Last week I published an article on the big things I got wrong over the last year and a half being heavily involved in crypto.

Plenty of things went well too, though, and it was definitely a successful time period. So aside from the things that went wrong, what went right? Or what were some decisions that ended up being prudent which I’m glad I made?

Here’s what stands out.

Not Trading

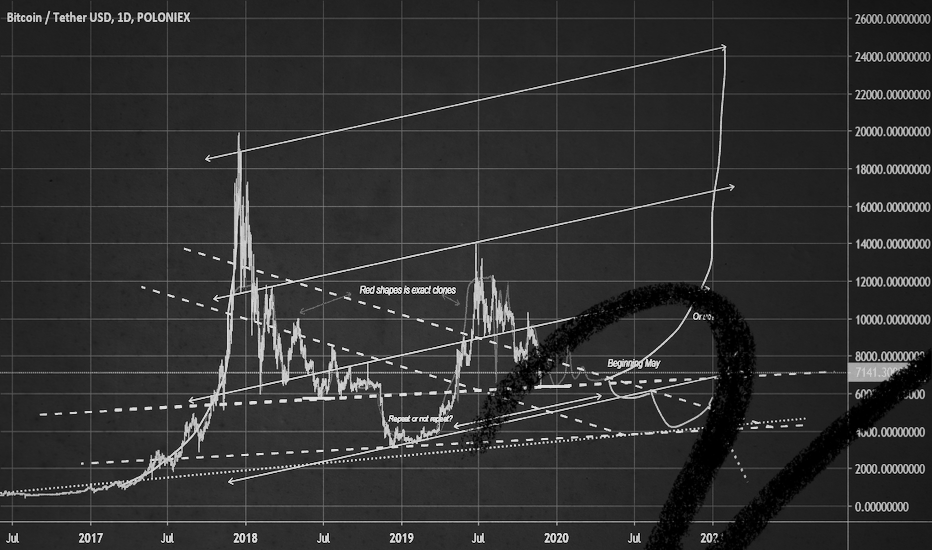

There’s a very easy trap to fall into when you first get exposed to crypto. You see these people on Twitter who at least seem like they have a huge amount of money and are crypto rich, and you see them posting charts with their predictions of where the price is going to go.

Then you assume that means they’ve made their money trading, so you should try to trade too if you want to get as rich as them.

This is almost never the case. Many times they don’t have much money at all, and for the ones who do, most did not make it from actively trading. More likely they bought a bunch of Bitcoin or Ethereum a few years ago, were crazy enough to hold it through the 90% drawdown, and then got rich through a combination of patience and stupidity depending on your interpretation.

Or, they already had a bunch of money from something else. Or they made one really great lucky trade.

However they got the money, just because they are now rich (or pretending to be rich) and posting trading charts does not mean they have any idea how to make money trading. It’s just as likely (more likely?) that trading is just a hobby now with all the money they made from other things. They might even be losing money trading! And you almost definitely will lose money trading.

So yeah, don’t try to trade. Buy and hold. The only extent to which I’ll do something close to trading is trying to buy things when they’re cheap and avoiding buying the top. I made my biggest ETH purchase last year when it was between 1700 and 2000, which I’m still very happy with.

Building

If trading isn’t the way to “make it” in crypto, what is? Working on stuff and waiting. I tried building a ton of different things in crypto starting in January 2021. I tried building an NFT platform for bloggers, tried building a LinkTree for crypto addresses, tried building an on-chain idle clicker game, plus a bunch of random ideas and other projects that never got off the ground.

But the two most impactful things I worked on were this blog and helping the Crypto Raiders team with their tokens and economy. While probably 10+ other random projects failed to go anywhere, these two made up for everything else.

If you want to try to build something in crypto or work with people who are building things, what I found the most helpful was to first get deeply ingrained in the crypto community (Twitter and Discord mostly), then figure out what kinds of skills were most useful.

I had one huge advantage from writing articles like these for 10+ years now. There aren’t that many good explainooors in Crypto, so having some writing chops gave me a competitive advantage.

Second to that though, I spent a solid 6-8 months last year doing almost nothing else but learning programming with a focus on Solidity and Web3JS. That got me good enough to work with a few different teams and start spinning up my own projects, which is what really let me contribute to building things in the space.

I’d say that’s the easiest route to getting to work on things in crypto. Go hard on learning Web3 Javascript and maybe some Solidity, and you’ll be an incredibly valuable asset to any team. That’s probably the only skillset guaranteed to somewhat easily land you a job. Community management and design are good too, but they’re definitely second-tier in terms of demand.

Starting Small

While I eventually ended up being pretty all-in on crypto, I started by moving a relatively small amount of my portfolio on-chain, and keeping the rest safer in Coinbase to start.

The crypto community gets a little overzealous about the benefits of self-custody. It’s definitely better if you know what you’re doing. But if you don’t, it’s a big risk to take, since you’re probably more likely to lose your private key or get scammed than Coinbase is to go bankrupt and take your coins.

I think anyone starting out should start very small and experiment on a low-cost L1 or L2, like Polygon, and get comfortable doing everything that way first. Once you feel like you really know what you’re doing, then you can take on full custody of your funds.

This ended up being smart too since I did get exploited when I accidentally published my private key on a public GitHub repo. Stupid mistake, but I’m not the first to make it, and some bot was able to steal about $30k from me. Not fun! But I’m sure glad I hadn’t put everything in that wallet, it was a good (albeit expensive) lesson to learn.

Strategic Information Consumption

The amount of information flying around in crypto is overwhelming, almost cripplingly so. It is extremely hard to stay on top of everything, and you should not expect to. If you try, you’ll spend all day on Twitter and Discord and never get anything done.

That ends up being a big problem because the more time you’re trying to consume info, the less time you’re building, and you’re much more likely to Make It from building stuff than reading stuff. There’s very little alpha in public channels like Twitter, Telegram, and Discord, so don’t spend all day hoping someone will leak something that makes you rich. It’s more likely that anything they’re sharing is to get you to be their exit liquidity.

But it is good to stay up on what’s going on, so trying to be very deliberate about creating a focused information funnel is extremely useful. I was constantly churning and replacing sources of info until I could arrive at what gave me the most bang for my buck, with a healthy dose of fun mixed in.

If you want the 80:20, here it is:

- Bankless Podcast (weekly roundups mostly)

- The Daily (Ape / Bear) Telegram channel

- This Twitter list

You could probably just follow those sources and you’d know 80-90%+ of everything you need to know about what’s going on. There are plenty of other great sources, and I don’t want to seem like I’m criticizing anyone else. But this will get you quite far if you want to minimize the number of things to stay on top of.

Again, you are very unlikely to get some crazy life-changing alpha from following tons of people on Twitter or joining tons of Telegrams or Discords. Follow a few big sources of highly focused news, and then join a couple of very tight-knit communities where you are sharing stuff with friends, and focus your energy on doing stuff.

Planning for Taxes

Around September I realized my taxes might be getting kinda messy. So I signed up for TokenTax, started running some reports, and realized I was super fucked.

So I started pulling money out of crypto to set aside for taxes to make sure it was covered. I knew there was a chance the market could tank and I’d have this huge tax bill that would require selling everything just to cover it.

Well, it turned out I was right to be worried about that. If I hadn’t prepped for taxes and had held everything, I would have gotten completely wrecked by the tax bill considering the market dropped so much between the end of 2021 and April 2022.

This also helped me find opportunities to tax loss harvest some of my crypto to reduce my liability. And sure you could be aggressive and not pay for a lot of your DeFi gains, but I absolutely do not think that’s worth it. It’s a completely transparent ledger, your wallets are doxxed whether you like it or not, and the IRS will figure out what you owe. Just pay it. No matter how painful it is.

Speaking of, now is probably a good time to tax loss harvest anything you bought in the last year. You’ll reset the long-term capital gains timer, but with the market down this much, I’m definitely going to do it to save on my taxes for this year.

Creating Some Rules (Eventually)

One of the things I got wrong that I mentioned last week was not creating rules for rebalancing from the start, or at least not following the guidelines I already had.

And while that’s true and it was a mistake, I did eventually come around and start following some. Thinking through this article on When to Sell is what really helped me, and made me realize how undisciplined I was being.

So considering it was one of my big mistakes, and the thing that ended up saving my ass, it feels like this is the most important lesson. Set some rules for yourself and follow them. You will be stupid and emotional in the moment, so if you don’t have good guidelines to follow, you’ll just react emotionally to whatever is happening in the market.

To quote from The Money Game again:

“the identity of the investor and that of the investing action must be coldly separate… to know what you're doing, you do have to be able to step outside yourself and see yourself objectively.”

Without some rules that help you see yourself and your situation more objectively, you’ll make many more mistakes. So create some rules and stick to them.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!