Thank you to everyone who is watching or listening to my podcast, How Do You Use ChatGPT? If you want to see a collection of all of the prompts and responses in one place, Every contributor Rhea Purohit is breaking them down for you to replicate. Let us know in the comments if you find these guides useful. —Dan Shipper

The best investment opportunities are found in moments of perceived crisis. But not every crisis will be a good investment.

In fact, identifying which moments of crisis are promising opportunities is an art. It’s the stuff that professional Wall Street traders grapple with every day—and something amateurs like us pore over, too, determined to beat the market.

In this episode of How Do You Use ChatGPT?, Dan Shipper and IA Ventures managing partner Jesse Beyroutey tell us how they outplayed Wall Street. Dan and Jesse invested in Nvidia in 2019 when the shares were trading at $33. They’re worth nearly $900 a piece today. It was the best trade of their lives. In this interview, Dan and Jesse walk us through how they used Google’s powerful LLM Gemini Pro 1.5 to try and top that.

To get them started, Dan opened an account on investment platform Robinhood and put in $1,000 as the principal amount. With 90 minutes on the clock, Dan and Jesse were off to the races.

This interview is a masterclass in how to use AI to refine your own investment thesis and make smarter financial decisions. I came away inspired—and more than a little tempted to test my luck and day trade!

First, we’ll give you Dan and Jesse’s prompts, followed by screenshots from Gemini and ChatGPT. My comments are peppered in using italics.

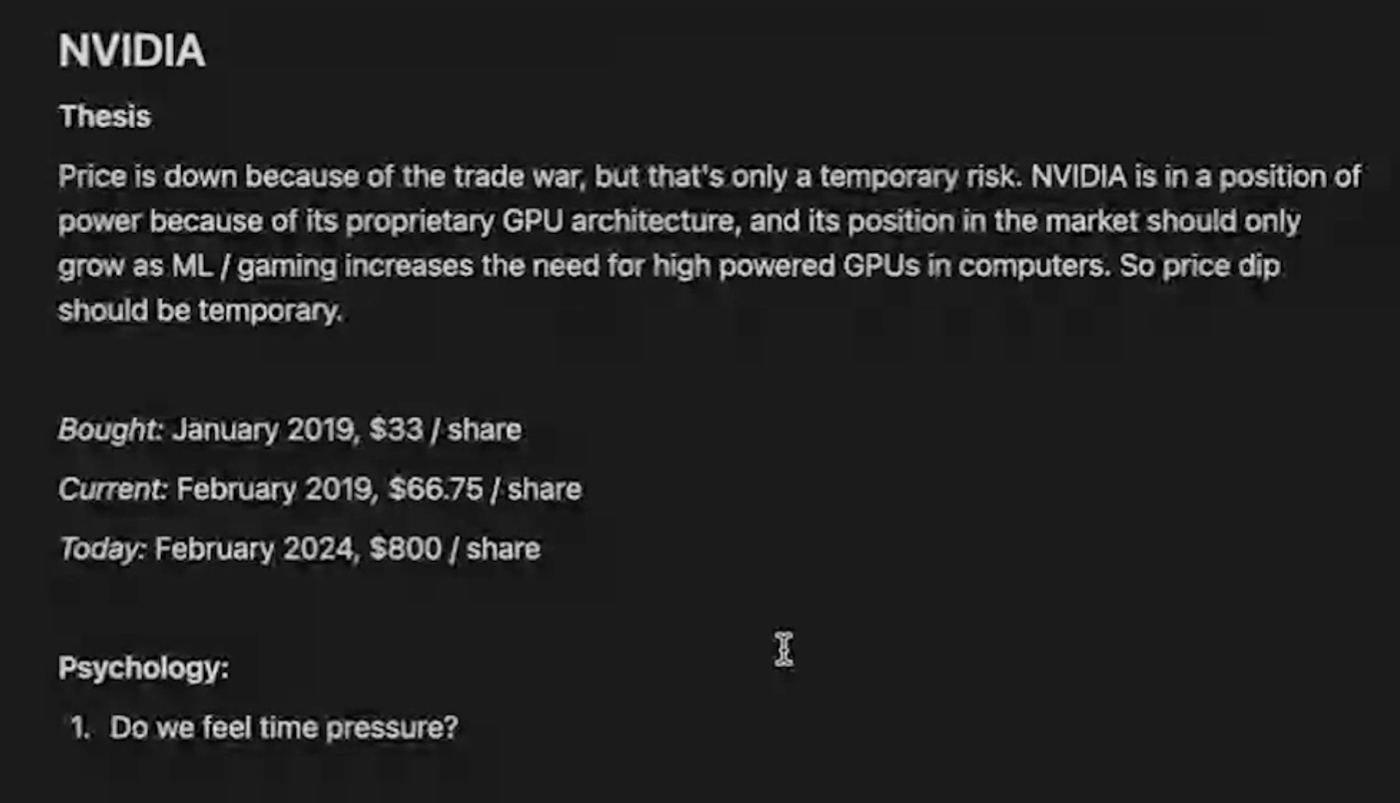

A page from “Beyroutey x Shipper Investments,” a Notion page which records why they thought Nvidia would be a good investment in 2019—even though the company’s stock price was down. Jesse says they fancied themselves as “distressed asset investors.”

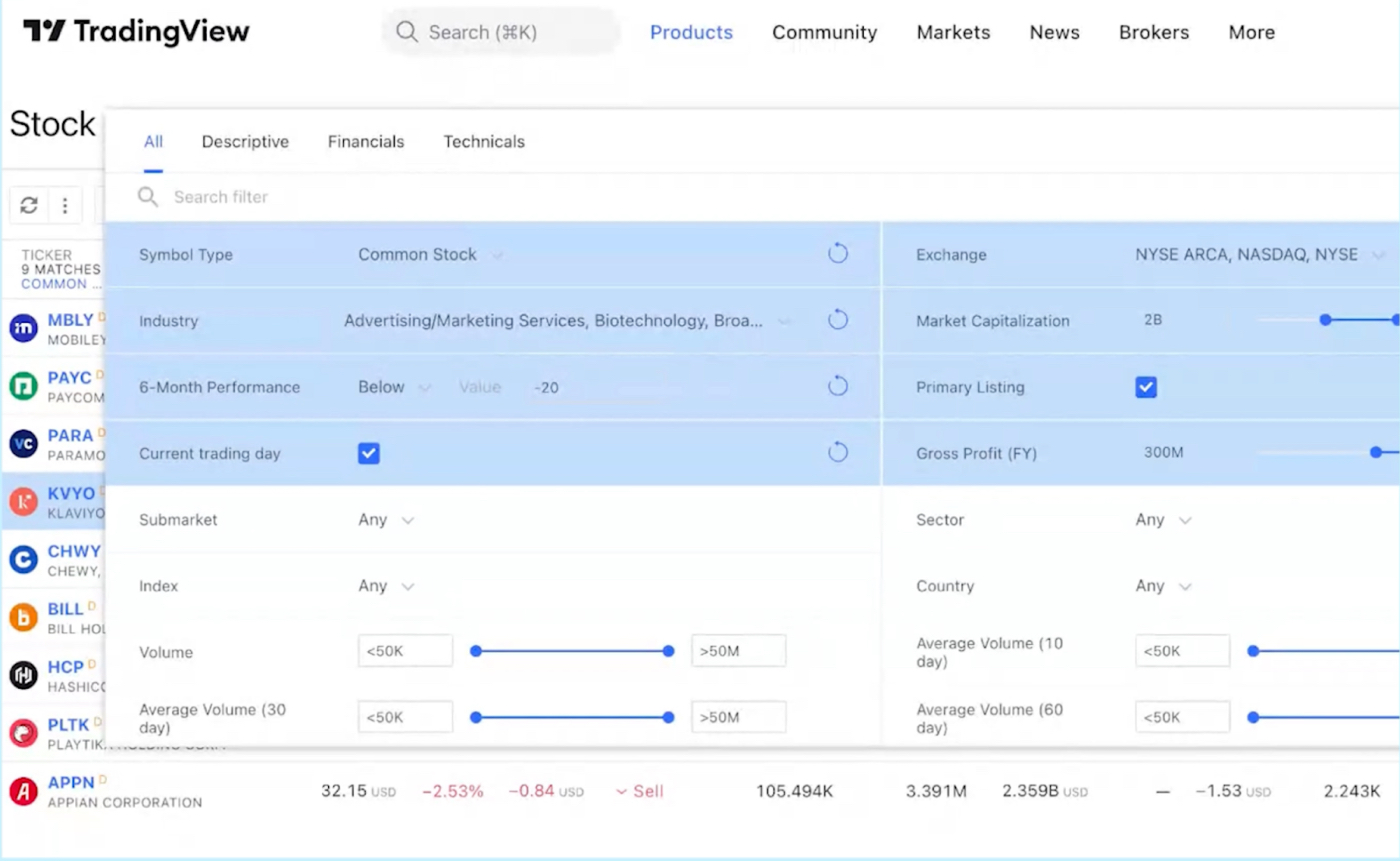

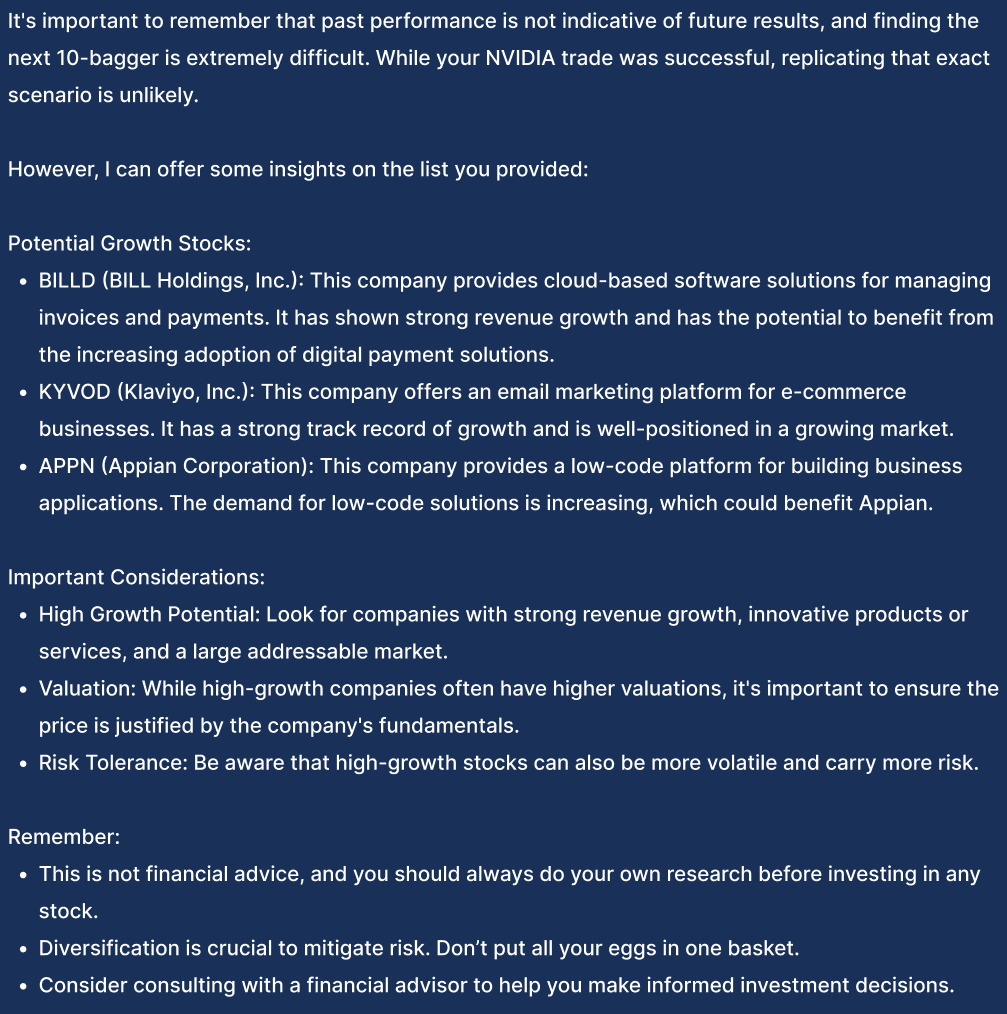

All screenshots courtesy of How Do You Use ChatGPTand Figma/Every illustrations.Dan and Jesse invested in Nvidia because they believed that the company was temporarily underperforming on account of identifiable reasons recorded in the screenshot above. With the clock ticking, Jesse uses the stock analytics platform TradingView to apply search parameters that might mimic this criteria. He adjusts the filters to find companies with a market capitalization between $2 billion and $100 billion, a positive gross profit, and a downturn in performance over the prior six months.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

.22.19_AM.png)