- This follows the classic principle: commoditize your complement.

Will it work?

- The reason most of McDonald’s competitors (like Burger King, Dunkin, and Pizza Hut) decided to co-brand with Impossible and Beyond is because they thought the co-branding would help more consumers adopt and trust these new products.

- The basic trade-off here is between revenue and power. McDonald’s is sacrificing revenue for power.

- Had McDonald’s rolled this out two years ago, it’s less likely that most consumers would know the difference between modern plant-based meats and old-school veggie burgers.

- But now that McDonald’s competitors have done the work of educating the public, it’s possible for McDonald’s to enter the category without giving up brand equity to any particular supplier.

- So yes, it’ll work. In fact, it’s a power move.

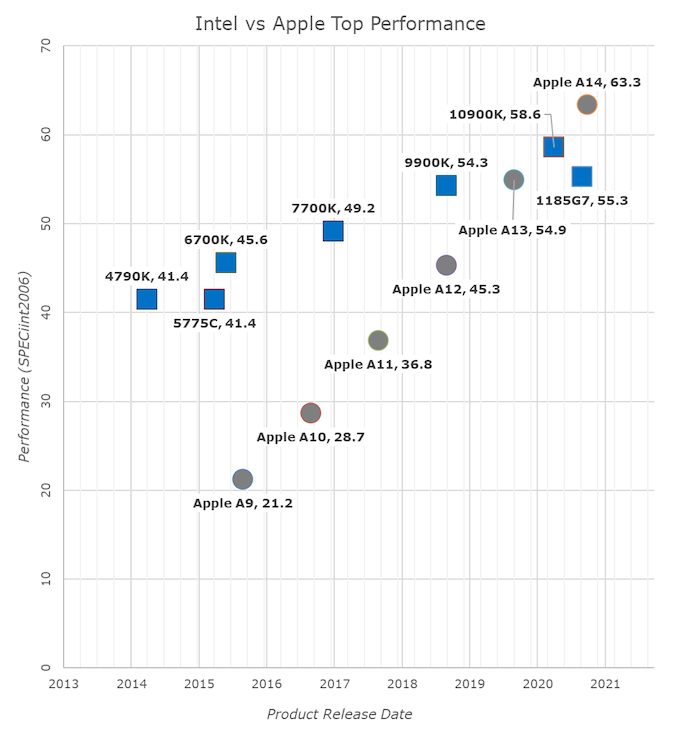

Apple’s M1 Macs — disruptive 📈

What happened?

- Yesterday Apple launched three new Macs with their in-house M1 chip.

- The M1 processor is based on the same ARM architecture that powers the iPhone and iPad, and is actually not just a CPU but is a SoC (system on chip), which combines CPU, GPU, memory, machine learning modules, and more to provide much more power-efficient performance.

- The first three Macs to receive some new interior decorating are the lower end of the lineup- the Macbook Air, the Mac Mini, and the 13” Macbook Pro.

Why? What’s the strategy?

- It’s simple — Apple wants to sell differentiated, high-end consumer laptops and desktops for a premium price.

- By leveraging their experience in mobile to develop a chip in-house, Apple gets two main benefits: 1) M1 and MacOS are optimized to work well together, and 2) unlike Intel chips, the M1 is exclusive to Apple.

- The reason Apple started the M1 with their lower-end computers is because chips based on ARM architecture, historically haven’t been powerful enough to work in laptops and desktops, and they’re working their way up towards the larger Macbook Pros, iMacs, and Mac Pros.

- This follows the classic “disruptive technology” pattern: start off with an orthogonal benefit (in this case battery life) and get a toehold in an environment where that matters most (mobile), but then improve performance until it eventually eats the original use-case.

Will it work?

- The smart take on Twitter, as far as I can tell, is that the M1 is a great first step in an incredibly promising long-term direction for Apple.

- Tony Fadell, the iPod inventor, says this will give the Mac “20+ years of life.”

- That being said, there is no guarantee that this transition will go smoothly from the beginning. Switching CPU architecture is a huge change, and it wouldn’t be surprising if there were quirks. Look for Apple to make mistakes and fix them quickly in the first year or two of production.

- In a case of vertical integration, it appears that though Apple will be able to lower its costs and reduce dependency on external partners even further.

This edition of Three Shorts was created by me, Nathan Baschez, with help from my friends Bryant Jefferson, Austin Langlinais, and Adam Keesling.

What’d you think of this article?

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!