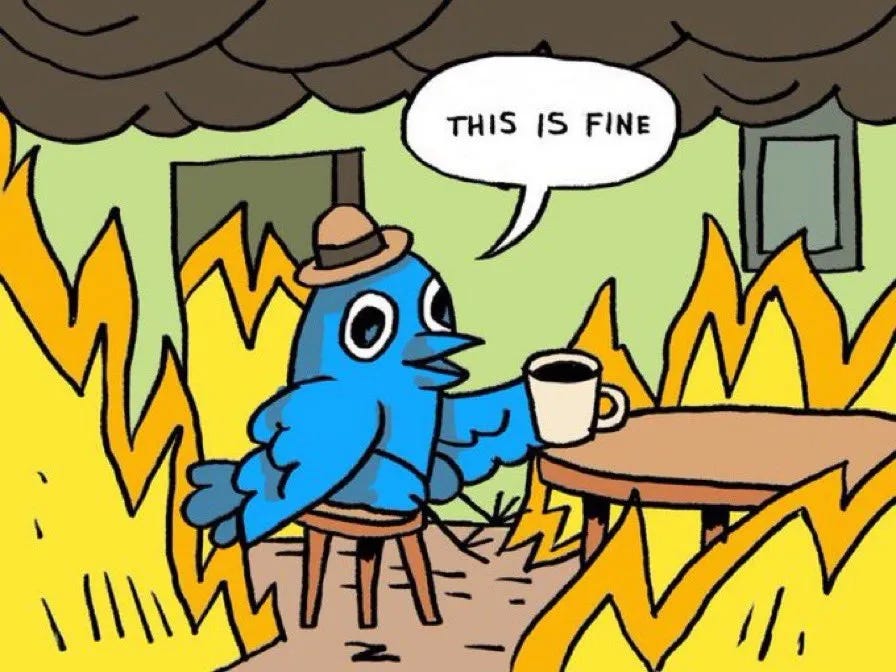

It’s already really bad over there.

A few weeks ago, Elon Musk said that ad revenues had fallen 50%. The site has experienced major outages at a higher rate than usual. During one such outage, Elon was laser-focused on the important stuff: reply-guying Jordan Peterson. The Twitter Blue rollout was such a disaster that he fired almost the entire team. Yesterday, he appeared to backtrack on his big plan to revoke legacy checkmarks. Twitter hasn’t been paying rent on its office space. It recently tried to create a new income stream by selling office plants to employees.

Take a deeper look and the company is in even worse shape than it appears. Twitter has two financial time bombs waiting to go off. My hunch is that Elon will file for bankruptcy as soon as one of these bombs self-detonates. It’s hard to say exactly when that will be.

If I were placing bets, I’d give it about six months.

Time bomb #1: Employment lawsuits

The first financial time bomb is all the pending employment lawsuits.

In March, Musk picked a fight with former employee Haraldur Thorliefsson. He said he fired Thorliefsson for using his disability (muscular dystrophy) as an “excuse” not to work. Sixteen hours later, Musk tweeted that he had jumped on a video call with the ex-employee—“better to talk to people than communicate via tweet.” He issued a lukewarm apology.

There has been occasional reporting over the past few months about Twitter denying former employees the full amount of severance pay they had been promised. These things tend to get worked out by lawyers, who reach settlement agreements that include non-disparagement clauses. So it’s difficult to get a clear view of how much money Twitter owes to how many former employees. But it’s a pretty safe bet to say that the company is going to eventually have to pay a whole lot of people a whole lot of money.

Keep in mind, on the day he acquired Twitter, Musk fired Parag Agarwal and the rest of the senior executive team “for cause.” (Why? ’cause you made me buy this stupid company, that’s why!) That was an attempt to avoid paying them the tens of millions they were owed from the merger agreement.

Does anyone really think Agarwal isn’t eventually going to get paid nearly all of the ~$50 million he is owed? If the other employment lawsuits eventually reach trial, does anyone think a judge is going to let Twitter out of its contractual obligations just because Elon basically declares “lol jk jk”?

Lawyers are expensive, and even simple legal proceedings tend to drag on. The court system is slow and can be rendered much slower if you are a well-lawyered billionaire. But eventually, Musk is either going to reach non-public settlements for close to what he owes, or he’s going to get smashed in the courtroom and have to pay full freight.

And look, I am not a lawyer, so this is nowhere close to legal advice. But I’m pretty sure “declare bankruptcy to escape paying what you owe” is a possibility here.

If it’s true Twitter is fielding over 1,000 arbitration cases from laid-off employees, then there are a whole lot of busy lawyers racking up billable hours right now. (Not to mention the lawsuits rolling in from unpaid vendors, landlords, and the like.) If Twitter hasn’t declared bankruptcy before the bulk of those lawsuits are decided, don’t be surprised if Elon declares bankruptcy just in time to dodge those judgments and avoid payouts.

…But it probably won’t come to that. Because the other time bomb is going to go off sooner.

Time bomb #2: The fines

Let’s talk about the fines.

Twitter operates under a consent decree with the FTC. Just last May, the company was fined $150 million for user privacy violations. That was back when Twitter had thousands of employees and was notoriously slow and careful in rolling out new features. Twitter is required under the consent decree to dutifully report any changes in how it “maintains and protects the security, privacy, confidentiality, or integrity of any nonpublic consumer information.”

(This is one of the many reasons why Elon-Twitter can’t afford to act like a startup, even if Elon would like to reclaim that startup vibe from his youth. Startups don’t have major FTC reporting requirements. Huge companies with a checkered regulatory history do.)

Elon-Twitter has been flagrantly ignoring the FTC consent decree. The FTC has already opened an investigation (and Musk’s attempts to meet with the FTC chair about it were reportedly rebuffed). Current and former employees have talked openly about the regulatory exposure he has created. One of his former lawyers basically shouted warnings on the company Slack, encouraging people to seek whistleblower protection.

European regulators have also sent repeat warnings that, if the company is in violation of the Digital Services Act, it will face several hundred million dollars in fines. Europe has a stronger regulatory state than the U.S. It does not mess around.

The fines are coming, and they will not be small. Between US and EU violations, I’d guess Twitter’s tab will be in the low single-digit billions. Might be more, might be less.

Regulatory investigations take time, but not as much time as the US legal system. And, again, these are broad-daylight violations. Twitter basically doesn’t have a Trust and Safety team anymore. Twitter’s compliance team is at least as decimated as all its other teams. The company has reportedly fired people who aren’t sufficiently obsequious to Elon. That’s not going to earn him much goodwill from regulators.

My hunch is that the fines will be the final straw. When they come, Elon may seize on them as a life raft.

I suspect he’ll declare bankruptcy and blame the regulators. He’ll say something like: “I was THIS CLOSE to turning around this important, innovative company that is a threat to the mainstream media and all those crooked politicians. But then the liberal bureaucrats stepped in and fined the company out of existence! There’s nothing I can do about it. Twitter is dead now. It all would’ve worked out if not for that meddling government.”

If this comes to pass, certain corners of the internet would buy this tale—it has all the “right” villains. In this version of history, Elon Musk didn’t burn Twitter to the ground. He almost saved Twitter, until he was foiled by the machinations of the professional managerial class.

That’s how I expect Twitter will end. The finances are bad, the product is breaking down, the user base is decaying. That downward slide will continue at a slow, steady pace. But what will finally break Twitter is one of these financial time bombs self-detonating. It will probably be the regulatory fines, and that will have the knock-on effect of offering him a face-saving story to tell.

The company will go bankrupt with a bang, not a whimper.

Dave Karpf is a professor of internet politics at George Washington University. He’s the author of The MoveOn Effect: The Unexpected Transformation of American Political Advocacy and writes The Future Now and Then newsletter. Follow him on Twitter.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!