NOTE: This information is not financial or tax advice; it's just general educational content and could be good to know. Even though he is employed by Compound Financial Inc., everything Adam Keesling writes in this article is not the official view of his employer. Please do your own research and make your own decisions, which is best done with the help of a professional advisor, and don't ever, for any reason, do anything to anyone for any reason ever, no matter what, no matter where, or who, or who you are with, or where you have been, for any reason whatsoever unless it is permitted.

If you were granted $100,000 worth of shares in Doordash ($DASH) on November 15, 2021, your shares as of June 1, 2022 are now worth $28,839.82 (-71.2%).

If you were granted $100,000 worth of shares in Robinhood ($HOOD) on November 15, 2021, your shares as of June 1, 2022 are now worth $26,802.06 (-73.2%).

If you were granted $100,000 worth of shares in Coinbase ($COIN) on November 15, 2021, your shares as of June 1, 2022 are now worth $19,872.02 (-80.1%).

If you were granted $100,000 worth of shares in a private technology company last year, well – what do you think your shares are worth now?

Unless your company is performing exceptionally well, chances are things could get rocky.

You, technology startup employee, are now faced with a choice. You can either exercise your options, stay at your current company, and build yourself out of this situation. Or, you can invest your money elsewhere, reconsider your current job and explore the market on your own.

In this article, we’re going to start by walking through a framework: should you exercise your options or not? Then we are going to use an example of a unicorn company (a startup valued at >$1.0B) to outline three scenarios of what startup employees can do with their options. We’ll walk through their situation and the actions they can take in the current market environment.

Exercise or not?

Is it even worth figuring out?

Before I get into a framework of how to decide, I want to take a step back and talk about time. Time? Yes time.

Time is your most scarce resource and you can spend your time in any way you want – you can spend it with friends, you can volunteer, you can spend it working out. You can also spend it reading business articles on the internet :).

Most people have to spend a lot of their time at a job to earn a living. Because of this, it’s worth making sure you’re at a job you’re excited about, utilizes your skillset, and fairly compensates you. So what about startups?

Now, if you want me to be completely honest, I don’t actually think working for a startup is good choice if you are optimizing your financial outcome. Not that startups pay poorly (let’s be real – they are pretty cushy compared to most jobs in the world) but in comparison to big tech, for example, there’s a lower financial “floor” and the “ceiling” is really, really unlikely.

But even with this view, I chose to get a job working at a startup.

So, Adam, why do you work at a job that you think isn’t a good financial decision?

I’m lucky to be able to work at a startup for reasons other than purely financial ones. I work at a startup because of the autonomy (I can’t stand bureaucracy), the exceptional people I work with and learn from, and the small chance of having a life-changing financial outcome. (Plus we are building some pretty sick products for tech employees).

I’ve heard similar stories from other people who work at startups. The choice to join a startup is usually for one or more of the following reasons:

- Mission or impact of the company

- People you are working with

- Chance at a large financial outcome

- Learning opportunities

- And many other reasons

Now, some people get the job choice right but screw up on the financial side. This is even more common at startups than in other kinds of companies because illiquid equity is such a large part of the compensation package and is often misunderstood. And it’s a shame because even though these people like their job, they aren’t rewarded in the way they thought they might be.

In many cases, people implicitly choose not to figure this stuff out. And listen – I don’t blame them. ISOs, NSOs, AMT, QSBS… it’s daunting. And much less fun than building products. Ultimately, it’s your choice if you want to put in the effort to learn about your equity.

But I’m here to reassure you that tax lawyers don’t actually rule the world (thank god). And if you do put in the effort to figure it out, it could be the most valuable investment you make. Often choosing to exercise your options sooner rather than later can save you hundreds of thousands or millions of dollars in taxes that you would’ve had to pay if you exercised them later.

So if you’re interested in being informed about your equity – what should you do?

Do I have liquidity?

When you join a startup, you are usually given equity options as part of your compensation package. Options are the right to purchase shares at a certain price (called the strike price) and exercising your options is when you use cash to purchase your options, turning them into shares.

So the first thing you need to figure out is if you even have the money to take action. If you don’t have any liquidity (assets like cash or public investments that can be easily turned into cash), then the choice is pretty easy: you shouldn’t exercise your options because you can’t.

It’s common for startup employees early in their career to have no liquidity and thus not have the ability to exercise their options. They just haven’t had the chance to save money yet.

One way to determine whether you have enough liquidity (besides simply looking at your checking account) is to save an emergency fund and then see if you have any remaining money after that. Typical emergency funds are 3-6 months of living expenses. So run the math, see if you have excess funds, and if you do, you can consider using them to exercise your options.

This is just one framework though – if you want to spend every last dime on exercising your options I can’t stop you. I will say that my compliance officer Ben requires me to say this is just educational and not investment advice so do your own research or whatever.

So now that you have a good sense of options, let’s dive into an example and discuss what to do specifically in a downturn.

Company example: Unicorn chops its horn

First – what’s a markdown?

A “markdown” is when a startup raises at a lower valuation than its last round. Markdowns occur for one or more of the following reasons:

- The company needs to raise capital and can’t find investment at a higher valuation

- The company has failed to hit milestones or meet investor expectations

- The market values the future cash flows of a company lower than before

Markdowns are most common in slowing market environments – if customers are purchasing less and the capital markets are tighter, it’s more likely that a startup will have to markdown their equity. It’s just worth less than before.

The scenario we are going to examine is a unicorn company that experiences a markdown. The example will be simplified but relatable. It’s simplified in that we are ignoring any unique equity terms. It’s relatable in that even if the company you are at is a few stages earlier or a few stages later, you’ll be able to connect the company’s characteristics to your situation.

Unicorn - founding days

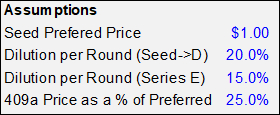

Unicorn was founded in 2017 and shortly thereafter raised a seed round. Because of their repeat founder and early traction, they raised a $5M round. This money funded the company as they built the right team and signed their early customers.

A year later, Unicorn decided to raise a Series A to accelerate their trajectory and give them a stronger chance of beating their competitors (the market was starting to notice that they were onto something). They raised a $15m Series A at a $75M valuation.

Unicorn becomes a Unicorn

The unicorn company continued to succeed—they raised a $40M Series B the following year. Around this time they started hiring executives to manage the slew of engineers, designers, and product managers that were now on the payroll. In addition to building larger product teams, the funds also went to sales and marketing.

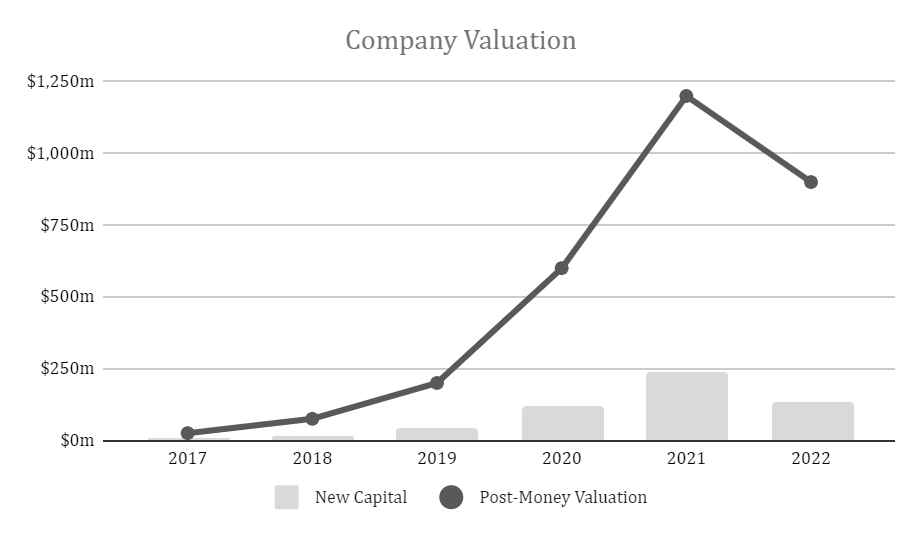

In each subsequent year, they raised a new round: a Series C in 2020 and a Series D in 2021. They rode the bull market just like dot com darlings did in the late 1990s – their investors had plenty of capital and continued to urge them to raise more money. Their Series D even made Unicorn a unicorn, reaching a $1.2 billion valuation.

Down round

In late 2021, the capital markets came crashing down—and while the company’s revenue was growing, they were burning a ton of cash in order to achieve it. So, instead of instituting layoffs, the company decided to raise a down round and push through it. The company was now valued at $900M —a 25% discount from their last round.

Here are the valuation and share details:

Quick note about the assumptions: one thing that’s commonly overlooked by startup employees is share dilution. Dilution is when a company issues new shares, thus decreasing the percent ownership of existing shareholders.

If you get shares at a $200m valuation and the company eventually raises at a $1b valuation, your share price almost certainly won’t 5x (it’ll be a lot lower than that). Ultimately what matters is the share price, not total company valuation. In this Unicorn example we assumed 20% dilution for each of the rounds while the valuation was increasing and 15% in the downround – this is a reasonable assumption but note that the percent dilution per round can vary widely.

So if you are an employee at Unicorn, what should you do?

Scenario 1: Grant in 2019, No Exercise

In the first example, we are going to pretend you joined Unicorn in 2019 and were granted options when you joined. However, you didn’t exercise them at the time. Now that it’s 2022—what should you do?

Facts

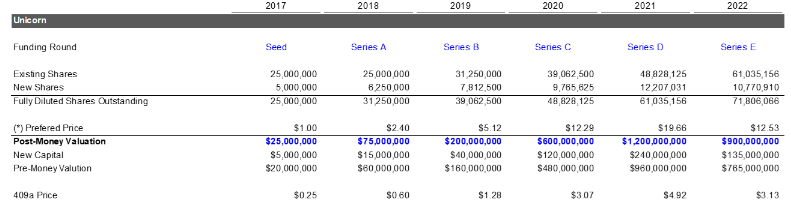

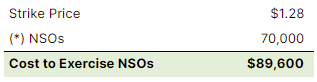

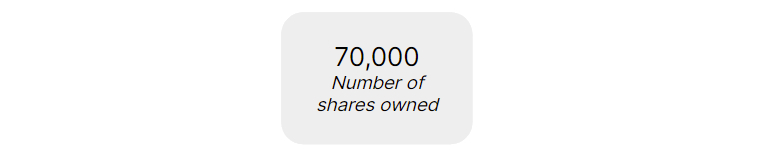

The strike price is $1.28 (matching the 409a in 2019) and you have 70,000 non-qualified stock options[0]. The cost to exercise your options would be $89,600: the product of $1.28 and 70,000.

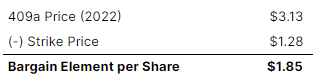

Because the 409a has increased, you’ll also owe taxes on this exercise event. The spread between your strike price ($1.28) and the current 409a ($3.13) is $1.85, also called the bargain element per share.

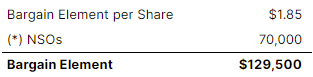

We can then multiply that by the number of shares (70,000) and we get the total bargain element of $129,500 that’s eligible for taxes.

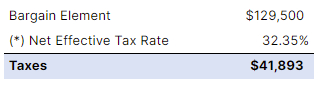

Assuming you make $150,000 per year and live in California, you would pay a net effective tax rate of 32.35%[2]. This results in $41,893 in taxes ($129,500 bargain element * 32.35% effective tax rate).

[2] In this example, we assume the net effective tax rate is applied to all additional income -- in reality, it will be taxed marginally by income brackets. We do this for simplicity sake because the difference is small and it's not the point of this article -- to calculate your exact tax bill, use the calculator above or consult a tax expert.

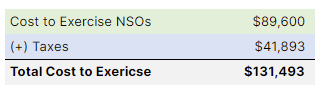

So, the total cost to exercise all of your options and pay the taxes is going to be $131,493 ($89,600 in exercise cost + $41,893 in taxes).

[0] In this scenario, Person 1 could have received either NSOs or ISOs as their stock options but for the example I chose NSOs. They likely didn’t receive RSAs (most tax-efficient but only for founders / early employees) or RSUs (least tax-efficient). NSOs, as described above, are likely taxed at the ordinary income rate. ISOs are different because you won’t pay taxes on them upon exercise unless you trigger a special provision called alternative minimum tax (AMT). AMT is essentially a way to make sure that wealthy citizens aren’t avoiding taxes. It works like this: you calculate your income for ordinary taxes, then you calculate your income from exercising ISOs for AMT taxes. If your AMT exceeds the threshold and your ordinary income, then you’ll pay AMT. It’s a bit complicated – and dry – so if you have ISOs you should probably talk to your tax person (or read about ISO tax treatment here).

Considerations

- If you believe in the long-term prospects of the business and you have liquidity now might be a uniquely great time to exercise your options. While the strike price will remain the same, if the share price continues to increase the bargain element (spread between your strike price and the 409a) will never be smaller, so the tax you pay will never be smaller.

- If you leave the company, your options will expire if you don’t exercise them. Let me repeat that: if you leave the company, your options will expire if you don’t exercise them. The exact timeline of how quickly they expire depends on option type and company policy, but the termination window is commonly as short as 90 days. So, exercising your options enables you to actually own what you helped build.

- Because you haven’t exercised your options yet, it will be a large cash expense – $131,493 to be exact. What are your life and career goals? What other things might you want to use your cash for? Consider how you will finance your exercise cost (and associated taxes) within your broader financial plan.

- Even though the company has been around for several years, there’s still a high risk of failure. Even a Series D company is more likely to fail than succeed (29% chance of exit)!

Scenario 2: Grant in 2019, Exercised

Now let’s look at another example—let’s say that you also joined Unicorn in 2019 and were granted options, but this time you exercised them right away.

Facts

You own 70,000 shares. You had early exercise rights, exercised your options for $89,600 at a strike price of $1.28 back, and correctly filed an 83(b) (the tax election associated with early exercise verifying tax treatment for that year). You did all of this back in 2019 when you joined the company.

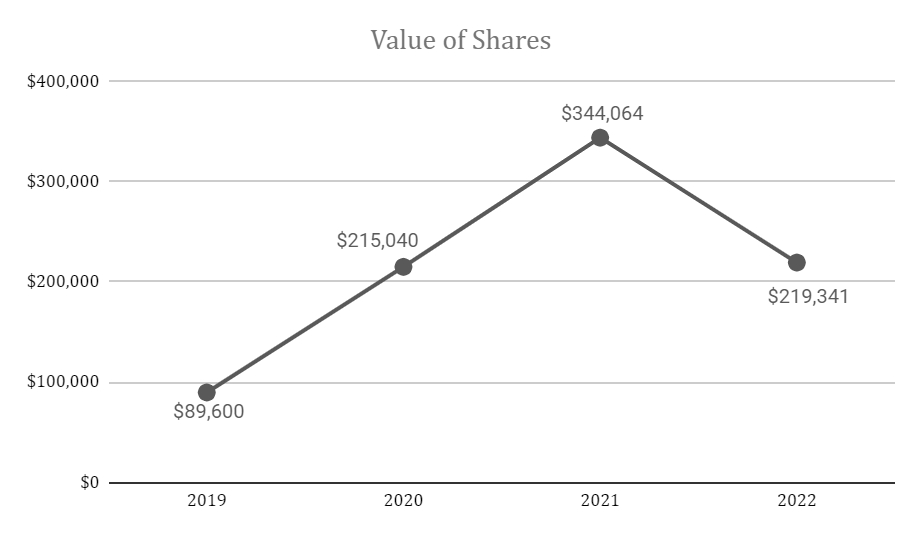

The 409a valuation is now $3.13 and so the shares you own are now worth a total of $219,341. This is higher than what you paid for them ($89,600) but is lower than they were worth at the last round in 2021 ($344,064).

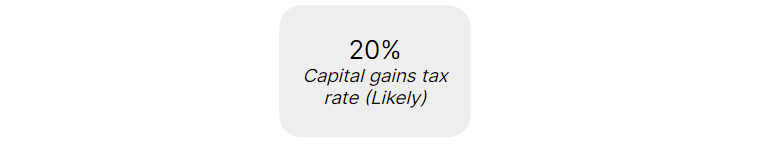

Because you purchased the shares when the strike price matched the 409a, you didn’t pay any taxes on them. However, if you sell your shares you’ll pay long-term capital gains tax. Likely this is 20%, but it depends on your personal situation and income.

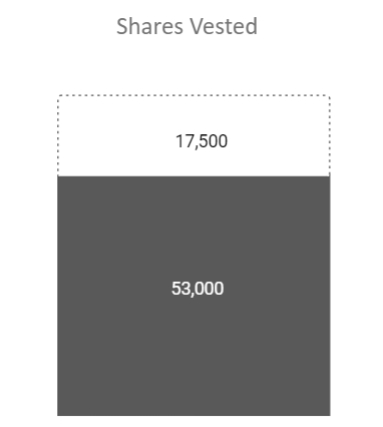

Finally, ¾ of your shares (53,000) have vested and ¼ of them (17,500) are yet to vest.

Considerations

- If you leave the company, you’ll only own ¾ of the shares that you purchased. The other ¼ will likely be returned to you by your company as cash [1]. While receiving cash might not seem like a bad option, consider what you are getting and what you’re giving up. If your company returns the cash, you’ll receive $22,400 – 25% of the original $89,600 that you paid for the shares. If you get this money back, you can, of course, invest this $22,400 elsewhere, but you’ll be giving up shares that have already more than doubled in value (from $1.28 to $3.13).

- What’s your long-term view of the company? Consider what the most likely outcomes could be and how much those are worth to you personally. Think about the valuation, the dilution, the chance of failure, how many shares you own, and the tax implications of selling. Because you’ve already exercised your options, this scenario is more about if you want to continue working at this company or not rather than what you should do with your capital.

- Your options are worth more than when you purchased them but are worth less than they were a year ago.

[1] If you leave the company but have early exercised all your options, startups typically buy back unvested options at the strike price. However, this isn’t guaranteed and you should double-check your employment agreement. This cash liability is also why many startups don’t offer early exercise at all! Additionally, this purchase of options usually doesn’t trigger any tax event, but once again, consult a CPA for personal tax advice.

Scenario 3: Grant in 2021, No Exercise

For the final example, let’s look at a situation where you joined Unicorn in 2021 when the valuation was at its peak (nice nice). Here, you were granted options in 2021 and didn’t exercise them.

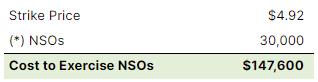

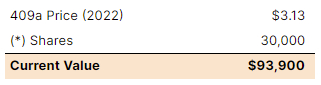

Facts

The strike price is $4.92 and you have 30,000 NSOs (you were granted 30,000 options because the strike price is higher – fewer options, higher value). The cost to exercise these options would be $147,600.

The current 409a price is $3.13. This means that if you exercise your options you will pay $147,600, but their value will immediately fall to $93,900.

Because the 409a has decreased since your shares were issued, if you exercise your shares, you won’t pay any taxes on them.

Considerations

- Because your options are “underwater”, purchasing them means that you would immediately lose value based on the current market price. While you could technically do this, be aware that it’s uncommon and very risky[2].

- Similar to Person 1, if you leave the company, your options will expire if you don’t exercise them. So, exercising your options enables you to own what you helped build. The exact timeline of option termination depends on what kind of options you hold, but the termination window could be as short as 90 days.

- It might take a long time for the company to return to the valuation at which you were granted the options—it might not be worth the opportunity cost to stick around even if you believe in the long-term prospects of the business. Since there’s less upside, the (still large) risk of failure might not be worth it.

[2] The only benefit of exercising at this time is it would enable you to pay zero in taxes because the current 409a price is lower than the strike price. And, if you really believed in the long-term trajectory of the business, you could maaaaaybe convince yourself that it’s worth it. In order to be worth it, the share price would first have to increase to the 2021 level (just to breakeven) and then you would hope that the share increases from there to actually earn a positive. As I said, doing this is very uncommon.

Tactical next steps

So what should you do? Here are a few next steps you can take.

Develop a view of your company

Ultimately the most important thing you can do is develop conviction on your company. Is this something you really believe in? Something you want to see in the world? Something you think can make some money?

If so, you should stay and figure out how to maximize your upside. If not, consider investing money elsewhere and exploring another job.

Consider your opportunity cost

Exercising your equity is an investment — you’re buying shares in a company. But it’s not like there are magical bags of cash earmarked just for exercising your options. After all, money can be invested in many different ways.

So since you are an investment decision, what are your other options if you don’t exercise your equity? Here’s a list of other opportunities and their associated tradeoffs:

- Public markets. This is the most common investment and is the best decision for most (*waves hand*) people. You might already know that over the long term, public market indexes have returned between 7-10% annually and many analysts believe this will continue. If you do choose to invest in public markets over your startup equity, you likely are more risk-averse. Public index funds haven’t ever gone to zero and have also 100x’d their value in a year. Neither is necessarily better, you just have to know your own risk tolerance.

- Private company equity. If you work at a startup now, there’s a good chance you’ve worked at a startup before. If this is the case, you might want to keep your net worth in other startups because they also have a high expected return. Sometimes this isn’t even your choice – a lot of private company equity is illiquid. But even if you have the option to sell shares in a secondary market, you’ll need to evaluate which startup you think is a better investment.

- Cash. Another option is to keep your money in cash. Many times this happens by accident—you get paychecks or a cash inflow and don’t do anything with it. If that’s your situation, give it some thought! There are a few good reasons to hold cash on your personal balance sheet, such as waiting for better investment opportunities (the classic Warren Buffett strategy) or wanting less volatility in your portfolio, but I’d recommend writing that out if that’s your strategy. In either case, make sure you think about it.

- Real estate. Houses cost lots of money and generally require a down payment! If you want to purchase a house to live in, then you might want to invest your liquidity in your primary residence (whether that is a good economic idea or not is another post). You could also purchase real estate as an investment property — which typically brings lower returns and lower risk than startups.

- Other alternative investments. The final option is to invest in other assets like startups, funds, or crypto. This bucket can be largely summarized as “if you are an expert, or are comfortable losing the money, go for it. Otherwise, it’s pretty dangerous”.

Ask for a repricing or refresher

One other idea – especially for someone like Person 1 – is to ask for an option repricing or refresher program. While the company has no obligation to provide such a program, you have the power as an employee to at least ask.

I’m probably the wrong person to advise on this (as I’ve never asked for a repricing myself), but if I were to try, I would position it within the context of recent personal accomplishments that made a large impact on an important business metric. Every company wants to keep top performers happy.

Final Note

These are complicated questions with no easy answers, but the framing I also go back to is investing: both your time and money. If I were you, I’d take this seriously and pursue the option with the highest expected return – it can have major consequences not just on your immediate financial situation but your broader wellbeing.

Adam works for Compound, a company that specializes in helping tech founders and employees manage their financial lives, starting with their illiquid company equity.

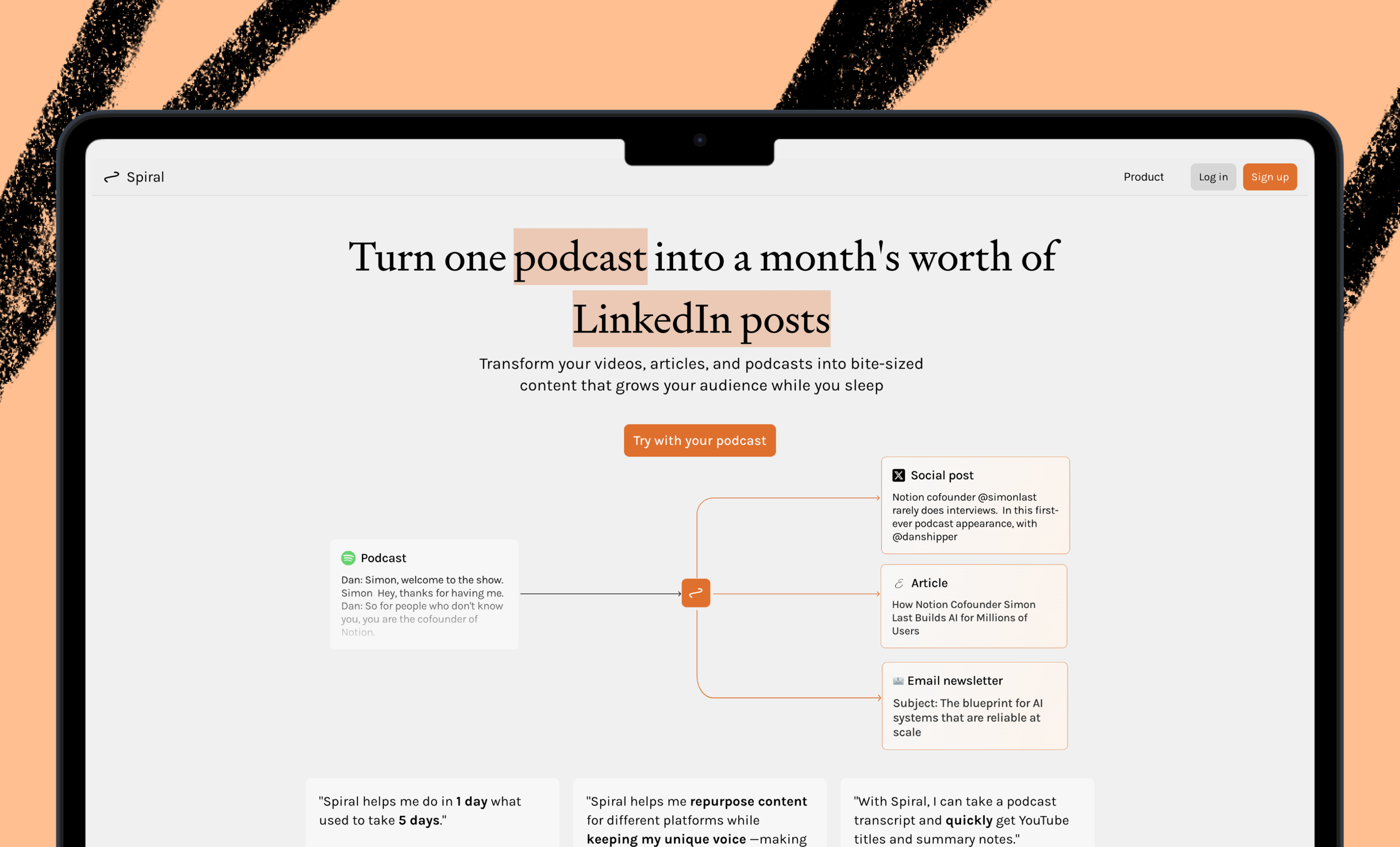

Ideas and Apps to

Thrive in the AI Age

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!