Brianne Kimmel knows how to drive a wedge into the market, and parlay it into lasting momentum.

Exhibit A: her investing career.

It’s incredibly hard to break into the market as a new VC. There’s a sort of double chicken-and-egg problem: great companies want investors with proven brands, but in order to build a proven brand, you need to invest in great companies. A similar dynamic exists on the LP side: in order to prove yourself a good fund manager, you need experience managing funds.

Most investors solve this “cold start” problem by working their way up through the ranks at established VC firms, then branching out on their own. But Brianne carved her own path.

She’s built a distinctive brand for WorkLife, the first enterprise fund focused on the consumerization of enterprise, investing in companies like Webflow, Voiceflow, Tandem, Command E and 20+ others.

Her early investors include Zoom CEO Eric Yuan, Slack CEO Stewart Butterfield and executives from breakout SaaS companies like Dropbox, Slack, Twilio and Zendesk.

Her fund advisors include the original super angels: Marc Andresseen, Felicis founder Aydin Senkut and Floodgate’s Mike Maples.

The story of how she did all this is a masterclass in strategy and momentum.

How Brianne positioned herself to start investing

In addition to operating full-time, first at Expedia and later at Zendesk, I started advising startups when I was teaching at General Assembly in Sydney. It worked well for me because I was an expat with free time on nights and weekends. When I moved to San Francisco, I continued teaching and ultimately taught over 5,000 students in four years.

This was a great way to build expertise in early stage growth marketing and GTM strategy. General Assembly served as an especially good platform for building a personal brand by leveraging their global social channels and mailing list, which I used to build momentum and spin out to launch my own program SaaS School.

As I continued to advise early stage startups and build relationships with both founders and VCs, my appetite for investing grew.

My first week at Zendesk I was asked to fill out a career card which highlighted my professional goals over the next ten years, which included a plan to move up the ranks as an operator and wait ten years before making the jump to venture.

Soon after that, I decided to accelerate my transition to investing, which led to a shift in my strategy where I chose to optimize for startup-facing projects inside Zendesk and double down on community-building events on evenings and weekends.

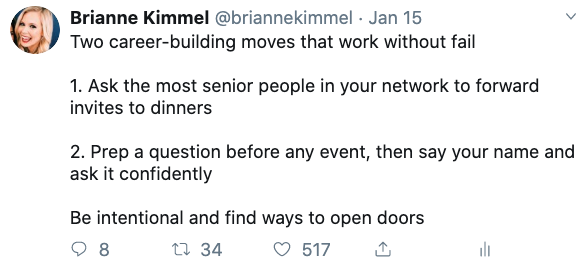

I also discovered a few tactical ways that to build my VC network:

Fund I: the friends & family “round”

Emerging funds are a lot like startups, in that your first fund (“Fund I”) looks a lot like a friends and family round. Even if you are a successful angel investor, you are still unproven as a good steward of other people’s money.

To raise my first fund, I first activated my co-investor network and my portfolio CEOs who could vouch for my working style and my ability to access great companies and provide portfolio support in scalable ways. Then, I exported LinkedIn contacts and emailed sector-aligned CEOs and executives in my network. I also changed my Twitter bio to: “Thinking about starting something new. DM me for deck,” which generated inbound interest from followers in the startup ecosystem.

I gathered all of these cold emails and inbound requests then started socializing my fundraising deck. It was a good way of getting people involved from day one and it turned out to be effective.

When I went to raise my fund, I had several things going for me:

- Angel investor in several competitive seed deals, including Webflow (recently raised $72M from Accel), Airgarage and Command E.

- A strong point of view of GTM for early stage enterprise companies, especially helping product-led companies identify new opportunities for growth.

- Access to deals from both SaaS School, building Zendesk Apps Marketplace & Zendesk for Startups and investing in professional networks like Dev.to, Girlboss and Webflow.

- Network of co-investors I had developed from angel investing and a growing portfolio with sector-aligned founders and early employees who can vouch for my work.

The combination of these helped me raise my first $5 million in 2.5 weeks and continue raising to grow the total fund size. My initial deck I used has now been viewed over 30,000 times.

Building a foundation for institutional LPs

To scale into a larger fund size, you will have to move beyond friends, family and high-net worth individuals and pitch family offices and institutional Limited Partners (“LPs”). In the same way that venture capitalists aim to buy a percentage of a company, LPs typically invest based on a percentage of total fund size and seek to build a concentrated portfolio across a number of top-tier funds.

What’s interesting about institutional LPs is how they approach building a portfolio across different asset classes ranging from real estate, private equity and in recent years a growing interest in venture capital. When it comes to institutional LPs, venture capital firms are competing against more mature, stable asset classes and seek to find LPs with established venture portfolios.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!